Logistics Sector Update : From capacity expansion to capturing the entire value chain by Emkay Global Financial Services Ltd

We initiate coverage on the Indian Ports sector with BUY on Adani Ports (APSEZ; 25% upside) and ADD on JSW Infrastructure (JSW Infra; 9% upside). The Indian ports sector is entering a structurally strong decade, supported by accelerating capacity additions, rapid privatization, and a decisive regulatory push to strengthen multimodal connectivity and position India as a global maritime hub. Capitalizing on their strategic port footprint and strong cash flows, private operators are scaling up from pure-play port entities to integrated logistics platforms, thus deepening presence across the supply chain. Backed by capacity expansion and shift toward integrated logistics offerings, we expect the growth trajectory for our coverage companies to stay elevated, granting a compelling multi-year opportunity as operational benchmarks converge with global peers’. Predictable cash flows, improving earnings visibility, and manageable leverage ratios should support multiple expansions in our Ports coverage companies.

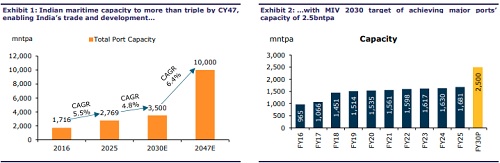

Ports remain the bedrock of India’s trade and development Ports handle 95% of India’s EXIM trade by volume and are hence at the core of its ambitious target of becoming a USD10trn economy. To transform India into a global maritime hub, the GoI targets doubling container capacity by CY30 and expanding overall cargo handling capacity to ~10,000mntpa by CY47 from ~2,700mntpa now. India’s ports sector is at an inflection point, given 1) rapid privatization (enables higher automation and digitalization); 2) regulatory reform (positions it as a transshipment hub); 3) improved multimodal connectivity (lowers logistics cost to strengthen global competitiveness)

Port privatization – An opportunity for private incumbents To replicate the superior efficiencies at non-major ports, the GoI aims to increase privatization at major ports (to 85% of cargo handled by CY30) in a bid to enhance cargo throughput by reducing turnaround time. The GoI targets capturing container transshipment share by actively pivoting toward privatization. The strategic success of Vizhinjam port serves as a powerful proof of concept, signaling a robust pipeline of investment opportunities in the high-potential maritime infrastructure.

Advantage incumbents – Scaling up capacity; extending the logistics moat With regulatory support and private sector investments, Indian ports are upgrading infrastructure to improve throughput and deliver seamless multi-modal solutions. Established private operators continue to lead operational improvements, adding capacity at pace while expanding across the logistics value chain through rail networks, MMLPs, warehousing, and CFS/ICDs. Such complementary capabilities reinforce customer retention, broaden wallet share, and enhance profitability, creating a virtuous cycle for incumbents with an expansion+execution track record. Robust financials and strong cash conversion support future expansion without straining the balance sheet, in our view.

We initiate coverage on the Indian ports sector; APSEZ (BUY), JSW Infra (ADD) We view the Indian ports sector as a key beneficiary of the Indian growth story and prefer incumbents with scalable platforms, history of superior execution, clear growth roadmap, and integrated logistics offerings gradually diversifying the earnings base. We initiate coverage on APSEZ (BUY; TP: Rs1,900) and expect the industry leader to transition into an integrated logistics platform, structurally reducing the cyclicality linked to trade volumes. Brownfield expansions and global port ramp up should keep the growth trajectory elevated without compromising on profitability. As regards JSW Infra (ADD; TP: Rs300), the expansion in group businesses—amply supporting the rapid capacity scale-up and minimizing execution risks—are captured in our current valuations

Key risks: Slowdown in global trade owing to regulatory uncertainties/geopolitical risks, delays in capacity additions, increase in competitive intensity in the logistics segment.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354.