Automobiles Sector Update : Strong growth momentum continues by Elara Capital

Strong growth momentum continues

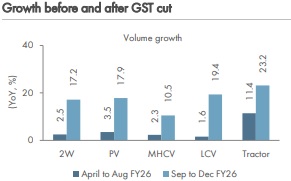

The recent cut in GST has provided much-needed boost to the Automotive industry. Post GST 2.0 reforms, all the segments have seen significant acceleration in growth as can be seen in Sep-Dec 2025 Vahan retail growth being in strong double digits compared to single digits in pre-GST cut period. Festive season growth and December 2025 has positively surprised; we hence raise our FY26E volume growth estimates for PV, MHCV, LCV and tractor segments by ~4-11% while maintain our growth estimates for 2W. We increase our FY26E-28E EPS estimates for OEMs in the range of 1-21% (ex TMPV). Given continued strong volume growth, share gains and likely bottoming out of EBITDA margin, we upgrade EIM to BUY from Reduce. Our top picks in the OEM space are Maruti Suzuki (MSIL IN), Mahindra & Mahindra (MM IN), TVS Motor Company (TVSL IN), and Eicher Motor (EIM IN). We monitor the sentiments in some parts of rural India given crop damage due to unseasonal rains and depressed Kharif crop price.

Significant growth acceleration in Sep-Dec 2025 YoY: Driven by weak consumer sentiment and a high base, the PV/2W/MHCV/LCV industry had grown by only +3.5%/+2.5%/+2.3%/+1.6% through April-August 2025. However, post GST 2.0 reforms, growth rebounded sharply to +18%/+17%/+11%/+19% YoY for PV/2W/MHCV/LCVs, respectively in Sep-Dec 2025. The inventory levels in the system are still not at elevated levels for 2W and extremely thin, especially for PVs. So, we raise our growth outlook for the PV industry to 8% for FY26E (Vahan growth of ~9%, implying retail growth of ~7% in Q4FY26E). We also revise our FY26E MHCV/LCV growth assumption to 9%/11% from 4%/4% and to 6%/9% from 4%/4% for FY27E. Growth for the tractor space continues to surprise positively – We now expect 19% growth in FY26E. The key state to drive incremental growth is Tamil Nadu for PVs and 2W and Maharashtra for tractors (see inside for state-wise growth trends pre vs post GST cut).

Earnings upgrade versus P/E re-rating post GST cut: Post the GST cut, stocks such as MSIL, MM, EIM and AL witnessed an 18-21% upgrade in FY27E EPS, but stock price movements were within 16-55%. AL saw the sharpest P/E re-rating at 37%, and MM the softest at -2%. TVS, Bajaj and Hero saw EPS upgrades of 3-10%, with P/E re-rating at 13-18%.

MSIL, MM, EIM (upgrade to Buy), TVS Motor remain our top picks: We have been positively surprised by the volume momentum sustenance of Royal Enfield even post festive season. The price cuts improved the affordability of even the Classic 350, volumes of which have revived now. We thus raise our FY26E-28E EPS estimates for EIM by 7-15% – Revise to BUY from Reduce (we raise our TP to INR 9,000 from INR 6,250). Overall, we raise our FY26E-28E earnings estimate by 1-21% (ex TMPV) and increase our TP for OEMs by 3-41% (ex TMPV), factoring in revised industry estimates and multiple upgrades owing to favorable growth outlook. We also revise our rating for TMPV to Reduce from Sell and AL to Sell from Reduce due to recent stock price movements.

Favorability matrix: Most macro indicators favorable

For two-wheelers, economic revival and good rainfall are likely to be the tailwinds to trigger a recovery in rural demand, with rural demand likely outperforming urban in FY26 (a trend visible in FY25). Going forward though, we monitor the sentiments in some parts of rural India given crop damage due to unseasonal rains and depressed Kharif crop price.

Above views are of the author and not of the website kindly read disclaimer