Aviation Sector Update : Nov-25 – Pax growth steady despite IndiGo woes by Emkay Global Financial Services Ltd

Festive season demand boosted domestic air traffic in Nov-25, though momentum moderated towards late-Nov/early-Dec-25 due to operational disruptions at IndiGo. With operations normalizing by mid-Dec-25, pax volumes stabilized, while weather-related disruptions weighed on OTP and cancellations.

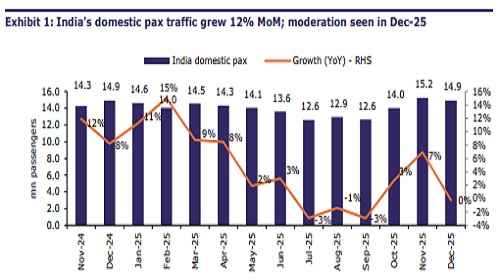

Stable domestic pax growth in Nov-25; SpiceJet’s market share rose

India’s domestic passenger air traffic rose 7% YoY to 15.2mn in Nov-25, likely driven by festive season demand. However, daily trends in Dec-25 (to date) indicate flat YoY growth, largely owing to airline-wide operational disruptions at IndiGo in the first half of the month. With operations normalizing by 10-Dec-25, pax volumes stabilized in the second half of Dec-25. Indigo faced operational disruption towards end-Nov-25, primarily due to weather-related disruption, software issues, and the implementation of FDTL norms. Consequently, Indigo’s market share declined by 200bps MoM to 63.6% in Nov25. SpiceJet’s market share rose by 110bps MoM to 3.7%, supported by additional slots, fleet expansion, and higher ASKs in the winter schedule. The Air India Group’s market share increased by 100bps MoM to 26.7%, while Akasa’s shed by 50bps MoM to 4.7%.

Marked improvement in PLF; weather weighs on punctuality and cancellations

Passenger load factor (PLF) witnessed improvement across key airlines in Nov-25, with the Air India Group leading the pack with the highest monthly uptick of 10.2%, resulting in Nov-25 PLF of 87.5%. IndiGo and SpiceJet followed, reporting MoM uptick of 6.3% and 5.5%, with PLF up to 88.7% and 87.7%, respectively. Akasa’s PLF rose by 260bps MoM to 93.8% in Nov-25. OTP (on-time performance) declined sequentially across key airlines in Nov-25, due to weather-related disruptions. Indigo’s OTP declined to 69.0% from 84.1%, largely owing to the operational disruption, while Akasa topped the punctuality chart with OTP at 72.2%. The Air India Group’s OTP declined MoM to 69.1%, from 79.3%, while SpiceJet reported the lowest OTP at 48.4%. Cancellations showed a mixed trend during the month, with Indigo recording the highest cancellation rate at 1.57% (up from 0.48% MoM). However, SpiceJet’s cancellation rate declined to 1.27% from 1.97%, while the Air India Group’s remained steady at 0.71%. Akasa reported the lowest cancellation rate of 0.46%, albeit higher than 0.19% last month.

Easing refining cracks set to drag jet fuel prices lower

PSU OMCs have increased domestic ATF prices for Dec-25 by 5% MoM to Rs99.7/liter (in Delhi). The hike, despite a ~2% decline in crude oil prices, was driven by a ~33% uptick in jet fuel cracks and a depreciating rupee. Given currently softening refining cracks and a decline in crude oil prices, we expect ATF prices for Jan-25 to decline by 5-6% MoM.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354