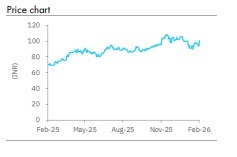

Buy GMR Airports Ltd For Target Rs.140 By Elara Capital

Earnings turn structurally strong

Q3FY26 marked a structural earnings inflection for GMR Airports (GMRAIRPO IN), driven by tariff-led aero yield expansion at Delhi and steady scaling of non-aero adjacency businesses, resulting in strong margin expansion leading to strong adjusted earnings beat. With Bhogapuram nearing commissioning and major capex behind, leverage is likely to peak in FY26 and net/EBITDA set to moderate from FY27 as EBITDA scales up. Sustained aero realization, improving non-aero monetization, and disciplined capital allocation are likely to support cash generation and balance sheet deleveraging in the medium term. We raise our earnings of 2% for FY26E, 3% for FY27E and 4% for FY28E. We retain Buy with a higher SOTPbased TP of INR 140 as we amend valuation framework and roll forward valuation to FY28E.

Delhi drives; Hyderabad stable; Goa scaling up: Consolidated revenue increased 50.5% YoY to INR 39.9bn, supported by higher aero realization post tariff reset at Delhi (DIAL) and consolidation in non-aero streams. EBITDA surged 71.5% YoY to INR 17.0bn, with margin expanding to 42.6% vs 37.4% YoY, reflecting strong operating leverage and improved revenue mix. It recorded an exceptional loss of INR 1.8bn on account of the new Labour law code. Adj PAT stood at INR 3.6bn, underlying earnings strength

Structural earnings transformation: In Q3FY26, DIAL remains key earnings driver with revenue of INR 20bn, up 48% YoY, on 20.8mn passengers, up 2.5% YoY, while EBITDA rose to INR 8bn, up 125% YoY, with a 40.4% margin, led by tariff-led aero yield expansion, steady nonaero growth and lower revenue sharing to Airport Authority of India (AAI) in Q3. Hyderabad posted revenue of INR 6.2bn, up 11% YoY, and an EBITDA of INR 4bn, up 16% YoY, with 63.5% margin, led by stable traffic and strong commercial performance. Goa (Mopa), in its ramp-up phase, generated total revenue of ~INR 1bn, down 15% YoY, on 1.5mn passengers, up 24% YoY, with an EBITDA of INR 369mn with margin at 36.5%, reflecting improving operating efficiency as traffic scales. At the GMR standalone level, revenue was at INR 12.3bn, driven by consolidation of duty-free (Delhi + Hyderabad) and cargo businesses, supporting stronger EBITDA and improving earnings mix. Commercial property development with ~1.0mn sq ft office and ~0.6mn sqft hotel at Delhi and ~0.8mn sqft retail at Hyderabad under development, with monetization likely in the next 18–24 months.

Capex at peak; deleveraging ahead: GMRAIRPO is nearing the end of its capex cycle, with net debt at ~INR 345bn (ex-FCCB) likely peaking in FY26 and moderating from FY27 as EBITDA scales. Bhogapuram (~96% complete) is slated for Q2FY27 commissioning. With limited near-term capex and Hyderabad’s expansion (~INR 120–130bn) from FY28, the company is transitioning toward a cash-generation and deleveraging phase.

Retain Buy with a higher TP of INR 140: We shift valuation from an airport asset valuation approach to business segment-wise SOTP framework, assigning differentiated EV/EBITDA multiples on FY28E to aero and non-aero segment. We value Aero EBITDA which is a regulated fixed RoE business on 12x inline with utility peers. While the structural Non-Aero business at 35x inline with consumer discretionary peers. We value landbank at each airport on per acre basis (incremental value of INR 17/share). We expect FY25-28E EBITDA CAGR of 29%. We reiterate Buy with a higher TP of INR 140 from INR 123 earlier.

Please refer disclaimer at Report

SEBI Registration number is INH000000933