Sell Tata Elxsi Ltd For Target Rs. 5,519 by Geojit Financial Services Ltd

Short-Term Prospects Remain Subdued

Tata Elxsi (TELX) is a leading provider of IT ER&D (engineering, research and development) services. TELX has capabilities across Automotive, Broadcast & Communications, and Healthcare industries.

* In Q1FY26, TELX posted a –3.7% YoY and –1.8% QoQ revenue decline, driven by reduced US client spending. The healthcare and communication verticals saw QoQ contractions of 6.5% and 5.0% in CC terms, reflecting ongoing industry softness and cautious tech investments.

* The transportation segment grew 3.7% QoQ, supported by new client acquisitions in AI and software-defined vehicle (SDV) development. Consequently, Europe’s contribution to the revenue mix improved by 160 bps QoQ.

* Despite multiple partnerships, Indian business is likely to face a slow ramp-up due to US tariff uncertainty, leading to a 2.6% QoQ decline. While other EMs continue to outperform, growing at 1.4% QoQ.

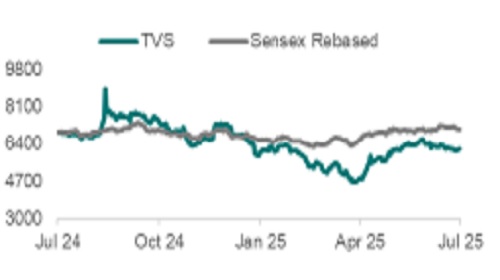

* EBITDA margin contracted to 20.9% (-200 bps QoQ, -630bps YoY), owing to lower operating leverage and higher employee cost due to an increase in onsite mix. • We believe the global macro challenges could delay the process and visibility. Hence, we expect the current valuation to remain under pressure for short term.

Outlook & Valuation

We believe softness in the spending by automotive clients is likely to pose a near-term challenge. As a result, reprioritization in the EV R&D budget is expected. To offset the same, TELX aspires to navigate by ramping up multi-year large deals. Despite new deals won in healthcare, the company expects stability only in the later half of the year. However, TELX is well positioned to capture the opportunities due to its deep domain knowledge and work on its clients’ long-term strategic projects. Meanwhile, the margin is likely to face pressure in the near term due to stiff competition from Chinese companies and GCCs. Hence, we value TELX at 41x FY27E EPS and recommend Sell rating with a target price of Rs.5,519 at CMP.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345