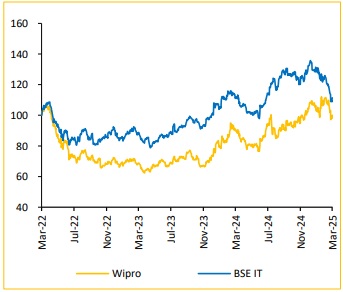

Hold Wipro Ltd For the Target Rs. 296 by Choice Broking Ltd

2.jpg)

Assessing Q3 Results in Light of Trump Tariffs & Macroeconomic Challenges Wipro Beats Estimates on all fronts

* Revenue for Q3FY25 was at INR 223.1Bn up 0.5% YoY and 0.1% QoQ (vs consensus est. at INR 222.1Bn).

* EBIT for Q3FY25 was at INR 38.6Bn, up 18.3% YoY and 2.7% QoQ (vs consensus est. at INR 36.2Bn). EBIT margin was up 259bps YoY and 44bps QoQ to 17.3% (vs consensus est. at 16.3%).

* PAT for Q3FY25 was at INR 33.7Bn, up 24.7% YoY and 4.3% QoQ (vs consensus est. at INR 30.6Bn).

Wipro secures $3.5Bn TCV in Q3FY25 with AI-driven deals and strong pipeline despite sequential dip:

In Q3FY25, Wipro achieved a strong Total Contract Value (TCV) of $3.5Bn, with large deal bookings reaching $961Mn, marking a 6.0% YoY increase in constant currency (CC). While large deal bookings saw a sequential dip, the overall pipeline remains robust, especially in the BFSI and EMR (Energy, Manufacturing & Resources) verticals. Key deals revolved around cost reduction, vendor consolidation, and AI-driven efficiency, with notable wins involving a major US retailer and a Middle Eastern airline. Despite the lumpiness in sequential large deal figures, the strategic nature of these AI-led transformations is expected to drive future revenue growth. We anticipate Wipro to continue to focus on acquiring new accounts and converting a strong pipeline into closed deals, particularly in the Americas, with sectors like healthcare and technology seeing steady demand. However, markets in Europe and APMEA remain sluggish

Potential slowdown in IT spends amid Trump tariffs:

Wipro may face revenue challenges due to uncertainty over the Fed's interest rate decisions and concerns about a potential US economic slowdown. With 60% of its revenue from North America, a dip in IT spending or delayed contract renewals from key sectors like BFSI, Consumer, Healthcare, and EMR could affect top line growth. Additionally, currency volatility poses a risk to profit margins. However, easing inflation and stable tariff policies could drive increased demand, helping US enterprises make more confident IT spending decisions

Wipro’s workforce, attrition & EBIT outlook:

Wipro saw a net decline in workforce during Q3FY25, continuing the trend from previous quarters. However, it plans to hire 10,000 to 12,000 campus recruits each quarter in the upcoming fiscal year, alongside lateral hiring. It expects attrition to reduce, driven by fewer resignations. Wipro reported an operating margin of 17.5% for Q3FY25, the highest in 12 quarters, despite absorbing 2 months of wage hikes. Management aims to sustain this margin in Q4 through improved execution, better utilization, enhanced offshoring, higher fixed-price project productivity, and cost reductions though no long-term EBIT target was set.

View and Valuation:

We anticipate that Wipro's success will depend on its ability to capitalize on its strengths in AI and consulting and improve performance in key markets. We expect Revenue/EBIT/PAT to grow at a CAGR of 6.2%/8.8%/8.0% respectively over FY25E-FY27E. We revise our rating to HOLD to arrive at a target price of INR296. Considering Wipro’s significant exposure to the US market, we have lowered our PE multiple to 21x (earlier 24x), based on the FY27E EPS of INR14.1.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131