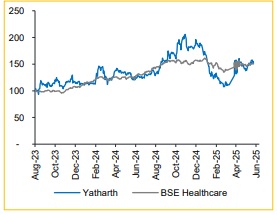

Buy Yatharth Hospital Ltd For Target Rs. 640 - Choice Broking Ltd

Yatharth Super Speciality Hospital, Noida Extension, Noida

We visited the Yatharth Super Speciality Hospital, Noida Extension, and met with Nitin Gupta, President-Finance & Group Chief Operating Officer.

Management guidance: The growth is to be driven by a change in the payer mix from government schemes (from 37% to 25%) to cash/TPA, a shift towards highend specialties, expansion into the Delhi-NCR region (a high ARPOB area), continuing its current revenue growth trajectory (~30%) with a sustainable ~25% margin, and adding 300-500 beds every year by acquiring at least one hospital.

About the facility: Yatharth Super Speciality Hospital, Noida Extension, established in 2019, is a 450-bed multi-specialty facility (expandable to 700 beds) with 390 operational beds, including 125 ICU beds. The hospital operates at an occupancy rate of 60%, with an ARPOB of INR 38,033 and ALOS of 4.26 days. It contributes ~36% to the group’s total revenue and is among the select hospitals to receive JCI accreditation on its first attempt

* The facility comprises 12 floors, each dedicated to key specialties such as oncology, cardiology, internal medicine, gastroenterology, and orthopedics. It also includes dedicated floors for general wards (govt. business), international patient services, pre- and post-operative care, pain management, and various other multi-specialty treatments.

* Expansion Plan: The expansion strategy is primarily focused on consolidating presence within the Delhi-NCR region, ensuring strong geographic control, with future plans to extend operations to nearby cities.

* The company holds a land bank adjacent to the Noida Extension facility, with the potential to add 250 beds. Construction is expected to commence by the end of 2026, with operations beginning within the subsequent 2–3 years. Expansion is structured to ensure new facilities become operational as existing ones mature.

* The aim is to acquire at least one hospital annually, with a capacity of 300–500 beds, aiming to reach a bed capacity of 5,000 beds over the next 5 years. Management is also open to asset-light expansion models. We have estimated to add 300 beds in FY27 with 60% occupancy.

* Following the acquisition of the Greater Faridabad facility in 2024, Yatharth plans to launch a 400-bed multi-specialty hospital in Faridabad by July 2025, offering oncology care and robotic surgeries. Operations will begin with 150–200 beds, with phased expansion based on performance.

Growth in the Operating Metrics:

* ARPOB: Growth will be driven by price revisions, growing interest from international patients driven by the upcoming Noida International Airport, the launch of advanced specialties such as liver and kidney transplants at two hospitals, and a strategic focus on high-end super-specialties including orthopedics, neurology, transplants, and oncology.

* ALOS is also expected to gradually decline from 4.33 days, driven by the oncology and other therapies that involve shorter lengths of stay.

* International Patient: The primary focus is on increasing patient footfall with higher ticket sizes; however, the impact on margins remains limited due to the brokerage fee, which accounts for ~40% of revenues.

* Payer Mix: Over the next 1–2 years, the share of government business is expected to decline from 37% to around 25%, supporting ARPOB.

* Robotics Surgery: While not essential, having robotic surgery capabilities is beneficial for the facility. The increase is primarily due to improved operational efficiency and the patients' paying capacity. Additionally, robotic assistance enables doctors to perform up to 1.5x more surgeries and serves as an effective marketing tool.

View & Valuation: We maintain our ‘BUY’ rating with a target price of INR 640, valuing the company at an EV/EBITDA of 14x on an FY27 basis.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131