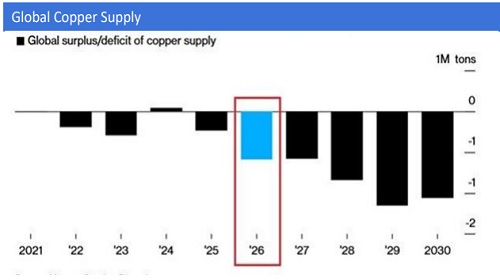

Experts see copper deficit: 590k tons in 2026, to 1.1m by 2029 - HDFC Sescurities Ltd

Chart with Interesting Observations

Copper is Heading Toward A Landmark Supply Crunch

* Market experts expect that the global copper market will post its largest shortfall in more than two decades in 2026, with a deficit of roughly 590,000 metric tons. By 2029, that gap is expected to balloon to nearly 1.1 million tons.

* This imbalance is unfolding as worldwide copper output is set to decline for the first time since 2020. Mining operations across the globe have been hit by significant disruptions, including technical and operational setbacks at several key production hubs, further tightening supply.

* Meanwhile, consumption is accelerating rapidly. Rising demand from artificial intelligence infrastructure and electric vehicle manufacturing is forecast to grow faster than the available supply.

* For years, copper producers have been unable to expand output quickly enough to match increasing usage. As a result, elevated copper prices appear poised to persist.

Nifty : “Doji” Candlestick On Daily Chart Bullish Reversal Indicates Probable

Nifty PSU Bank Index : Fresh Breakout On The Daily Charts; Expect Further Gains

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Rollover Report before September 25 Expiry by Nirmal Bang Ltd