Buy Rainbow Children`s Medicare Ltd For Target Rs.1,600 by Prabhudas Liladhar Capital Ltd

Growth to improve as new capacities ramp up

Quick Pointers:

* New units guided to breakeven in 12-18 months.

* Guided for ~20% revenue CAGR over next 3 years

RAINBOW’s Q2FY26 was weak quarter with EBITDA grew by mere 1% YoY to Rs1.5bn. RAINBOW enjoys higher margins, strong FCF generation with net cash B/S, and healthy return ratios because of the asset-light hub-and-spoke model, it being the only integrated multi-specialty pediatric hospital chain in India offering comprehensive services, and its full-time doctor engagement model. Strategic expansion across its core markets in South India also augurs well for its sustainable growth. Our FY26E / FY27E EBITDA stands reduced by ~10% as we factor in lower occupancy. Overall, we see profitability to improve from FY27 with 19% EBITDA CAGR over FY26-28E vs 10% CAGR over FY24-26E as new capacities ramp up. Maintain ‘BUY’ rating with revised TP of Rs1,600/share valuing at 27x EV/EBITDA based on pre-IndAS Sept 2027E EBITDA.

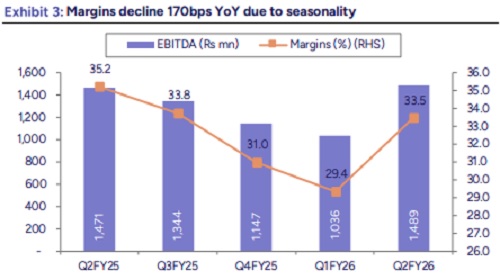

* Muted quarter: RAINBOW reported EBITDA of Rs1.5bn, up 1% YoY. Margins declined by 170bps YoY to 33.5%, impacted by seasonally weak pediatric quarter. Pre-INDAS EBITDA came in at Rs1.25bn, flat YoY. OPM stood at 28.2%, declined by ~180bps YoY. Adj PAT decreased 5% YoY to Rs753mn impacted due to lower other income.

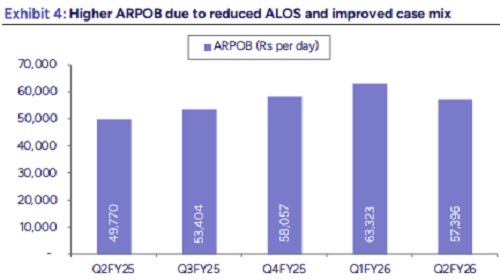

* Higher ARPOB; lower occupancy: Revenue grew 7% YoY to Rs4.5bn. ARPOB increased 15% YoY to Rs67.4k per day aided by better case mix and reduction in ALOS to 2.73 days from 2.94 days in Q2FY25. Average occupancy decreased by 800bps YoY to 52%. In Q2, Rainbow integrated Prashanthi Hospital, Warangal and Pratiksha Hospital, Guwahati. Occupancy of mature units declined by 1,000bps YoY to 56%, while that of new units was flat YoY to 44%. IP volumes were flat YoY, while OP volumes improved 6% YoY.

Key con-call takeaways:

* New acquisitions - Rainbow integrated both Prashanthi (Warangal) and Pratiksha (Guwahati) in Q2. The transition phase temporarily impacted revenues due to insurance empanelment delays, which are now largely resolved. Management expects a meaningful pickup in volumes and revenues from Q4. Pratiksha, previously operated under multiple entities, is now fully transitioned into Rainbow with unified systems and processes. The Northeast expansion strategy will follow a hub-and-spoke model, with Guwahati as the regional hub and potential spokes potential in nearby areas of Shillong.

* Bed expansion – Rainbow has added ~780 beds over the past two years, effectively concluding its current expansion cycle. The 90-bed Electronic City unit in Bengaluru is fully ready and awaiting final government approvals for launch, while the 60-bed Hennur facility is on track to commence operations by Jan’26. The 100-bed Rajahmundry hospital has been commissioned, guided for accelerated ramp-up with strong brand recall in Andhra. The Coimbatore regional hub is under construction and scheduled for commissioning by endFY27. Construction at the 450-bed Gurgaon project is temporarily paused due to pollution-related restrictions, with a sizable capex outlay expected over the next three years. The 150-bed Pune project has been signed and is currently in the design phase.

* Capex – Q2 capex stood at Rs 2.6bn, including acquisition-related outflows. Management expects H2FY26 capex to be at Rs 1bn, primarily driven by the Bengaluru expansions and the Gurgaon project. The combined capex for Pune, Coimbatore, and Gurgaon is guided at ~Rs 6bn over FY27–29E. Funding remains comfortable with strong internal accruals and a healthy net cash position of Rs5.6bn

* Mature hospitals (constituting ~50% of the base business) reported an 8–9% YoY decline in IP volumes, largely due to unusually weak seasonal incidence (lower general pediatrics and PICU loads). Management reiterated that seasonal trends typically boost occupancy by ~8% and revenue by 12–14% in Q2–Q3; the absence of this led to a muted quarter.

* New hospitals – Sarjapur (Bengaluru) achieved breakeven in 15 months, while the other Bengaluru spoke reached breakeven in 18 months, both within guided timelines. Rajahmundry is expected to breakeven in 15–18 months, supported by strong brand recall in coastal Andhra. Hennur is guided to breakeven within 12 months of launch, and the Electronics City unit is expected to breakeven in ~15 months post regulatory approvals.

* Delhi - Madhukar is now generating consistent double-digit EBITDA post turnaround, though margins are capped at ~15% due to the mandatory freebed quota, which skews the mix toward ICU-heavy patients. The Rs 230– 240mn receivable from the Madhukar Trust has been restructured with a moratorium in place. Rosewalk has been repositioned from a luxury birthing centre to a regular maternity unit, driving improved operating performance.

* International biz - International revenues have recovered to ~Rs 30mn per month, with Bangladesh volumes still constrained by visa challenges and Africa is showing steady improvement. Management is targeting a mediumterm contribution of ~10% of revenues from international markets, which will require scaling the doctor network and forging deeper clinical partnerships.

* IVF revenues account for ~3.2% of topline and are expected to exceed Rs 400mn+ in FY26, implying ~40% YoY growth on a low base. The business is primarily driven by in-house referrals and direct B2C channels, with minimal B2B activity. Management targets ~25% annual growth over the medium term.

* Insurance tariff renegotiations are largely completed for the Hyderabad cluster, while discussions in the Bengaluru cluster are currently underway.

* Revenue and margin guidance - 20% revenue CAGR over 2.5–3 years, driven by new capacity, acquisitions, and scale-up of existing units. Base EBITDA margins guided at 25% (pre-Ind AS); room for improvement as new hospitals mature. H2 expected stronger due to seasonality normalization.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)