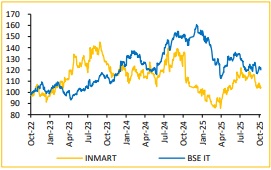

Buy IndiaMART Ltd for the Target Rs. 2,875 by Choice Institutional Equities

INMART Growth Backed by Monetisation & Investments

INMART’s outlook remains positive, driven by strong monetisation and 6–8% ARPU CAGR, despite short-term subscriber churn (7% monthly) in the Silver segment. Core financials are solid, with deferred revenue up 18%. Long-term growth potential is compelling, with just 2–3% penetration in a INR 15–20Mn SME TAM. The company is advancing its tech stack by leveraging AI, voice bots, call analytics and platform enhancements to deepen engagement. While a recent Silver-tier price hike may slightly impact near-term additions, strategic initiatives are expected to support growth. We upgrade our rating to BUY while maintaining the Target Price to INR 2,875, based on a 25x PE multiple (maintained) to the average FY27E–FY28E EPS of INR 115.

Revenue & EBITDA Beat Estimates; PAT Misses Due to Low Other Income

* Revenue for Q2FY26 came in at INR 3.9Bn, up 5.1% QoQ and 12.5% YoY (vs CIE est. at INR 3.6Bn).

* EBITDA for Q2FY26 came in at INR 1.3Bn, down 2.8% QoQ and 3.6% YoY (vs CIE est. at INR 1.2Bn). EBITDAM was down 271bps QoQ and 554bps YoY to 33.2% (vs CIE est. at 33.0%).

* PAT for Q2FY26 stood at INR 0.8Bn, down 46.1% QoQ and 38.8% YoY (vs CIE est. at INR 1.3Bn).

Management Guides 6–8% Long-Term ARPU Growth:

Annualised revenue per paying supplier (ARPU) rose 1.6% QoQ to INR 65,000, driven by price hike and 2,800 new paying suppliers. Management anticipates 6–8% ARPU CAGR in the long term, accounting for full cycles and lower-tier dilution. Significant upside remains among enterprise clients with larger budgets and broader reach. We expect monetisation efforts to benefit in this segment, as Platinum and Gold tiers continue to deliver strong upsell and retention. Monthly churn remains healthy at ~1%, reinforcing the value of premium tiers and supporting sustained growth in supplier monetisation across the platform.

Silver Plan Churn Persists Despite Price Hike:

Silver monthly and annual plans see higher churn at ~7% and ~4% respectively. This elevated churn continues despite efforts to improve platform quality. Management recently implemented a price increase for Silver plans, the first since 2019, viewing a 10% hike every 2 years as necessary to counter inflation. This increase is expected to result in a slightly temporary dip in gross additions for the next one or two quarters. We expect management finding the right solution to stabilise this churn and secure the overall subscriber funnel.

EBITDAM Stabilising as INMART Invests in AI & Customers:

EBITDAM for Q2FY26 stood at 33%. Selling and marketing cost is expected to stay stable at 17–18% of revenue, down from pre-COVID 19%. Increased performance marketing spends, rising from INR 6 to 10Crs per quarter, may reduce margin by about 1%. Additionally, new ESOP expenses of INR 90Crs will impact costs. Overall, stable expenses and revenue growth will support margins, though marketing and AI investments could influence future performance.

Management Call – Highlights

* Treasury Impact: Other income declined significantly due to mark-tomarket losses taken on the treasury portfolio, resulting from a significant increase in bond yields during the quarter.

* Churn Stability: Platinum and Gold customers, who contribute more than 75% of revenue, continue to have a very good upsell and retention rates, with churn remaining healthy at about 1% per month.

* Reducing Competition: The number of sellers introduced per buyer has reduced, as supplier responsiveness significantly improved (now 70%–80%), increasing the effectiveness of leads.

* Improving Inquiry Quality: The company is now requiring buyers to fill in more details, such as quantity and specification, when submitting RFQs. This clarifies buyer intent (since they fill more details) and helps suppliers to choose the most relevant inquiries.

* Localisation: The platform is shifting towards providing more citypreferred localised search results.

* Voice Bots: AI-based voice bots are being rapidly deployed and are expected to handle up to 100,000 calls per day by January, 2026.

* Call Analytics: AI is being leveraged for call analytics to process the approximately 30Mn calls per month which takes place within the ecosystem, turning this "black box" data into actionable insights for cataloguing and categorisation.

* Platform Quality Steps: Efforts to improve retention include reducing the number of sellers introduced per buyer and increasing inquiry quality by asking buyers for more details.

* KPI Change: Management is no longer relying on web traffic growth as a KPI because metrics have become unreliable due to extensive crawling, scraping and bot traffic from various AI agents (including Meta and ChatGPT).

* Marketing Spends: Performance marketing is budgeted for up to INR 8–10Crs per quarter (compared to INR 6Crs spent in Q2), with selling and marketing cost generally expected to hover around 17% to 18% of revenue.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131