Buy Ugro Capital Ltd For Target Rs.320 by Centrum Broking Ltd

Guidance deferred due to macro stress

UGRO Capital reported decent numbers with total income and earnings coming in 2.1% and 9.7% above our estimates. The rise was mainly led by the highest ever disbursement in a quarter, resulting in higher interest income for the quarter. Other operating income declined by 5% QoQ due to lower Co-lending/DA volume. AUM as on Q3FY25 stood at Rs110.7bn, up 32% YoY and 9% QoQ. Total income at Rs2.2bn was up 34% YoY (9% QoQ), in line with AUM growth as the portfolio yields (reported) increased by 40bps YoY to 16.7%. However, opex came in higher (C/I ratio at 56.7% in Q3FY25 vs 52.7%/53.2% in Q2FY25/Q3FY24) due to branch expansion and will continue to be higher in the coming quarters as the expansion continues, as per the management. Resultantly, operating profit came in flat at Rs942mn (up 24% YoY and flat QoQ). Credit cost (on AUM) inched up by 7bps YoY (fell by 27bps QoQ) to 1.56%. Higher interest income translated into strong net profit of Rs375mn (up 15% YoY and 6% QoQ). RoA stood at 1.9%, down 10bps QoQ. GNPA was flattish while NNPA saw an uptick of 20bps QoQ to 2.1% and 1.5%, respectively. Further, at the current price, the stock is trading at an undemanding valuation of 0.8x P/B on 1-year forward basis, making it an attractive investment opportunity. However, we remain mindful of the challenging macroeconomic environment – the management eluded to stress in the unsecured segment, the broader de-rating in valuation multiples across the lending space and higher expansion plans, which would delay its guided 4% ROA target by three more quarters. Considering these factors, we have reduced our P/ABV multiple from 2.0x to 1.25x and we roll over to FY27E valuation to arrive at our revised target price of Rs320. Maintain BUY

Highest ever disbursement clocked in a quarter

Ugro reported disbursements of Rs20.9bn, up 35.2% YoY and 6.4% QoQ with high growth registered in Emerging Market (EM) loans (+202%/+19% YoY/QoQ). Other segments of SCF witnessed foreclosures. A diversified product mix and strong growth over the last few quarters supported AUM growth of 32% YoY and 9% QoQ. The management remains committed to maintaining higher share of secured book (including quasi secured) and to bring it to 70% of AUM with increasing mix of high-yields products. The share of off book AUM is likely to move up to 50%. It plans to reach 400 branches by FY26, which would ensure continued growth.

Mixed performance on operational front

Operating profit increased by 24% YoY (flattish QoQ), led by (1) Higher AUM growth and (2) Lower Co-lending volume and (3) Higher opex. Further, CoF (calc.) was up slightly by ~4bps. Resultantly, NIM (calc, incl. gain on de-recognition of FI) on AUM was flat at 7.2%. Portfolio yields (reported) remained flat QoQ at 16.7%. The management has guided for 70bps100bps improvement in yields over the next one year and in total 150bps by FY26 as the share of high-yield book increases.

Asset quality stable

Ugro witnessed a sequential rise in Stage 2 assets by 10bps to 4.4%. However, GNPA came in flattish at 2.1% vs. 2.1% in Q2FY25. As per management, asset quality is stable currently but regulatory tightening on unsecured loans is impacting the perception towards NBFCs. It expects credit cost to increase over the next few quarters and settle ~2% (of AUM) on a steady-state basis as the book seasons

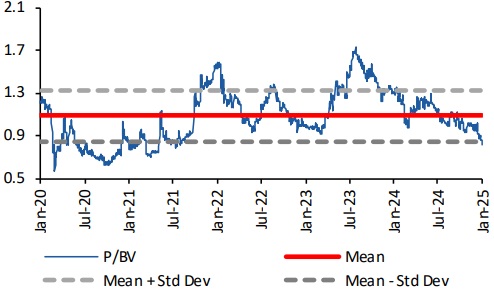

Valuations

We remain mindful of the challenging macroeconomic environment – management eluded to stress in unsecured segment, the broader derating in valuation multiples across the lending space and higher expansion plans of the company which would delay its guided 4% ROA targets by 3 more quarters. Considering these factors, we have reduced our P/ABV multiple from 2.0x to 1.25x and we roll over to FY27E valuation to arrive at our revised Target Price of Rs320. Maintain Buy.

P/BV mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331