Buy Oil and Natural Gas Corporation Ltd For Target Rs. 313 By Yes Securities Ltd

EBITDA exceeds estimates, while PAT takes a hit on higher depreciation

ONGC’s Q3FY25 earnings saw a higher-than-expected EBITDA supported by a stable crude and gas production as well as strong sales. The crude net realization was lower than our estimated while PAT misses estimate on higher depreciation. Crude and natural gas production were flat YoY but saw marginal QoQ recovery, an increase in production from both oil & gas, especially from KG basin remains the key. Other expenses were marginally higher than estimated while other income was a miss, there was dividend income of Rs1.5bn. OVL's topline performance improved in crude and gas with the volumes increased for crude and gas production. OVL’s profitability deteriorated YoY & QoQ. We maintain a BUY rating on ONGC, with a revised TP of Rs 313/sh.

Result Highlights

* Performance: EBITDA/Adj. PAT was at Rs 189.7/82.4bn was +10.5/-13.6% YoY and +4%/-31.2% QoQ. (note: Exploration write-off costs are taken below EBITDA). EBITDA was higher than our estimates on strong product sales while PAT missed expectations on higher depreciation.

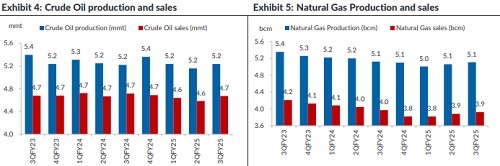

* Crude production: was flat YoY and up 1.5% QoQ to 5.24mmt (was lower than the company target), the shortfall is primarily due to delays and underperformance in key fields, unplanned power shutdowns, reservoir declines, suboptimal polymer EOR, and drilling restrictions in Cauvery Asset. Natural gas production: was flat YoY and up 1% QoQ to 5.11bcm, missing company’s target on delays in KG-98/2 and Bantumilli South, lower output from WO-16 and VA-DA wells, drilling and pipeline delays in Tripura, reservoir management shutdowns, consumer offtake issues, and production declines in Rajahmundry.

* Crude and Gas realization: Net crude realization was down 1.3% YoY and 3.1% QoQ to USD 72.5/bbl. The gas realization was at USD 6.5/mmbtu. Windfall taxes stood were NIL as compared to USD3.5/bbl the last quarter.

* Depreciation including exploratory write-off stood at Rs 87bn (vs our expectations of Rs72.5bn) up 17.5% YoY and 27.8% QoQ. Finding cost: increased to USD 10.9/bbl, near last 3 years’ average of USD10/bbl. The statutory levies as a % of revenue stood at 19.7% (versus 27.4% YoY and 23.1% QoQ).

* Other expenses at Rs 65.2bn (was up 17.5% YoY and 15.5% QoQ). The other income at Rs18.1bn, down 46.7% YoY and 62% QoQ, including a dividend income of Rs1.5bn which is lower than our expectations.

* OVL performance: production for crude at 1.8mmt (vs 1.82mmt YoY and QoQ) and gas at 0.77bcm (vs 0.86bcm YoY and 0.71bcm QoQ). The EBITDA at Rs 2.7bn was down 70.6% YoY and 72.7% QoQ while PAT loss at Rs 4.2bn vs a profit of Rs1.8bn YoY and Rs3.3bn QoQ.

* 9MFY25 Performance: EBITDA/Adj. PAT was at Rs 559.7/291.6n vs Rs 549.8/297.7bn in 9MFY24. Crude production was down 0.9% to 15.6mmt, natural gas production was down 2.4% to 15.2bcm. Net crude realization was down 1.2% to USD73.9/bbl. Dividend: Board approved a 2nd interim dividend of Rs 5/sh ) with 7th Feb’25 being the record date (47% payout on 9M earnings with 1st interim of Rs 6/shr).

Valuation

We maintain a BUY rating on ONGC, with a revised TP of Rs 313/sh. Our TP of Rs 313/sh comprises of a) Rs 257/sh for the stand-alone domestic business, valued on 3x EV/EBITDA FY27e, b) Rs 5.9/sh for OVL on PER of 6x FY27e, c) Rs 50/sh for investment in listed equities, valued at 30% hold-co discount to market price.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632