Buy Carysil Ltd For Target Rs.1,035 By Yes Securities Ltd

Maintained guidance; reiterate BUY!

We visited Carysil Ltd's plant at Bhavnagar wherein we interacted with the CMD, CFO and plant heads. Following are the key highlights from the same:

Factory:

Factory has 200+ moulds for quartz sinks of which ~86 work at one time and the process takes ~45mins per piece after which it goes for finishing. Mould price is in the range of Rs5-10Mn and there are also some moulds functioning from 1990s. 34-36 pieces are made presently per day per machine totaling 2,200-2,300. 55-56 colors are being made currently. Acrylic resin RM is a mix of MMA (imported from Evonik) + PMMA. Packaging cost is 8-8.5% of revenue. Orders are delivered within 45-50 days for exports & 30 days for domestic.

* Press steel sink takes 7-8 mins to make that is followed by cleaning, finishing, etc. and the total process takes ~1 hour. Quadro sinks take longer as they are completely handmade and offer better touch & feel. Steel sheets RM is procured from Jindal Steel. Steel sink inventory of 1-1.25 months is maintained.

* Plant has a current workforce of ~1,400 of which 550-600 are permanent and rest are on a contract basis.

* RM warehouse audit happens every 3-4 days by both new and old clients.

* An after sales service team is present only for appliances and is based out of Mumbai.

* Company bought a 40,000sqm plot 1-1.5 years back for capacity expansion whose value has appreciated by 6-7x. Were the plot bought today, the cost would have been ~50% of capex. Layout for the same is on the drawing board.

Guidance:

* Management expects FY26E volumes to be more than FY22 and has a target to reach 20%+ blended EBITDA margin within 3 years.

* 90-95% of the market in India is dominated by steel sinks. However, there has been a shift to quartz owing to more colors and its dent-free, scratch-free nature.

* Company sees India & USA as key markets for the next 4-5 years. The aim will remain to manufacture only in India and sell globally.

Operations:

* Revenue breakup - 30-35% USA, 30% EU, 10-15% UK, 20% India, rest RoW.

* South & West contribute 30-35% each to revenue, followed by North at 20-25%, and the rest coming from East. Management is focusing more on tier-II/III cities where the traction has been rapidly increasing.

* Top 5 clients contribute ~40% to sales. Company is the sole supplier for Grohe globally and supplies ~30% of IKEA’s global annual sales of 3.5mn sinks. IKEA wants to increase the same to ~50%. IKEA is also in talks to enter the USA market and Carysil is designing models for IKEA to pitch in USA.

* Management sees RM cost to remain fairly stable with a marginal downward trajectory.

The manufacturing cost advantage has increased from 20-25% to 30% Vs other peers owing to backward integration (only company in the world) and the same is expected to go up to 40% gradually.

* 15% sales were being lost owing to supply related problems, working capital being blocked in higher inventory of other SKUs, lack of inventory, etc. To resolve this, ~50% of the SKUs, mainly colors, have been reduced across the fastest moving sinks & appliances to focus on hero products and higher margins. New products lines are being offered in the non-existing colors to offer product differentiation.

* Company is sitting on a comfortable level of debt and can also borrow additional funds till Rs5Bn level. Debt reduction will only take place from cash flow generation.

Product segments:

* Quartz sink ASP has increased from ~Rs4,500 5-6 years back to Rs5,600-5,700 presently. It has a GM of 47-48% and EBITDA margin of 20%+.

* Quadro sinks has a 25-30% higher ASP of Rs6,000-6,500 than plain steel sinks of Rs4,000. But the cost of Quadro sinks is also higher by ~15%. Of the total steel sinks volumes, ~40% is Quadro. Steel sinks have a blended EBITDA margin of ~15% wherein quadro sinks have a margin of 18-20%.

* PVD color to steel sinks has a value addition of ~10-15% to ASP.

* Appliances have an EBITDA margin of 16-17%.

* Chimneys & hobs/faucets register a revenue of Rs450-500Mn/Rs70-80Mn respectively.

* 90% of the products sold currently are outsourced in chimneys & hobs. With the new upcoming plant, the management plans to eventually manufacture 100% (60% will be assembly, 40% manufacturing) of the products in-house. GM would increase by 5-6% over the 40% for outsourcing model. Consequently, EBITDA margin is expected to increase from 16-18% to 20%+.

* Faucets have an ASP of Rs6,000-8,000 with a GM of 50% and EBITDA of 20%+. Carysil currently is only present in domestic market and has received its 1st export order (only company to export) from Australia & Dubai and will eventually start in USA & UK.

* No major price hike has been taken. A price hike is taken only if there is an increase of 10%+ in RM cost. Currently, margins are being impacted by ~1.5% by increase in freight costs that have been witnessing a downward trend.

* Company is planning to start assembly of ovens & wine chillers.

* Carysil is planning to launch sinks with seamless fabrication into surfaces in India. The market for the same is US$100Bn globally, US$40Bn in USA and non-existent in India

Subsidiaries:

* UK is the major subsidiary contributing ~40% of the total revenue. Carysil Products has a GM of 33-34% with an EBITDA margin of 17-18%. Home Products (surfaces) has a GM of 30% with an EBITDA margin of 15-16%.

* Carysil Brassware has a GM of 40% with a lower EBITDA margin of 13-14% owing to relatively lower volumes. The total turnover stands at ~GBP2Mn and company plans to merge it with Carysil Products primarily to safeguard the faucet technology obtained.

* Annual revenue for the US subsidiary has decreased from US$12Mn to US$7-8Mn and is incurring losses that is causing a drag on the blended margins. Management aims to improve the revenue to at least US$10Mn by FY26E.

* Furthermore, the sourcing for United Granite has been changed from local procurement to India whose impact is expected to be seen from Q1FY26E. It is expected to lead to an increase in GM by 10-15% from 30-35% to 40-45%. With Trump coming in, the situation seems to have improved and USA market has opened up. Company expects that it will lead to an increase in utilization from 50-55% to 60-65% in Q1FY26E and 70-75% by FY26E end. Thus, management expects to achieve an EBITDA margin of 8-10% for FY26E.

* UAE revenue for the last quarter was ~Rs60Mn which has led to doubling of the annual expected revenue for year 1 to ~Rs200Mn Vs earlier estimate of ~Rs100Mn. A new 3,000sqft showroom is also being opened in both Muscat and Dubai.

* Acrycol quartz RM plant is expected to start is 1-1.5 months with more advanced technology. Currently, the quartz RM is being sourced from a smaller plant whose operations will completely shift to Acrycol. Acrycol will also support Carysil’s expansion plans. The management plans to merge Acrycol in 5-7 years

Growth initiatives:

* Major thrust for growth is expected to come from new client acquisition. Company has penned 5-year contract with Karran, a major supplier in USA.

* Carysil has received another huge order from USA for sinks where due diligence is complete, and papers are expected to be signed by Q4FY25E that would increase capacity utilization by 20-25%. 2 more big clients are in the pipeline.

* Capacity expansion for sinks is expected to be completed by next year as it will be required to service the 2 new clients. Steel sinks capacity will go to 200-250K per annum.

* Management is expecting 3 big players to send orders for faucets in Mar’25 mainly for export market.

* A new team is being hired solely to cater to the rapidly growing e-commerce market

Valuation:

At CMP, the stock trades at P/E(x) of 20.0x/16.1x on FY26E/FY27E EPS of Rs33.4/41.4 respectively. We continue to value the company at P/E(x) of 25x on FY27E EPS, arriving at a target price of Rs1,035 (adjusted for revised share capital). Hence, we reaffirm our BUY rating on the stock.

Exhibit 5: 1-year forward P/E (x) chart

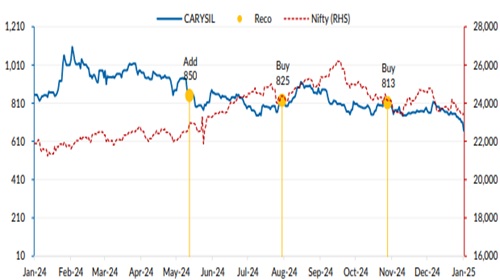

Recommendation Tracker

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632