Add Ujjivan Small Finance Bank Ltd For Target Rs. 42 By Yes Securities Ltd

Turn of the cycle in sight

Accelerated shift towards Secured products impacts NIM; much-betterthan-industry trends in Microfinance

Ujjivan SFB’s PPOP/PAT in Q3 FY25 were 10%/28% below our estimate owing to a material contraction in NIM, lower other income and higher credit cost. Gross loan book was flat sequentially, representing sharp decline in Group Loans, no growth in Individual Loans and strong growth in Secured products of Affordable HL, MSME and FIG. The shift towards Secured products has accelerated in recent quarters with their contribution rising from 31% in June to 35% in Sept to 39% in Dec. Besides this, slight increase in deposit cost, higher interest reversals from higher GL & IL slippages and portfolio yield decline across Secured products drove the contraction in bank’s NIM. Overall other income in the quarter was impacted by lower processing fees and insurance income (both connected with moderate disbursements) and full provisioning on SRs created from the ARC sale done.

Credit Cost rose to annualized 2.9% on account of increased slippages in GL & IL (Rs2.98bn v/s Rs1.97bn in Q2) and accelerated provisions of Rs300mn (PCR stood at 80% including higher allocation of Floating Provisions). For Ujjivan SFB, the collection and PAR trends in Group Loans have been trending much better than industry due to better regional mix/diversification and guarded underwriting/growth aggression which is reflected in significantly comforting lender overlap across borrower base (high percentage of unique borrowers and low percentage of over-leveraged borrowers having loans from multiple MFI lenders). Even in Individual Loans, the borrower and exposure selection has been prudent translating into materially lower PAR/NPL levels than GL. Slippages and credit cost ratios in the Secured portfolio of the bank have been stable.

Growth to pick-up and credit cost to peak in Q4 FY25; NIM a key monitorable in coming quarters

PAR addition in GL & IL was lower in Q3 FY25 versus Q2 FY25 with NDA collection efficiency exhibiting consistent mild improvements from October. With augmentation of collection staff for delinquent buckets also, the resolutions across SMA pool have improved by 20-35% than earlier (ebbing the fwd. flows). Given SMA pool in GL & IL is largely flat sequentially in absolute terms and that current bucket collection efficiency is improving, the slippages in Q4 FY25 could be around the level of Q3 FY25. Nonetheless, the credit cost has been guided higher to incorporate incremental accelerated provisions. Comforted by improving collection/resolution trends and lesser lender overlap across borrower portfolio, the bank has stepped-up GL & IL disbursements from January. To drive growth and retain/acquire quality borrowers, the bank has taken a pricing reduction of 115 bps and 75 bps in GL and IL respectively from start of January. Robust traction in various Secured products is expected to continue. NIM would likely remain under pressure over the next couple of quarters due to loan pricing reduction and incremental impact of portfolio mix shift and interest reversals from further slippages.

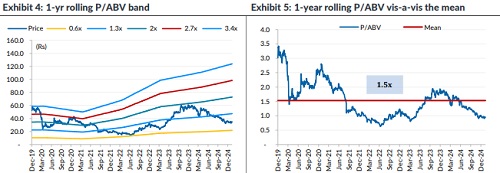

Significant Growth/RoE turnaround could play out over FY25-27

Ujjivan SFB is much better poised to start its outward journey from the current cycle. Normalization of growth and credit cost is expected to start from Q1 FY26 and the fullyear outcomes would likely be much better than FY25. Stock is available at attractive valuation of 5x PE and 0.8x P/BV on FY27 estimates for a significant Growth/RoE turnaround. Retain constructive stance with 12m PT of Rs42.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632