Buy L&T Finance Ltd For Target Rs. 1,330 By JM Financial Services

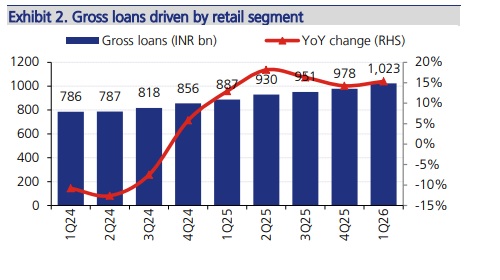

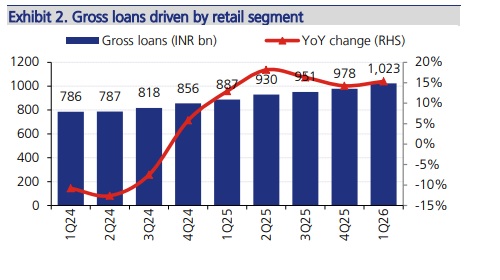

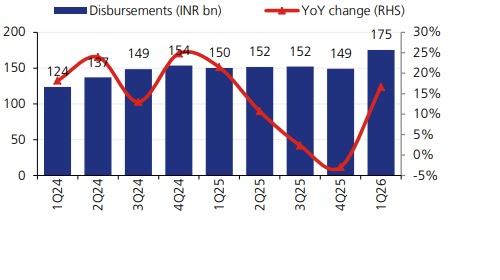

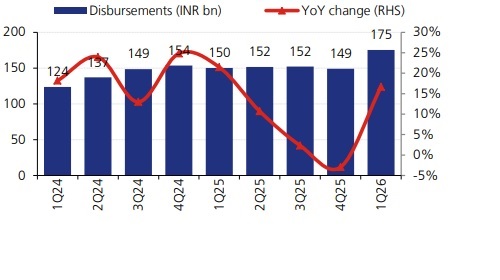

L&T Finance (LTF) reported a steady quarter, with PAT beat of +4% on our estimates increasing (+2%/+10% YoY/QoQ), leading to RoA of ~2.4% (+15bps QoQ). Credit costs, improved sequentially to 2.2% (-28bps QoQ) and the company utilized further INR 3bn macro-prudential provisions. Adjusting for this utilized overlay, credit costs would have been 3.4% (vs 3.8% in Q4). GS3/NS3 was steady at 3.3%/1% (both +2bps QoQ). Margins (reported) improved +9bps QoQ led by -16bps QoQ decline in CoFs and -8bps QoQ decline in yields. NIM+Fees stood strong at ~10.2% (+7bps QoQ) vs management guidance of 10- 10.5%. Gross loans grew (+15%/5% YoY/QoQ) led by strong disbursements of INR 175bn (+17% YoY/QoQ). Company also acquired gold loan business of worth INR 13.6bn from Paul Merchants Finance. Current quarterly performance has been steady with moderating credit cost and improved growth visibility given its partnerships with Amazon and Phonepe. Its project Cyclops also offers significant support to the business in terms of underwriting. We maintain BUY with a revised TP of INR 240 (valuing at 1.9x FY27E BVPS).

* Growth pick up led by gold book acquisition:

Disbursements growth during the quarter was strong at (+17% YoY/QoQ both) majorly led by pick up in LAP (+35% QoQ), farm equipment (+25% QoQ), 2W (+15% QoQ), rural business loan (+10% QoQ) and HL (+13% QoQ) segments. On the other hand, the company acquired Paul Merchants Finance’s gold loans business which led to incremental disbursements of INR 15.3bn. As a result, overall growth came in strong at +5% QoQ, +15% YoY. Within the retail book, growth was driven by LAP (+10% QoQ), Personal loans (+8% QoQ), SME finance (+7% QoQ) and home loans (+5% QoQ). In addition, it acquired gold loans book of INR 1.3bn from Paul Merchants Finance. Company aims to add 175 more branches in gold loans (currently at 130 branches) which will also cross-sell microLAP, SME and PL. Wholesale book contracted -3% QoQ leading to total retail composition of 98% of total book. We build in gross loan growth of ~15% CAGR over FY25-27E (~17% CAGR in retail loans).

* Margin improves sequentially: LTF reported largely line operating performance led by modest NII growth of +2% YoY, +6% QoQ as reported margins improved +9bps QoQ led by -16bps QoQ decline in CoFs and -8bps decline in yields. NIM+Fees stood strong at 10.22% (+7bps QoQ) vs management guidance of 10-10.5%. Opex grew +9% YoY, +4% QoQ leading to PPoP growth of +4% YoY, +6% QoQ -2% JMFe. Lower than expected credit costs of 2.2% (vs 2.5% QoQ) led to a PAT growth of (+2% YoY, +10% QoQ) beating our estimates by +4%. The lower credit costs was on the result of utilization of macro prudential provisions of INR 3bn adjusting for which credit costs was 3.4% vs 3.8% QoQ. We forecast EPS CAGR of 23% over FY25-27E.

* Steady asset quality: GS3/NS3 was largely steady at 3.31%/0.99% (+2bps QoQ both), with PCR at 71%. Retail GS3 was up +3bps QoQ at 2.93% on which the company maintains PCR of 72.3% (72.8% QoQ). Due to macro utilization during the quarter, the ECL cover on its retail stage 2 declined sharply from 42% in Q4FY25 to 29.1% during the quarter also leading to total provision cover to decline to 3.4% from 3.7% QoQ. The LTF+3 or more lenders now comprise 5.2% of total book (vs 8.2% in Q4FY25). Management expects Karnataka CEs to stabilize in next 3-4 months while Tamil Nadu legislations had negligible impact on collections. Management thus guided for 2.4% credit costs over FY26E with steady decline up to 2.3% in Q4FY26E.

* Valuation and View: We believe that the current quarterly performance highlights steady recovery from Karnataka book over the coming quarter while remaining book continues to perform well thus indicating better asset quality over the long term. The growth visibility has also strengthened given its partnerships with Amazon and Phonepe while its project Cyclops also offers significant support to the business in terms of underwriting. We maintain BUY with a revised target price of INR 240 (valuing at unchanged multiple of 1.9x FY27E BVPS).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131