Reduce Asian Paints Ltd For Target Rs. 2,800 By JM Financial Services Ltd

Strong execution in a challenging environment; sustaining momentum will be key

Asian Paints reported a strong earnings print in a challenging environment (intense monsoons/ competition). Revenue growth of 6% was led by better-than-envisaged decorative volume growth (+10.9% vs. our est. of 5%), resulting in 10-11% beat on EBITDA/PAT. Management attributed outperformance to a string of internal initiatives (higher brand spends, innovations, enhanced services, widening B2B net, thrust on micro markets) coupled with benefit of early festive season. On the outlook it remains cautiously optimistic – Industry growth in 1H has been soft. Some green shoots seen in September/first fortnight of October; upcoming marriage season should provide support but need to be watchful of sustainability. Overall it expects mid-singledigit sales growth with unchanged margin guidance of c.18-20% for FY26E. We have raised our est. by c.2-4%, factoring double digit volume growth in 2H and low-double-digit sales growth for FY27/28E. With improving outlook and stabilizing competitive intensity, we raise our target multiple to 50x (vs. 43x earlier) to arrive at revised TP of INR 2,800 (earlier INR 2,245). We like Asian Paints’ execution; however, with recent run-up (20% in last 1 month), upsides are capped. Maintain REDUCE. Sustained demand recovery will be key for rerating from current levels.

* Decorative business surprises positively...: Consol. sales grew by 6.3% to INR 85.3bn, while EBITDA/adjusted PAT grew at a much faster pace by 21.3% and 18.6% to INR 15bn and INR 10bn respectively. Revenue performance was 5-6% above our and street estimates, primarily driven by robust volume growth in domestic decorative business (broad-based growth across urban/rural markets and across segments). Difference between volume and value growth of c.5% was largely due to adverse mix/higher rebates; mgmt. expects gap of c.4-5% to sustain in coming quarters. Home improvement segment declined 6% YoY (bath fitting: -5% and kitchen: - 7%), impacted by subdued consumer discretionary demand. Weatherseal sales grew 56.9% while White Teak sales (-15.2% YoY) remained impacted by BIS challenges. Industrial business saw healthy performance (AP-PPG sales grew 10.2% YoY driven by protective coatings while PPG-AP sales were up 13.3% YoY led by automotive segment). On the international side, sales grew 9.9% YoY (+10.6% in CC terms) – led by Asia (+17% YoY) and Africa (+8% YoY).

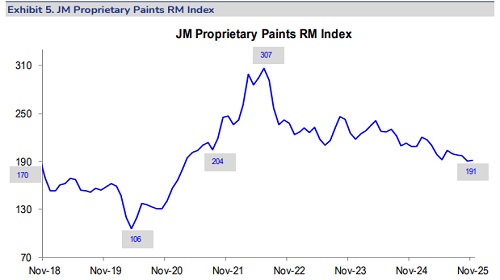

* …which along with benign RM led margin expansion driving earnings beat: Consol. gross margin expanded by 242bps YoY and 51bps QoQ to 43.2% (JMFe: 43%), led by RM deflation (down 1.6%) and benefit of sourcing efficiencies. Standalone GMs were up 249bps YoY and 55bps QoQ. Staff cost grew by mere 1.4% YoY, while other expenses up by 10.2% YoY due to increased brand investments. Resultant EBITDA grew by 21.3% to INR 15bn (c.10% above JMFe) with margin expansion of 218bps YoY to 17.6% (JMFe: 16.9%). Reported PAT increased by 43% YoY to INR 9.9bn on account of exceptional loss of INR 1.8bn in base quarter. Going forward, management expects input cost environment to remain stable to benign while investment behind brands/innovation and capabilities will continue.

* Key takeaways from the call: a) strong internal initiatives & early festive aided revenue outperformance; expects mid-single digit value growth for FY26E, endeavour would be to achieve higher value growth by end of the year, b) backward integration – commissioned white cement plant; VAM/VAE project on track; will unfold in 1QFY27E and provide strong product differentiation, c) increased focus on dealer relationships/improving dealer ROIs over last 6-9 months. d) Margin guidance remains unchanged at 18-20%.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361