Buy Max Financial Services Ltd For Target Rs. 1,350 By Elara Capital Ltd

In-line results

Axis Max Life Insurance, a partly owned subsidiary of Max Financial Services (MAXF IN), reported ~17% YoY annualized premium equivalent (APE) growth, ahead of private firms, and driven largely by unit-linked investment products (ULIP). After a strong Q2, non-par products declined by 11% YoY. Retail protection growth was lower than peers at 15% YoY. Value of new business (VNB) was flat YoY, primarily due to contraction in margin on account of surrender charges and product mix change. We expect Q4FY25E APE growth of ~15% YoY, translating to FY25E APE growth of ~21% YoY with robust performance in retail protection, owing to new product launch and continued traction in the ULIP segment. We expect VNB margin to continue to compress YoY in Q4FY25E, resulting in full-year VNB margin of 22.3% (including the group term segment).

Long-term VNB margin to be in the range of 24-25%:

We expect VNB margin to improve on account of product mix recalibration with higher contribution from the non-par segment, resulting in VNB margin in the range of ~24-25% during FY26-27E.

Leverage from rebranding can aid in banca channel growth:

The rebranding of Max Life Insurance to Axis Max Life Insurance is likely to be a key driver of growth in the upcoming years by leveraging Axis Bank’s (AXSB IN, Buy, CMP: INR 1,013, TP: INR 1,386) strong brand equity and distribution reach. This strategic move integrates Max Life’s established expertise with Axis Bank’s trust and recognition, particularly in Tier 2 and 3 cities. Therefore, we expect Axis Max Life Insurance to report higher-than- industry growth in the upcoming quarters and factor in overall APE growth of 15-16% during FY26-27E. However, any adverse regulatory action, as highlighted in November 2024 by various media outlets, could impact growth in this channel, and the onus on growth would fall on the proprietary channels, which have seen strong traction.

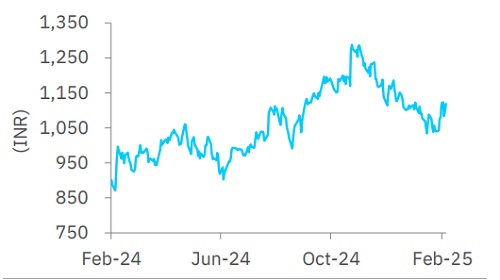

Price chart

Source: Bloomberg

Reiterate Buy with a lower TP of INR 1,350:

We revise our target P/EV to 1.8x from 2.2x after factoring in a 50bp increase in risk premium to account for potential regulatory scrutiny of the bancassurance channel. Our residual income model based on a 12.5% required return, 5% terminal growth and FY27E ROEV of ~18.6% implies 1.8x December 2026E P/EV on embedded value per share of INR 742. This translates into a reduced TP of INR 1,350 from INR 1,560 and a Buy rating. Key risks are: 1) adverse regulatory changes, and 2) a slowdown in ULIP growth & an inability to offset it with non-par growth.

Please refer disclaimer at Report

SEBI Registration number is INH000000933