Accumulate Aarti Industries Ltd For Target Rs.403 by Prabhudas Liladhar Capital Ltd

Strategic partnerships to fuel growth in long term

Quick Pointers:

* Focus on strategic collaborations to drive the next leg of growth

* All Zone IV products have been completed at pilot scale

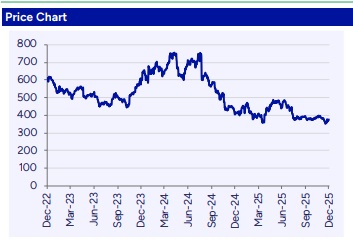

We upgrade Aarti Industries (ARTO) to ‘Accumulate’ rating due to sharp correction in the stock price. ARTO is undergoing a structural transition from a contract manufacturer of market established molecules to a partnershipdriven, innovation-led platform, with strategic collaborations at the core of its growth strategy across agrochemicals, polymers, energy and advanced materials. The company aims to scale its quarterly EBITDA from ~Rs2.8bn to ~Rs4.5bn driven by Zone IV assets, rapid scale-up of capabilities, and deep R&D strength, cost savings initiatives and operating leverages, while consciously moderating balance-sheet risk through co-development, coinvestment, and long-term customer partnerships. The shift also reflects a move away from China-exposed commoditized chains toward differentiated chemistries, application-led solutions, and multi-year earnings visibility. ARTO’s transition toward becoming a long-term strategic manufacturing partner can emerge as a key structural strength over the long term. However, in the near term, the company is facing dumping pressure from Chinese players across its existing value chains like PDA, NCB and NT, which could result in margin pressure. We expect revenue/EBITDA/PAT to clock 12%/16%/27% CAGR over FY25–28E. We upgrade the stock to ‘Accumulate’ rating from ‘HOLD’ with TP of Rs403, valuing it at 24x Sep’27E EPS

* Strategic partnerships to fuel growth going ahead: ARTO is prioritizing strategic partnerships, focusing on its top customers across agchem, polymers/adv materials and energy, fundamentally reshaping its business model. ARTO’s focus is to jointly develop new technologies with customers, improving entry barriers, capital efficiency, and demand visibility. The customer conversations are increasingly chemistry-agnostic related to niche and advanced applications / end uses, rather than focusing on existing value chains.

* Zone IV to fuel earnings growth till FY28: Zone IV was initially planned to focus on chlorotoluene and downstreams, but the focus has now shifted to more downstream products in chlorotoluene along with a Multi purpose plant capable to adding newer products/chemistries to AIL's portfolio. All Zone IV chemistries have been completed at pilot scale, with customer approvals expected to come alongside the commercialisation of key facilities; commercial-scale validation will be much faster. Multiple assets, including calcium chloride, PEDA and MPP, are expected to be commissioned over the next 3-4 months while the chlorotoluene and downstream blocks to commercialise in next couple of quarters, with Zone IV EBITDA contribution guided at ~Rs2.5bn by FY28. ARTO’s ability to scale from pilot to commercial production within 9-12 months using existing assets will materially enhance the time to market and return metrics going ahead

* R&D depth enabling differentiation and accelerating product development: ARTO’s R&D ecosystem anchored by the Mahape R&D center with ~200 scientists and 16 granted patents, underpins its transition toward advanced chemistries such as vapor-phase processes, photochemistry, polymerization, nitration, hydrogenation and circularity linked solutions. The company is focusing on its strengths across 10–15 core chemistries, with a proven track record of rapid commercialization (PEDA scaled in 9–12 months). Engagement with global R&D heads of marquee customers and collaboration with early stage innovators positions ARTO well for emerging areas such as electronic chemicals, battery chemicals, sustainability solutions, and MOFs.

* Portfolio optimization amid China pressure: Despite near-term pressure persisting in NCB, NT and PDA chains due to aggressive Chinese pricing, however Aarti has structural competitiveness across most of the portfolio, aided by feedstock advantages in select downstream products. The company is consciously deprioritizing high China exposure commoditized expansions, selectively pursuing MMA within the existing value chain, and adopting a waitand-watch approach for high-capex projects, until balance-sheet strength and market conditions improve.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271