Add United Breweries Ltd For Target Rs. 1,990 By JM Financial Services Ltd

Compelling opportunity, improving execution

UBL’s scale positions it as the largest beer player and gives it an edge over competition to tap the large India opportunity. Sales trajectory is improving; we expect this momentum to sustain led by stable growth in mainstream brands and c.25%+ growth in the premium portfolio. While Karnataka is facing excise hike-related headwinds, improving growth in Maharashtra and strengthening presence in UP and AP should provide some offsets. Further, UBL’s historical performance and Carlsberg India’s cost structure/margins definitely suggest that its current profitability is below the underlying potential of the business. While strategic initiatives undertaken by the new CEO entail higher initial investments, they are in the right direction and are laying building blocks for future growth. We are baking in a higher earnings trajectory (29% CAGR over FY25-28E) vs. historical performance, which, along with improving return profile/cash generation will help sustain premium valuations. Faster growth by competition and regulatory headwinds (in Karnataka) needs to be watched for as these could slowdown pace of margin expansion. We like UBL’s moats and strategic initiatives initiate coverage with ADD and a Sep’26 TP of INR 1,990/share (60x Sep’27E).

* Industry opportunity compelling; UBL has necessary ingredients to capture the same: The beer category has large headroom to increase share of throat (< 20%), gain share of occasions (c.25-30% currently) and gain shelf space at outlets (c.90% is occupied by spirits). Hence, 6-8% volume/low double-digit value growth is achievable in a stable regulatory environment. The attractiveness of geography is visible from global majors making it a priority market (4th largest market for Budweiser, key growth engine for Carlsberg/Heineken). While competition is enhancing presence, UBL is by far the largest in terms of scale and has a portfolio with strong brand recall, which gives it an edge. Its sustained dominance (market share of c.50%) over decades is a testament to this.

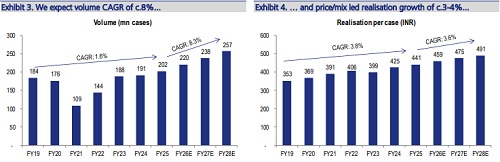

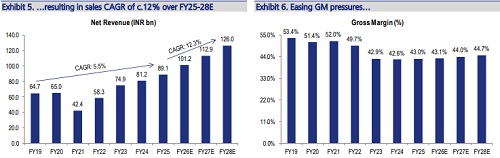

* Strategic initiatives underway to accelerate growth and fortify leadership position: Under new CEO Vivek Gupta, several strategic initiatives are being implemented to a) address portfolio gaps, b) enhance/localise manufacturing presence, c) accelerate premiumisation, where it is under-indexed vs. peers, and d) dial up execution in trade outlets (visi-cooler penetration). Initial results are promising - despite external headwinds, UBL’s c.9% sales CAGR over FY23-25 and 16% in 1QFY26 is commendable. We expect momentum to sustain and build revenue CAGR of c.12% over FY25-28E (volume CAGR of c.8%).

* Margin pressures to ease, underlying potential suggests enough headroom to expand: Margin pressures for UBL are bottoming out (stable RM, improving salience of old bottles, supply chain optimisation). Although, in the near term, expansion could be more gradual due to external challenges (in Karnataka/Telangana), infusion of new bottles for premium portfolio (currently lower EBITDA/case vs mainstream brand) and capability investments. UBL’s cost structure is leaner vs. Carlsberg India; however, the latter’s EBITDA margin (c.13-14%) is higher due to better mix. Hence, we see headroom for expansion (we forcast 350bps expansion over FY25-28E) and execution on premiumisation can accelerate expansion over FY27/28E for UBL.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361