Neutral United Breweries Ltd for the Target Rs. 1,750 by Motilal Oswal Financial Services Ltd

Disappointing performance; margin volatility persists

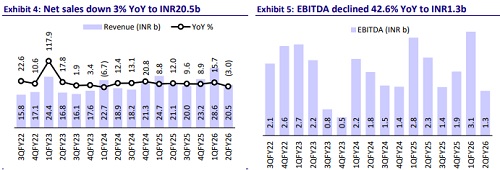

* United Breweries (UBBL) reported a 3% YoY revenue decline in 2QFY26 (vs. our est. of +3%), after clocking 16% growth in 1QFY26. We were already building up muted growth due to weak seasonal demand and the extended monsoon, but it was weaker than expected. Volumes dipped 3% YoY (est. of +3%; +11% in 1QFY26), while the premium portfolio clocked a 17% growth, led by strong traction in Heineken Silver, which grew 34% YoY. UBBL experienced a double-digit volume decline in Jul and Aug’25. However, demand revived in Sep’25 with 4-5% volume growth; the positive trend continued in Oct.

* Management highlighted that roughly one-third of the business delivered robust growth, another one-third was affected by adverse weather conditions, while the remaining one-third faced headwinds from affordability pressures and elevated excise duties in select states.

* Regionally, the West and South markets grew 16% and 4%, while the North and East dipped 18% and 6%, respectively. The overall volume dip was mainly led by softness in Odisha, Karnataka, Telangana, West Bengal, and Rajasthan, partially offset by recovery in Andhra Pradesh, Assam, and Maharashtra.

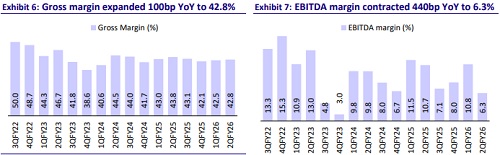

* Gross margin contracted 100bp YoY to 42.8% (vs. est. 44%) due to temporary pressures from interstate transfers and an adverse state mix. EBITDA margin fell sharply by 440bp YoY to 6.3% (vs. est. 9.8%), marking a 10-quarter low. The margin compression was largely driven by volume deleverage, higher brand investments, and short-term cost headwinds (flood-related), rather than structural weakness. Management reiterated its medium-term aspiration of achieving double-digit EBITDA margins. We forecast EBITDA margins of 10.5% for FY27 and 11.5% for FY28 (prepandemic margin at more than 15%).

* UBBL remains focused on volume-led growth and further market share gains in the premium segment. We expect a ~12% revenue CAGR over FY26-28, led by high single-digit volume growth and a steady recovery in margins, which have been under pressure for the past five years. Despite volatile margin history, we model EBITDA margin expansion given high growth for the premium portfolio and the scope of cost rationalization. Given rich valuations and lingering regulatory headwinds, we maintain our Neutral stance on the stock with a TP of INR1,750 (55x Sep’27E EPS).

Weak revenue delivery; multi-quarter low margin

* Decline in revenue: UBBL’s standalone net sales declined by 3% YoY to INR20.5b (est. INR21.8b) after clocking 16% growth in 1QFY26. Volume declined by 3% (est. +3%), while the premium segment sustained robust growth and clocked 17% YoY growth.

* Regional performance: The West and South regions posted volume growth of 16% and 4%, while the North and East regions reported volume declines of 18% and 6%, respectively. The volume growth seen in Maharashtra, Andhra Pradesh, and Assam drove regional performance.

* Big miss on margins: Gross margin contracted 100bp YoY to 42.8% (est. 44%, 42.5% in 1QFY26). Employee expenses grew 6% YoY, and other expenses rose 7% YoY. EBITDA margin contracted 440bp YoY to 6.3% (est. 9.8%, 10.8% in 1QFY26). After delivering an improved margin trajectory, there was a sharp contraction in margin in 2Q.

* Decline in profitability: EBITDA declined 43% YoY to INR1.3b (est. INR2.1b). Interest cost rose ~570% YoY to 147m (est. INR50m). APAT declined 65% YoY to INR0.5b (est. INR1.2b).

* In 1HFY26, net sales grew 7%, while EBITDA and APAT declined 14% and 25%, respectively.

Highlights from the management commentary

* During 2QFY26, there was an unusually heavy and prolonged monsoon, which hit beer consumption across multiple key markets. Despite the weather-related challenges, UBBL outperformed the broader beer industry, showcasing resilience and effective execution of its commercial strategy.

* The company plans to step up capital expenditure to high single digits as a percentage of sales (vs. mid-single digits historically).

* Maharashtra delivered strong double-digit growth led by improved execution, capacity upgrades, and distributor redesign, while Karnataka, Odisha, West Bengal, and Telangana faced sharp declines due to high taxation, adverse weather, and affordability issues. Meghalaya saw demand recovery post excise cuts, and Uttar Pradesh remained a key growth market despite can shortages, supported by premium brand traction and upcoming brewery expansion.

* Management remains confident that the Indian beer category can deliver a 5– 6% annual growth rate in a normalized environment.

Valuation and view

* We cut our PAT estimates by ~20% for FY26 and 10% for FY27, factoring in the miss on EBITDA in 2Q and adjusting the margin for FY27.

* UBBL continues to face multiple headwinds, including prolonged monsoon-led disruptions, high excise duties, and affordability pressures in key markets such as Karnataka, Telangana, and Odisha, which have weighed on category growth. Management is focusing on portfolio premiumization, cost discipline, and proactive engagement with state authorities to drive recovery.

* UBBL remains focused on volume-led growth and further market share gains in the premium segment. We expect a ~12% revenue CAGR over FY25-28, led by high single-digit volume growth and a steady recovery in margins, which have been under pressure for the past five years. However, given the rich valuations and lingering regulatory headwinds, we reiterate our Neutral rating on the stock with a TP of INR1,750 (premised on 55x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412