CPI Inflation : Deflationary forces in food gathered momentum by JM Financial Services Ltd

Deflationary forces in food gathered momentum

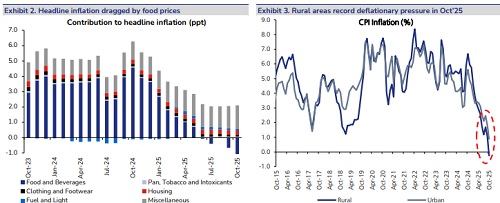

Headline inflation moderated to its lowest levels of 0.25% in Oct’25 vs. market expectation of 0.4%. Deflationary pressure in the food category gathered momentum while the sharp rally in gold prices kept core inflation elevated at 4.4%. Ex of vegetables, headline inflation averaged 3%. Consumer-facing sectors like clothing and footwear reflected the impact of GST rate rationalisation while inflationary pressure in services remained elevated. We see downside risk to RBI’s inflation projection of 2.6% for FY26, with our expectation of inflation at 2.2%. We believe that the RBI will avoid a failed transmission in the bond market (yields); hence, we expect a dovish tone in the December MPC meet.

* Deflationary pressure in food drags headline to 0.25%: Headline inflation moderated to the lowest levels of 0.25% in Oct’25 vs. market expectations of 0.4%. The sustained deflationary pressure in the food category in the past 6 months gathered momentum in Oct’25 (-5.0% MoM vs. -2.3% MoM prior), which dragged headline inflation. However, on a broader level, deflationary pressure in the headline weakened (-0.20% MoM vs. -0.39% MoM prior), mainly on the back of the sharp rally in gold prices (12.5% MoM vs. 7.9% MoM Prior). We expect headline inflation to bottom out in 3QFY26; however, in FY26, inflation is expected to average 2.2% vs. RBI’s projection of 2.6%.

* Pace of deflation in vegetables slows: Food category continued to record deflationary pressure in Oct’25, although at a moderated pace (-0.20% MoM vs. -0.39% MoM prior). The favourable impact on food prices was mainly aided by cereals (-0.2% MoM), milk (0% MoM), oils & fats (-0.4% MoM), fruits (-1.4% MoM), pulses (-0.66% MoM) and spices (- 0.18% MoM) while the pace of deflation in vegetables slowed to -0.28% MoM vs. -3.24% MoM prior. Ex of vegetables, headline inflation would have averaged 3% in Oct’25. Consumer-facing categories like footwear (-1.01% MoM), and clothing (-0.1% MoM) also reflected the deflationary trend, indicating the impact of GST rate rationalisation. Energy inflation was stable sequentially.

* Core elevated due to gold & silver: Core inflation (net of food, fuel and intoxicants) continued to reflect stubborn inflationary pressure in October as well (0.54% MoM vs. 0.44% MoM prior), and remained elevated at 4.4%. This is the 9th consecutive month with a reading above the 4% mark. A closer look reveals that the spike in inflationary pressure was mainly in “personal care and effects” category led by gold (12.5% MoM vs. 7.9% MoM prior) and silver (21.7% MoM vs. 9.9% MoM prior) and to some extent in housing (0.9% MoM vs. -0.2% MoM prior), education (0.15% MoM vs. 0.1% MoM prior) and household goods (0.2% MoM vs. 0.1% MoM prior), while pricing pressure was under control in other categories.

* Expect a dovish tone in December for effective transmission: Although we believe that the deflationary trend in the food category will aid the headline inflation in 3QFY26 as well (0.6% vs RBI’s 1.8%), we expect it to bottom out in 3QFY26. Benchmark yields have moderated ~4bps to 6.52% since the start of November, and markets will be keenly awaiting the MPC’s policy decision in December. As the growth (resilient) inflation (under control) dynamics does not warrant policy easing, the RBI will conciously avoid a failed transmission in the bond markets. Despite the US Fed’s recent pivot, markets are factoring in a rate cut in December. We believe that an accelerated rate cut cycle in the US would be negative for the dollar and vice versa EM currencies, opening up policy space for easing by RBI. Overall, we expect the MPC to deliver its policy decision tactfully with a dovish tone in Decembe

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

More News

Signing of India-UK FTA marks breakthrough for Indian engineering exports: EEPC India