Buy Privi Speciality Chemicals Ltd for the Target Rs. 3,960 by Motilal Oswal Financial Services Ltd

Reinventing the aroma chemicals landscape

Privi Speciality Chemicals (PRIVI) is India’s largest aroma chemical manufacturer and exporter with 75 products and over 30 years of industry expertise. The company also develops custom aroma chemicals, with strong in-house R&D focused on innovation and process development.

* The global aroma chemicals market is projected to grow from USD5.4b in CY23 to USD9.2b by CY30 at an 8% CAGR, driven by rising demand in home care, personal care, and food products. To leverage this growth, PRIVI plans to expand capacity from 48k MT to 66k MT in core products by Mar’28, to be funded through debt and internal accruals. In parallel, it is focusing on high-demand, high-margin value-added products to further enhance profitability.

* To strengthen its green chemistry portfolio, PRIVI plans to merge with Privi Fine Sciences (PFSPL), which develops speciality aroma chemicals from renewable feedstocks. PFSPL’s facilities produce high-value bio-based products like furfural, cyclopentanone (CP) and maltol, positioning it as a pioneer in sustainable chemical manufacturing. Looking at strong opportunities in these new products (gross margins of more than 40%), the company plans to add 18k MT of capacity in FY27 and double it to 36k MT by FY29.

* In Jul’21, PRIVI formed a JV with its long-standing client, Givaudan, to set up a new greenfield facility in Mahad, Maharashtra, for producing small-to-mid volume, high-complexity fragrance ingredients, with a total investment of ~INR2.7b. PRIVI holds a 51% stake in the JV, supported by equity contributions from both partners and loan funding from Givaudan. This collaboration strengthens a decades-old relationship and marks a major strategic milestone, enhancing PRIVI’s technological capabilities and positioning it as a co-creator of high-value, sustainable fragrance ingredients in the global flavor and fragrance (F&F) value chain.

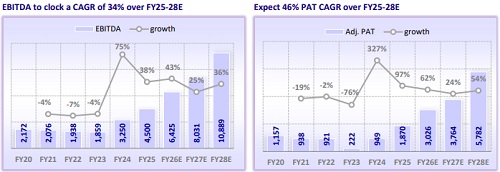

* We expect PRIVI to deliver a CAGR of 27%/34%/46% in revenue/EBITDA/adj. PAT over FY25-28, driven by an increase in capacity of its core products, an increase in TAM with the addition of new products, and improving relationships with existing customers (Givaudan). We value the stock at 28x FY28E EPS of INR141 to arrive at our TP of INR3,960. We initiate coverage on PRIVI with a BUY rating.

Leveraging scale, integration, and product leadership for stronger growth

* The F&F market is gaining traction on rising demand for home fragrances, personal care, and food products, coupled with higher disposable incomes and greater focus on product safety. This is expected to propel the aroma chemical market from USD5.4b in CY23 to USD9.2b by CY30 at a CAGR of 8%.

* To capitalize on strong demand, it is scaling up its production capacity from 48k MT to 66k MT in core products by Mar’28. In parallel, it is focusing on high-demand, high-margin value-added products to enhance profitability.

* PRIVI has achieved a majority of its growth through the pinene segment (~60% share in total revenue). This segment is led by two major products, i.e., dihydromyrcenol (DHMOL) and amber fleur. DHMOL is often referred to as the ‘God Molecule’ in the fragrance industry (it is a critical ‘freshness’ component used in 99% of contemporary perfumes).

* The two key raw materials used in manufacturing these products are crude sulphate turpentine (CST) and gum turpentine oil (GTO). PRIVI’s core competitive edge lies in its strong backward integration through CST, a costefficient, pine-based raw material sourced from over 60 pulp mills across the globe.

* Pinene-based aroma chemicals can be produced using two key sources: tapping pine trees for GTO or utilizing CST. While GTO prices are volatile due to Chinadependent supply, CST provides greater price stability with 6-12 months of fixed contracts.

* PRIVI is one of only four global players and the only Asian firm with the expertise of efficiently utilizing CST, highlighting its leadership and cost advantage in aroma chemicals. PRIVI is a global leader in pine-based aroma chemicals, supported by backward integration and its CY16-commissioned CST refinery, the world’s largest at a single site.

* Compared to GTO, CST on average offers 15-20% cost advantage and greater price stability through long-term supply contracts. Previously, PRIVI imported alpha pinene, beta pinene and GTO from China, facing price volatility that kept EBITDA margins at 11-12%. With capacity ramp-up and backward integration (to manufacture alpha and beta pinene in-house), margins have now exceeded 18% in FY24, FY25 and 1HFY26 (21% in FY25, 25% in 1HFY26).

* Though CST is challenging to process due to sulfur-induced odor, PRIVI has overcome this by developing a sulfur separation process and a dedicated CST refining plant. Since its inception, PRIVI has secured market leadership in at least four major products, including DHMOL, Amber Fleur, and Terpineol-Pine Oil.

* PRIVI’s flexibility to switch between CST and GTO makes it the industry’s lowest-cost producer and enables stable pricing for its B2B clients — a key competitive edge globally.

Strengthening green chemistry and new product development

* To strengthen its green chemistry portfolio, PRIVI plans to merge with Privi Fine Sciences (PFSPL) and Privi Biotechnologies (PBPL). PFSPL, founded in CY21, develops specialty aroma chemicals from renewable feedstocks, while PBPL is primarily an R&D-focused biotechnology unit.

* Implementing green chemistry entails high upfront costs and R&D. Hence, Mr. Mahesh Babani, Chairman and MD of PRIVI, founded PFSPL as a separate entity to incubate these initiatives.

* PFSPL runs plants at Lote MIDC, Maharashtra, and Jhagadia GIDC, Gujarat. With Lote now fully operational, PRIVI has started the process of merging with PFSPL to consolidate operations and scale up key products like Privial, Anethole, and Cyclamen Aldehyde (cumulative TAM of ~INR22b, 29k tons).

* Further, the Jhagadia facility (spanning 39.7 acres) produces green specialty chemicals like furfural and cyclopentanone (CP) from corn cob. While others focus on ethanol from kernels, PFSPL will process cobs into furfural and derivatives (such as maltol and CP).

* Maltol, a flavor enhancer used in foods and beverages, is currently produced only in China. Privi aims to be India’s first fully integrated producer from furfural to maltol.

* The market size of Furfural /CP is more than USD950m/USD180m owing to their varied uses. CP, which is used for semiconductors, pharmaceuticals, fragrances and polymers, is typically made from petroleum-based adipic acid. PFSPL plans to produce it from natural sources (would be the first company to do so), offering a renewable alternative. The company is also piloting downstream products like Ferulic Acid and bio-vanillin from corn cobs.

* Looking at the immense opportunity in these new products, the company is planning a capacity expansion of 18k MT in FY27. Moreover, it is planning to double its capacity for new products to 36k MT by FY29.

* These new products are expected to deliver gross margins of more than 40%, with revenue contribution (excl. state incentive) expected to rise from ~6% in FY27 to ~27% in FY29, driven by strong demand and capacity expansion. Overall, the new products are expected to bolster growth for the company, led by increasing demand and healthy margins.

JV-driven expansion into complex, high-value fragrance molecules

* In Jul’21, Swiss fragrance major Givaudan SA entered into a JV with PRIVI to enhance the production of specialty fragrance ingredients. The JV, named PRIGIV, was established to set up a new greenfield manufacturing facility in Mahad, entailing a capex of INR2.3b.

* Management expects an asset turnover of ~1.0-1.1x, revenue of INR1.8-2.0b, and a breakeven within a year after the FY25 commissioning. The JV’s committed offtake, formulation stickiness, and tighter spec alignment provide multi-year visibility, supporting stable utilization and pricing discipline.

* Givaudan, headquartered in Vernier, Switzerland, is the world’s leading company in the creation of flavors, fragrances, and active cosmetic ingredients.

* PRIVI holds a 51% stake in the joint venture, with Givaudan owning the remaining 49%. The partnership has established a greenfield production facility dedicated to manufacturing small-to-mid volume, medium-to-high complexity fragrance molecules.

* The total investment of ~INR2.7b is funded through equity capital of INR350m (INR180m from PRIVI and INR170m from Givaudan) and loans from Givaudan totaling INR2.3b to support fixed assets and working capital.

* The company has been associated with this esteemed client for the last few decades. This JV is expected to further strengthen their association.

* This collaboration represents a significant milestone in PRIVI’s growth trajectory, enhancing technological cooperation, reinforcing customer engagement, and positioning the company as a preferred global partner for high-value, sustainable fragrance ingredients. It underscores the company’s evolution from a dependable supplier to a strategic co-creator within the global F&F value chain.

Valuation and view: Initiate coverage with BUY and TP of INR3,960

* PRIVI is not only scaling up its core operations—through capacity additions, product diversification, and deeper engagement with existing customers—but also strategically entering the green chemistry domain. This move is aimed at strengthening its long-term growth trajectory, tapping into environmentally sustainable demand pockets and broadening its client base across end-use industries.

* The aroma chemicals market continues to gain traction, supported by robust demand for home fragrances, consistent growth in cosmetics, personal care, bakery, and confectionery segments amid rising consumer focus on safety and ingredient transparency, and a steady increase in disposable incomes in key emerging economies.

* Further, given the diverse applications of green chemistry products, company is expected to address a larger wallet share from its existing customers (TAM of new products is ~USD386m), presenting a significant growth opportunity for PRIVI. The merger with PFPSL is expected to further strengthen the company’s long-term growth prospects.

* To cater to this demand, PRIVI plans to increase its production capacity from 48k tons to 66k tons in core products by Mar’28. It also aims to add another 18k-ton capacity in FY27 for new product launches and targets doubling this expanded capacity to 36k tons by FY29. This phased expansion supports the company's growth and product diversification strategy in green chemistry.

* The JV with Givaudan marks a pivotal step in PRIVI’s strategic evolution, deepening its technological capabilities and strengthening long-standing customer relationships. With a dedicated greenfield facility and shared investments, the partnership firmly positions the company in the higher-value, complex fragrance ingredient segment.

* Over the last three years, PRIVI rerated from ~31.6x P/E (average of the last three years; one-year forward) to ~35.5x as of Nov’25, fueled by strong cash flow generation (CFO of INR2.8b in FY25), consistent performance (24% PAT CAGR over FY22-25), and improved RoE (18% in FY25). The company has reported a CAGR of 14%/32%/24% in revenue/EBITDA/adj. PAT over FY22-25. We expect PRIVI to deliver a CAGR of 27%/34%/46% in revenue/EBITDA/adj. PAT over FY25 to FY28.

* PRIVI currently trades at 39x/32X/22x FY26E/FY27E/FY28E EPS with ROE/ROCE of 25%/18% in FY28E. We value PRIVI at 28x FY28E (~10% discount to three-year average) EPS of INR141 to arrive at our TP of INR3,960. We initiate coverage with a BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412