Buy Triveni Turbine Ltd for the Target Rs. 640 by Motilal Oswal Financial Services Ltd

Export inflows remain weak

Triveni Turbine’s (TRIV) 2QFY26 PAT beat our estimate on better-than-expected margins. Domestic order inflows have started improving and enquiry levels too have remained broad-based. Export order inflows are still weak due to delays in decisionmaking from customers. Weak inflows can result in volatility in export revenue. We thus believe that TRIV’s near-term performance would be impacted by delays in order finalization. As it picks up in FY27, execution will start ramping up. We broadly maintain our estimates and roll forward our TP to INR640 on 40x Dec’27 estimates. Retain BUY as the company is continuously introducing new products and has the capability to ramp up sharply whenever demand starts reviving.

In-line revenue, margin resilience led to PAT beat

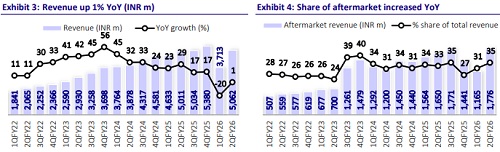

2QFY26 performance was above our estimates on profitability. Revenue growth was flat at INR5.1b, in line with our estimate. Domestic sales declined by 20% to INR2.2b, while export sales increased by 27% to INR2.8b. Export as % of sales increased to 56% in 2QFY26 from 44% in 2QFY25. Gross margin at 50.7% expanded by 140bp YoY. This led to EBITDA margin expansion of 40bp YoY/280bp QoQ to 22.6%, higher than our estimate of 20.5%. Absolute EBITDA increased 3% YoY/56% QoQ to INR1.1b, a 12% beat to our estimate. PAT was broadly flat YoY at INR914m (8% above our estimate). Order inflows increased 14% YoY to INR6.5b, aided by strong domestic order inflows. Total consolidated order book stood at INR22.2b as of Sep’25 (+24% YoY). For 1HFY26, revenue/EBITDA/PAT declined 9%/9%/9% YoY to INR8.8b/INR1.9b/INR1.6b, whereas EBITDA margin contracted slightly by 10bp YoY to 21.4%. For 1HFY26, OCF/FCF declined 81%/99% to INR387m/INR25m, mainly due to an increase in working capital.

Domestic enquiry conversion expected to ramp up FY27 onwards

TRIV’s domestic business saw a strong rebound in 2QFY26, with order inflows rising 52% YoY to INR4b and the domestic order book standing at INR11b, up 55% YoY. Growth was broad-based across steel, cement, sugar, and process cogeneration sectors, supported by improving industrial capex momentum. Domestic market enquiries also increased ~86% YoY, indicating healthy demand visibility and a strong pipeline. TRIV gained market share in high-specification API and drive turbine segments, supported by expanding industrial demand. Though enquiry levels remain strong, the finalization of enquiries is taking longer; hence, we expect softer inflows from the domestic segment in FY26. With the conversion pace improving from FY27, we expect domestic inflows to grow over FY27-28.

Export momentum is taking time to build up amid global uncertainty

TRIV’s export business has not yet regained full momentum, with order inflows declining 19% YoY to INR2.5b in 2QFY26, mainly due to deferred project finalizations and tariff-related uncertainties in the US. Europe and the Middle East markets are growing, while Southeast Asia remains subdued. Though enquiry activity remains strong and has improved by 43% YoY in 2QFY26, led by healthy traction from Europe, the Middle East, and energy-transition markets, order conversions are taking longer.

Aftermarket segment rebounds strongly in 2QFY6

Aftermarket business rebounded strongly in 2QFY26 after a weak start to the year, with order inflows rising 15% YoY to INR2b and revenue up 8% YoY to INR1.8b, contributing 35% to total turnover. Growth in 2Q was driven by recurring demand from the company’s large installed base, higher service intensity, and rising refurbishment orders across domestic and export markets. The company is also broadening its aftermarket portfolio beyond steam turbines to include other rotating equipment, enhancing service scope and customer engagement. With a healthy enquiry pipeline, diversified customer base, and recurring demand, the aftermarket segment is expected to maintain steady growth and remain a key contributor to overall performance over the medium term.

Expanding portfolio through product innovations

TRIV is strengthening its growth outlook through focused product innovation and portfolio expansion across industrial and clean energy applications. The company is developing advanced turbine designs and efficiency-enhancing technologies for sectors such as process co-generation, waste-to-energy, and renewables. It has also entered the utility drive turbine segment, supplying 15-20 MW boiler feed water pump turbines and gaining approvals from major developers like NTPC, supported by growing domestic power demand. New offerings, including a carbon dioxidebased heat pump and high-efficiency drive turbines, have received encouraging market feedback.

Financial Outlook

We broadly maintain our estimates for FY26/27/28. We expect TRIV’s revenue/EBITDA/PAT to clock a CAGR of 14%/14%/14% over FY25-28. Backed by a comfortable negative working capital cycle, strong margins, and low capex requirements, we expect its OCF and FCF to report a CAGR of 48% and 55% over the same period, respectively.

Valuation and view

The stock is currently trading at 46.1x/38.8x/32.4x on FY26E/27E/28E earnings. We revise the TP to INR640 (from INR620) based on 40x Dec’27E EPS. Maintain BUY. However, in the near term, we expect performance to remain impacted by weakness in order conversions.

Key risks

Slowdown in capex initiatives; intensified competition; technology disruption; inability to innovate and launch new products; and geopolitical headwinds resulting in a sharp slowdown in exports and aftermarket segments.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412