F & O Rollover Report 26th December 2025 by Axis Securities

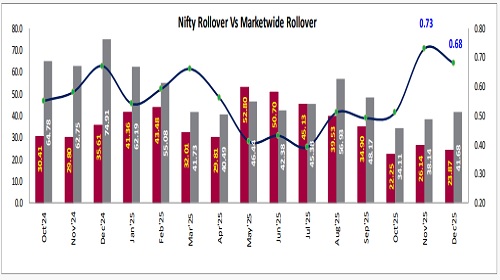

Nifty Rollover: The Nifty December rollover settled at 23.9% this Wednesday, reflecting a noticeable deceleration compared to the 26.1% recorded during the equivalent period of the previous expiry. This current figure significantly trails the three-month and six-month historical averages of 32.0% and 38.5%, respectively, suggesting a shift toward a more cautious and subdued sentiment among index traders as they hesitate to carry forward large aggressive bets into the new series.

Bank Nifty Rollover: The Bank Nifty December rollover stood at 23.2% on Wednesday, failing to match the 26.3% reached during the previous month's same-day interval. Furthermore, the banking index's rollover activity is currently positioned well below both the three-month average of 32.9% and the six-month average of 32.7%, highlighting a marked lack of directional conviction and a preference for light positioning within the financial heavyweights.

Market wide Rollover: In contrast to the headline index, the Market wide December rollover demonstrated robust momentum, advancing to 41.7% on Wednesday from the 38.1% observed during the prior month's cycle. While this activity comfortably exceeds the three-month average of 40.1%, it remains slightly below the six-month benchmark of 44.2%, indicating a healthy appetite for stock-specific positioning even as broader index conviction remains tempered.

Rollover Cost: The cost of rolling over positions in December moderated to 0.68% this Wednesday, down from the 0.73% seen on the same day of the last expiry. This marginal decline in the cost of carry implies a reduction in the premium traders are willing to pay, signaling a neutral-to-soft bias and potentially diminished urgency to maintain long exposure at higher price points.

Stock-Level Rollover Gains: Market participants showed increased commitment in select individual names, with SAIL, PATANJALI, ALKEM, APLAPOLLO and BRITANNIA registering higher rollover percentages on Wednesday compared to the same day in the previous series.

Stock-Level Rollover Declines: Conversely, a reduction in rollover interest was evident in NMDC, AMBER, INOXWIND, BPCL and INDIANB, where traders appeared to be unwinding positions or showing reluctance to carry exposure into the upcoming month.

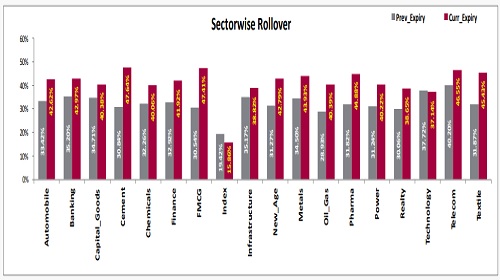

Sector-Level Rollover: At the sectoral level, FMCG, Cement, Textile, Pharma and Oil & Gas emerged as the primary areas of interest, witnessing higher rollover activity relative to the same day of the previous expiry. In sharp contrast, the Technology sector was the sole laggard to record lower rollover participation, suggesting a shift in institutional focus away from IT in favor of defensive and commodity-linked pockets.

NIFTY HIGHLIGHTS

Nifty December rollover at 23.9%, trails the previous 26.1% and remains significantly below the 3-month (32.0%) and 6-month (38.5%) averages, indicating a cautious and light-weighted approach by index traders. Bank Nifty rollover also shows subdued conviction with a 23.2% rollover, lower than the previous 26.3% and well below the 3-month (32.9%) and 6-month (32.7%) averages. The rollover cost eased to 0.68% from 0.73% in the prior expiry, reflecting a stable but less aggressive demand for carry positions as the series transitions. Market wide activity expanded to 41.7% from the previous 38.1%, surpassing the 3-month average of 40.1% but staying under the 6-month average of 44.2%, signaling robust stock-specific interest. The option data for the December series indicates a strong Call Open Interest (OI) at the 26,200- strike price, followed by 26,500. In contrast, a substantial concentration of Put OI is observed at 26,000, with additional levels at 25,800. This suggests the likely range for the current expiry is between 25,800 and 26,500

Nifty Rollover Vs Market-wide Rollover

Stock & Sector Highlights

* SAIL, PATANJALI, ALKEM, APLAPOLLO and BRITANNIA saw higher rollover on Wednesday compared to same day of previous expiry.

* NMDC, AMBER, INOXWIND, BPCL and INDIANB saw lower rollover on Wednesday compared to same day of previous expiry.

* Highest rollover in current expiry for the day is seen in WIPRO, AUROPHARMA, APLAPOLLO, HINDALCO and NAUKRI.

* Lowest rollover in current expiry for the day is seen in HAL, INDIANB, PRESTIGE, BPCL and NYKAA.

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633