Macro Pulse, Eco Flash by Mr. Arsh Mogre, Economist Institutional Equities, PL Capital - Prabhudas Lilladher

U.S. Fed Holds Rates Steady, Signals Increased Risks of Inflation and Unemployment: The U.S. Federal Reserve kept interest rates unchanged, citing rising risks of higher inflation and unemployment due to global trade tensions, particularly President Trump's tariffs. Fed Chair Jerome Powell emphasized the uncertainty of the economic outlook and indicated that the central bank remains in a "wait and see" stance, closely monitoring economic data before making future policy adjustments

India-EU FTA Expected by December 2025, FM Sitharaman Optimistic: Finance Minister Nirmala Sitharaman expressed hope that India and the European Union will finalize a free trade agreement by December 2025, with only a few major issues remaining. She emphasized the need for flexibility from both sides and highlighted India’s strategic role in global trade, driven by its strong human capital and youthful population.

Equities

Domestic Equity

India's equity benchmarks ended slightly higher on Wednesday, despite early losses, as geopolitical tensions with Pakistan weighed on sentiment, while investors anticipated easing global trade tensions. The Nifty 50 and Sensex rose 0.1%, with sectors like automobiles and textiles benefiting from a recent India-UK trade deal, while defense stocks saw volatility amid military escalations.

Global Equity

U.S. stocks closed higher (Dow +0.70%, S&P 500 +0.43%, Nasdaq +0.27%) as chip stocks rebounded late on reports of AI export curbs being rolled back; SOX +1.7%. Fed held rates steady, flagged rising risks from Trump tariffs. Disney surged 10.8% on strong earnings. In Europe, STOXX 600 fell 0.5% as retail and healthcare lagged; earnings mixed, with Jyske Bank +7.1%, Ambu -13.5%.

Currencies

DXY rose 0.38% to 99.61 as USD gained across G10; USD/JPY jumped to 143.83, EUR/USD fell to 1.1301, GBP/USD to 1.3292. INR weakened 0.5% to 84.83—worst since Apr 9—amid geopolitical flare-up with Pakistan; Asian FX broadly softer, CNH at 7.22, IDR -0.5%.

Bonds

UST 10Y fell 3.5 bps to 4.269%, 2Y down 0.6 bps to 3.776% as Fed held rates and warned of tariff-driven inflation and jobs risk; 2s10s spread narrowed to 49.7 bps. India 10Y G-sec closed at 6.341%, stable despite Operation Sindoor strikes; bullish bias persists on sub-4% CPI, dovish RBI, and strong OMO-led demand.

Commodities

Brent fell 1.7% to $61.12/bbl and WTI slid 1.7% to $58.07/bbl as rising OPEC+ output overshadowed India-Pak tensions; U.S. crude stocks fell 2.03 mn bbl, jet fuel demand hit post-2019 high. Gold declined 2% to $3,364.50/oz after a two-day surge, tracking a stronger dollar.

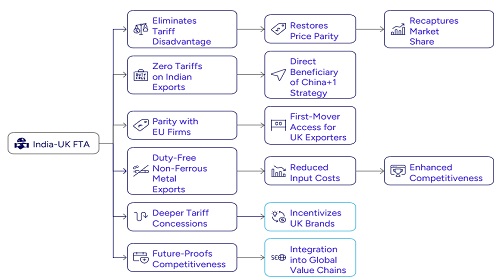

India–UK Free Trade Agreement: Strategic Trade Realignment in a New Global Order

The India–UK Free Trade Agreement signed on May 6, 2025, marks India’s most ambitious and commercially significant bilateral trade pact since the ASEAN FTA, and is the UK’s largest post-Brexit trade liberalization. It targets a doubling of bilateral trade to ~$120 billion by 2030 from $53 billion in 2024, unlocking £25.5 billion in new trade flows and boosting UK GDP by £4.8 billion annually, with analogous (and likely higher) incremental gains for India, given its superior growth elasticity to trade. Tariff liberalization is near-universal: India will eliminate tariffs on 99% of its goods exports to the UK (by value) and reduce duties on 90% of UK exports (85% of lines duty-free by Year 10). The quantifiable impacts—across duty reductions, sectoral gains, import substitution, and global competitiveness.

Exhibit 1: Near-Universal Tariff Cuts Set to Reshape Bilateral Trade Dynamics

Key Insights:

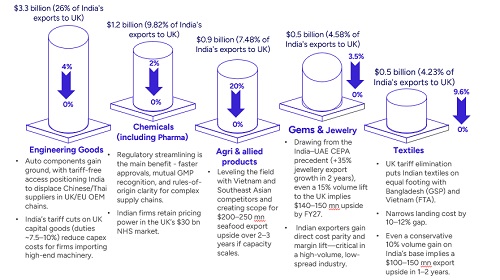

~52% Of India’s Shipments To UK Have Substantial Headroom For Market Share Expansion Post FTA: The India–UK Free Trade Agreement grants 99% of Indian exports zero-tariff access to the UK — a G7 market where India previously faced MFN duties ranging from 2% to 18%. India’s exports will see effective duty cuts of 5–20%, improving price competitiveness against Bangladesh, Vietnam, and China. UK importers will save £400–900 million annually in tariff costs. India’s exports to the UK —already in trade surplus— are now positioned to rise by at least 25–30% over the next five years, particularly in labor-intensive sectors. They key sectors to benefit are:

Exhibit 2: ~52% Of India’s Shipments To UK Have Substantial Headroom For Market Share Expansion Post FTA

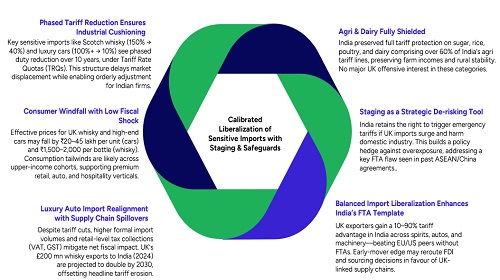

Calibrated Liberalization of Sensitive Imports with Staging & Safeguards: India has safeguarded critical domestic industries via tariff phase-downs and quotas. For instance, whisky tariffs fall from 150% to 40% over 10 years, and luxury car tariffs from 100% to 10% under TRQs. Despite a ~45% drop in effective import price for luxury vehicles or scotch, the staged reduction moderates immediate displacement. Excluded sectors—sugar, rice, poultry, dairy—protect India’s agri base. Consumer benefit is high (e.g., ~?1500–2000 per bottle savings on premium scotch), while revenue loss is offset by potential volume growth and investment linkages.

Exhibit 3: FTA Ensures Protecting Core Sectors While Enabling Competitive Access

Strategic Competitive Parity with Global Trade Partners: This FTA neutralizes tariff disadvantages vs. Vietnam, Bangladesh (GSP), CPTPP, and EU in UK markets. Indian apparel now enters UK duty-free like Vietnamese, erasing a prior 10–12% cost disadvantage. UK exporters, in turn, gain tariff advantages in India over EU, US, and China—securing a first-mover edge in high-value goods (e.g., machinery, spirits). It could redirect trade and FDI flows from EU to UK. India’s positioning in global value chains improves meaningfully: e.g., UK’s £2.0 bn metal exports to India will now land cheaper, reducing input costs for India’s downstream sectors like steel and jewellery

Exhibit 4: Strategic Tariff Parity - India Unlocks Global Competitive Advantage

Above views are of the author and not of the website kindly read disclaimer

More News

Market Watch : Nikkei up +4%, lifts Asia by Geojit Financial Services Ltd