Navigating Trade Headwinds: Implications of the 25% U.S. Tariff on India

Global trade negotiations and impact on US

Global trade tensions remain elevated, driven by ongoing negotiations between US and China, concerns over transshipment practices, and the introduction of sectorspecific tariffs. The United States has implemented a multi-tiered tariff regime, beginning with a 10% baseline tariff on all imports. This is further compounded by additional levies targeting critical industries such as steel, aluminium, copper, automobiles, and pharmaceuticals. As a result, the effective global tariff rate on goods entering the U.S. has surged from 2% to approximately 15%

Tariffs May Prove Inflationary for U.S

The imposition of tariffs is expected to have a measurable impact on U.S. inflation. A 15% average tariff functions similar to a 3% sales tax, potentially resulting in a one-time increase in core inflation of between 1.2% and 1.5% by the end of the year. This projection assumes a full pass-through of tariff costs to end consumers, which could affect purchasing power and price stability in the short term.

Despite the scale of tariff revenue, the consensus view is that the overall impact on U.S. GDP growth will be minimal. With the U.S. GDP standing at approximately $30 trillion, the $400 billion in tariff-related income represents a relatively small fraction. However, at the microeconomic level, certain households may experience financial strain due to increased costs. Nevertheless, the resilience of U.S. consumers remains strong, supported by robust employment levels, which are expected to cushion the broader economy from significant downturns.

US - India Negotiations and impact on India

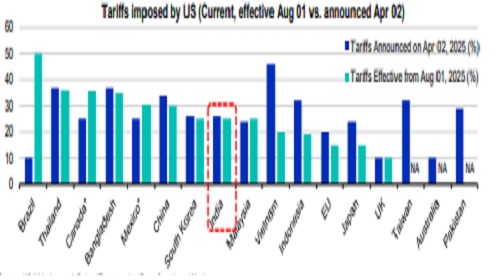

The United States has announced a 25% tariff on Indian exports, effective August 1, 2025, along with unspecified additional penalties linked to India's energy & defence trade with Russia. The announcement was made by the US President on his Truth Social platform. Specifics are not fully available. This rate is significantly higher than the 10% baseline tariff introduced in early April and could surpass the 26% rate proposed later that month. It remains unclear whether this new rate will apply uniformly across all Indian products or if sector specific tariffs will be imposed. Compared to other countries, India faces a steeper tariff than Japan, the European Union, Indonesia, the Philippines, and Vietnam, which are subject to rates between 15% and 20%. However, the tariff on India is still lower than those imposed on Brazil, Bangladesh, China, South Africa, and Taiwan. The lack of clarity around sector-specific application adds complexity for Indian exporters, who may need to reassess their pricing, supply chains and market strategies.

India faces higher tariff than some Asian Peers

India’s reluctance to open its agricultural sector might have emerged as a challenge in its trade negotiations with the United States. Drawing from its recent experience with the India–U.K. Free Trade Agreements, India has been advocating for a gradual reduction in tariffs, rather than immediate liberalization. India’s goal has been to conclude a comprehensive trade agreement with the U.S. by the end of 2025, with any earlier arrangement likely serving as an interim framework. With specifics on the announcement of the tariff not yet available, it appears that talks on the India– U.S. Bilateral Trade Agreement are still ongoing, with both sides working through complex issues.

Key Sectoral Impact

In 2024, India’s goods trade with the United States remained robust, with the U.S. accounting for 20% of India’s export basket. Exports to the U.S. totalled $87 billion, contributing 2.3% to India’s GDP, while imports reached over $40 billion, or 1.1% of GDP. This resulted in a trade surplus of $46 billion (1.2% of GDP).

India’s leading exports to the U.S. include electronics, jewellery, pharmaceuticals, and textiles—industries that play a critical role in sustaining the bilateral trade momentum and may be directly impacted by evolving tariff structures, depending on the final details.

Way forward for the markets

The situation around U.S. tariffs remains highly dynamic, and further developments are expected in the coming weeks. There is speculation that the current announcement may be part of a broader negotiation strategy, positioning India for future discussions. What has been announced so far excludes the “penalty tariffs,” and there is no clarity yet on what those penalties will entail.

Countries like Japan, Indonesia, the Philippines, and Vietnam have negotiated tariff rates in the range of 15– 20%. Initial expectations for India were in the 10–15% range, but the announced rate of 25% significantly exceeds that, implying an incremental tariff of around 10%, plus any additional penalties that may be introduced.

From a macroeconomic perspective, if the full impact of these tariffs is passed on and sustained, it could result in a GDP growth reduction of approximately 0.2–0.3%. However, this estimate is based on several assumptions and remains subject to change depending on how the situation evolves.

Markets have remained in a consolidation phase after a strong rally in April through June 2025. Compared to broader emerging markets, which have seen a more sustained rally, Indian equities are moving through their own cycle.

The earnings momentum from Q2 to Q4 FY25 is likely to extend into Q1 FY26, albeit at a modest, single-digit pace. Consensus earnings have been revised downward, especially for the Nifty, resulting in more conservative expectations for FY26. This could help limit downside risks, with the pace of earnings downgrades expected to be less severe. From an economic standpoint, there is optimism around a growth pickup in the latter half of FY26, though current earnings remain subdued

Valuations have expanded, with large caps trading above historical averages. Mid and small caps are also elevated at the index level, but there are still pockets of opportunity.

Despite global volatility, India’s economy remains resilient. With 80% of Nifty 500 revenues generated domestically and limited U.S. exposure (5%), strong internal demand has cushioned external shocks. The investment cycle is gaining momentum, driven by rising corporate capex, though actual spending may trail forecasts. Consumer discretionary demand is poised to rebound, supported by tax relief, lower interest rates, and improved credit access. GDP growth for FY26 is projected to remain steady at around 6.5%, indicating sustained expansion.

Given the current global uncertainties, adopting a diversified investment strategy could be prudent for investors. A systematic and diversified approach— across asset classes, sectors, and market caps—might assist in managing risk. Hybrid funds like multi-asset allocation and balanced advantage funds aims to offer a blend of relative stability and potential growth, aiming for optimal risk-adjusted performance.

Investors with a higher risk appetite and long term investment horizon may take a staggered investment approach through SIPs in diversified equity funds.

Above views are of the author and not of the website kindly read disclaimer

More News

Perspective on Evening Markets 04th November 2025 by Mr. Vikram Kasat, Head - Advisory, PL C...