Daily Derivatives Report 09th January 2026 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,985.6 (-1.0%), Bank Nifty Futures: 59,885.2 (-0.5%).

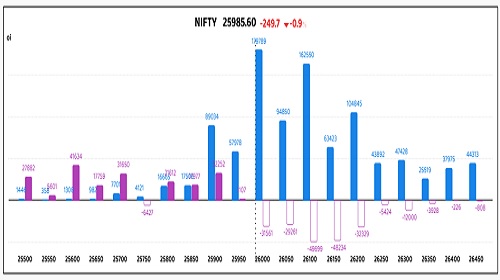

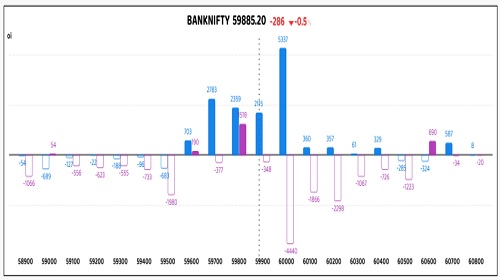

Nifty Futures fell 249.7 points as open interest increased by 15.7% to 181.77 lakh shares, signalling a distinct short build-up as aggressive sellers dominated the session. Bank Nifty Futures dropped 286 points with a 6.9% reduction in open interest to 13.10 lakh shares, indicating long unwinding as bulls liquidated positions amid mounting pressure. Equity benchmarks slid for a fourth straight session on Thursday, dragging the Nifty below the 26,000 level as relentless selling reflected a deepening bearish grip. The intraday trajectory saw indices gap flat at the open and progressively crater, breaching critical psychological support after early recovery attempts were ruthlessly pared. Markets were rattled by U.S. President Trump’s backing of a sanctions bill proposing 500% tariffs on Russian oil, directly threatening India's energy costs and margins. Further dampening valuation premiums, the UN downwardly revised India’s 2026 growth forecast to 6.6%, souring the long-term fundamental outlook. All sectoral indices ended in the red, led by declines in metals, PSU banks, and energy stocks as risk-off sentiment permeated the floor. Despite the sell-off, Nifty and Bank Nifty premiums rose to 109 and 199 points respectively, suggesting a persistent cost-of-carry despite the underlying spot weakness. India VIX jumped 6.5% to 10.60, a rapid rate of change indicating high downward momentum that may not have yet found a floor. Finally, the USD-INR appreciated slightly to 89.88, though intraday volatility tightened liquidity as importers hedged against potential tariff-led inflationary spikes.

Global Movers:

US markets demonstrated a pronounced sectoral rotation, catalysed by a hawkish recalibration of fiscal expectations and resilient labour data. The primary market driver was the White House’s $1.5 trillion defence budget proposal, which propelled the Dow Jones Industrial Average higher by +269 points (+0.55%) to 49,266, while simultaneously triggering profit-taking in high-multiple technology shares. Consequently, the Nasdaq Composite slumped -104 points (-0.44%) to 23,480, and the S&P 500 remained effectively stagnant at 6,921. Fixed-income markets saw the 10-Year Treasury Yield climb 4.5 basis points to 4.18% following lower-than-expected jobless claims. In commodities, WTI Crude Oil staged a violent +4.30% reversal to $58.40 per barrel on supply-chain re-evaluations, while COMEX Gold edged lower to $4,447 and Silver plummeted -2.6% to $75.13.

Stock Futures:

IDFCFIRSTB defied sector gravity as a strategic 200 bps savings rate cut, effective 09 January 2026, signalled an aggressive expansion of Net Interest Margins. This 1.7% price surge forced a Short Covering phase, evidenced by a 5% contraction in Open Interest (OI) to 33,093 contracts. While the futures premium narrowed to 0.66 points, the Put-Call Ratio (PCR) climbed to 0.57. Nomura’s bullish initiation, combined with 679 new call additions, suggests institutional buyers are prioritizing margin-accretive structural changes over short-term basis compression.

BHEL suffered a 10.5% liquidation, triggering a lower circuit as fears of Chinese competition in the thermal segment decimated its moat. This Long Unwinding was characterized by a 4.7% drop in OI to 27,505 contracts and a sharp basis contraction to 1.8 points. Call writers dominated the tape with 7,456 fresh contracts, far outstripping the 3,432 added puts. The PCR’s descent to 0.61 reflects a definitive shift in momentum, where aggressive supply is overwhelming the historical support of long-term holders.

HINDZINC underwent a 6% valuation reset, fuelled by a ?10,000/kg collapse in silver and a robust DXY at 98.7. The 1.1% increase in OI to 28,564 contracts confirms a Short Addition regime, even as the basis widened to 5.6 points. A significant exodus of 1,769 call contracts, coupled with 2,049 new put additions, pushed the PCR to 0.71. This data suggests that while the premium remains high, the magnitude of the commodity-linked sell-off is forcing a defensive concentration in hedging instruments.

HINDPETRO witnessed a 5.5% correction as geopolitical shocks in Venezuela and Russian oil tariffs threatened refining profitability. A 0.5% reduction in OI to 18,523 contracts indicates moderate Long Unwinding, while the futures premium softened by 0.95 points. Despite the PCR rising to 0.57, the concentration of 1,850 new call contracts against 1,241 puts reveals a market attempting to catch a falling knife. This divergence between price velocity and option additions points to a fragile sentiment as crude procurement costs are recalibrated.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.66 from 0.89 points, while the Bank Nifty PCR fell from 1.09 to 1. points.

Implied Volatility (IV):

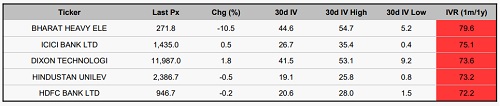

BHARAT HEAVY ELECTRICALS LTD closed at 271.8 following a 10.5% retracement, with a 44.6 30d IV and a high 79.6 IVR. This elevated risk pricing justifies a delta-neutral stance, anticipating that the current sell-off will stabilize into moderate range-bound price action.

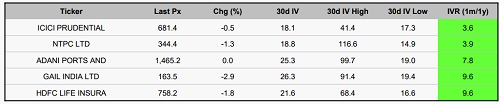

ICICI BANK LTD sits at 1,435.00 with a 0.5% uptick, carrying a 26.7 30d IV and a high 75.1 IVR. High relative volatility suggests a neutral hedging advantage, as the equity is expected to move sideways within a defined trading corridor. ICICI PRUDENTIAL LIFE INSURANCE CO LTD is priced at 681.4 after a 0.5% dip, showing an 18.1 30d IV and lowest IVR in the F&O segment. The compressed volatility environment mandates a wait-and-watch approach, forecasting continued narrow consolidation and limited price discovery. NTPC LTD trades at 344.4 with a 1.3% decline, marked by an 18.8 30d IV and a minimal IVR. With premiums at cyclical lows, a stay-aside posture is advised while the stock maintains its current sideways trajectory without clear momentum.

Options volume and Open Interest highlights:

Solar Industries and Oberoi Realty are showing robust short-term bullish momentum, reflected in sharply skewed Call-to-Put volume ratios of 4:1 and 6:1, respectively. At the same time, such extreme positioning if being read as a contrarian signal, raises the risk of momentum fatigue and near-term profit-taking. In contrast, Jindal Steel and JSW Steel remain under pressure amid strengthening bearish sentiment and substantial Open Interest built at lower strike levels, although a brief counter-trend recovery is still possible if selling intensity eases. CG Power and IEX continue to trade within a consolidation phase, marked by heavy Call Open Interest clustered near their 52-week highs. Meanwhile, Trent Ltd and ITC are seeing concentrated Put Open Interest, indicating that all four stocks are positioned for decisive breakouts once these tightly packed derivative positions begin to unwind. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index futures saw 35,228 contracts change hands as proprietary traders and retail clients aggressively absorbed heavy institutional selling. While proprietary desks boosted exposure by 24,787 contracts and clients added 10,441, FIIs and DIIs retreated, slashing positions by 31,075 and 4,153 contracts, respectively. This divergent trend extended into stock futures, where 57,611 contracts rotated. FIIs spearheaded a massive liquidation of 55,888 contracts, complemented by a modest 1,723-contract reduction from clients. Conversely, proprietary traders and DIIs signalled bullish resilience, adding 32,969 and 24,642 contracts. The data reveals a stark polarization: sophisticated institutional capital is de-risking significantly, while proprietary desks and retail participants are contrarily increasing their delta, suggesting a precarious shift in market conviction.

Securities in Ban for Trade Date 09-January-2026:

1. SAIL

2. SAMMAANCAP

Nifty

Banknifty

Stocks with High IVR:

Stocks with Low IVR:

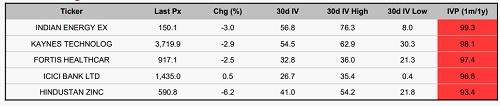

Stocks With High IVP:

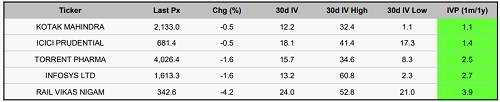

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Market is expected to open on a gap down note and likely to witness range bound move during ...