F & O Rollover Report 01st Aug 2025 by Axis Securities

NIFTY HIGHLIGHTS

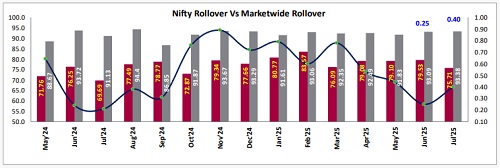

Nifty August Series Rollover stood at 75.7%, lower than the previous expiry’s 79.5%, and below both the three-month average (79.2%) and six-month average (79.7%). This decline suggests a subdued rollover sentiment, indicating cautious positioning in the benchmark index. On the other hand, Bank Nifty August Series Rollover came in at 78.0%, up from 75.8% in the previous expiry, and above the three-month (76.7%) and six-month averages (68.0%). The uptick reflects renewed interest and conviction in banking stocks. Nifty Futures began the August series with 16,453,050 shares in open interest, up from 16,284,750 shares, adding 168,300 shares. Despite this increase, a price decline of 3.1 percent suggests short build-up and cautious positioning. Bank Nifty Futures opened with 1,955,520 shares, down from 2,272,060 shares, shedding 316,540 shares, alongside a price cut of 2.2 percent, indicating long unwinding and profit booking in the banking segment. Nifty rollover cost rose to 0.40 percent from 0.25 percent, while Bank Nifty’s cost increased to 0.37 percent from 0.07 percent. The higher costs imply stronger commitment to carry forward positions, hinting at moderate bullish sentiment despite price corrections. For the August series, Nifty is expected to trade within a range of 24,500 to 26,000, driven by significant Call Open Interest at 26,000, followed by notable resistance at 25,500 and 25,000, while strong Put Open Interest at 24,000, along with support at 24,500 and 25,000, positions 25,000 as a potential reversal zone.

Nifty Rollover Vs Market-wide Rollover

Fii’s , Stock & Sector Highlights

* LICI, IREDA, BLUESTARCO, INDIANB and MANAPPURAM saw higher rollover on Thursday compared to same day of previous expiry.

* MUTHOOTFIN, LAURUSLABS, JSL, INOXWIND and JINDALSTEL saw lower rollover on Thursday compared to same day of previous expiry.

* Fii’s Futures Index Long ratio for the current expiry is 10%, down from 38% in the previous expiry, indicating a Bearish outlook.

* FIIS have initiated their positions in the current series with 16,338 contracts on the Future Index Long, a decrease from 38,565 contracts in the previous expiry. In contrast, the Future Index Short begins with 1,53,998 contracts, a significant increase from 89,870 contracts at the last expiry.

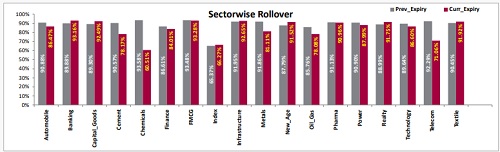

Sector wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633