Daily Derivatives Report 01st Aug 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 24,871.6 (-0.4%), Bank Nifty Futures: 56,194.0 (-0.3%).

Nifty Futures fell by 87.5 points, signalling a Short Build Up as open interest increased by 30,92,700 shares, a rise of 23.1% to a total of 1,64,53,050. Similarly, Bank Nifty Futures also experienced a Short Build Up, declining by 165.8 points with a 30.4% increase in open interest, adding 4,55,560 shares to reach 19,55,520. Despite a negative start, the indices showed resilience, recovering from their daily lows, yet ultimately ending a two-day winning streak with modest losses. This sell-off was primarily triggered by U.S. President Donald Trump's announcement of a 25% tariff on Indian goods, effective 1st August, alongside an additional penalty. Investors' recovery from the day's lows stemmed from a view that the tariff announcement was a negotiating tactic rather than a firm policy. Trading volatility was heightened by the monthly F&O series expiry. Sectoral performance was mixed, with Oil & Gas, Pharma, and Metal shares correcting, while FMCG and Media shares advanced. India VIX, the market's volatility gauge, rallied 3.01% to 11.54. Nifty futures August series premium narrowed to 103 from 104 points, while Bank Nifty premium increased to 232 from 209 points. The domestic unit at the interbank foreign exchange opened at 87.66 against the U.S. dollar, saw an intra-day low of 87.74 and a high of 87.51, before settling at 87.58, down 22 paise from its previous close.

Global Movers:

US stocks reversed their earlier gains yesterday as President Trump sent letters to some of the biggest pharma companies in the world demanding that they cut drug prices charged to US customers, in-line with how much citizens of other nations pay. The S&P 500 fell 0.4% in New York after being up 1% earlier in the session, while the Nasdaq 100 fell 0.6%. Yesterday was the first time since April that the S&P ended lower after being up at least a percent during the session. Elsewhere, Meta and Microsoft rallied on strong earnings, but investor enthusiasm was also tempered by the Fed's core inflation measure rising more than expected. Coming to markets, the VIX jumped 8%, the dollar index rose for a sixth day and closed at nearly 100 while the US 10-year treasury yield was flat for a second day. In commodities, gold climbed 0.5% but still remained under $3300, while oil prices were set for their biggest weekly gain since June on expectations that penalties will be imposed on Russia.

Stock Futures:

Kaynes Technology, Delhivery, Indus Towers, and IIFL Finance experienced a considerable uptick in market activity, evidenced by elevated trading volumes and pronounced price swings. This phenomenon signalled a discernible alteration in investor sentiment, as market participants strategically realigned their portfolios in either a pre-earnings anticipation or post-earnings disclosure context.

Kaynes Technology India Ltd. soared on the back of its robust Q1FY26 financial results, which, despite a slight revenue miss, saw a stellar 47% YoY surge in net profit, fueled by a significant expansion in gross and EBITDA margins. The stock recorded its highest single-day gain for the year at 10.4% on the highest single-day volume in six months. This powerful rally was accompanied by a Long Addition in the derivatives market, with open interest climbing 4.9% and 320 new contracts pushing the total to 6,883. In the July series, the futures open interest saw a substantial increase of 24,000, while the rollover stood at a healthy 89.6%, up from 88.3%. This combination of strong fundamentals and bullish derivatives activity paints a clear picture of strong institutional and retail buying interest, with new long positions being established and rolled over.

Delhivery's stock edged higher with a 4.5% gain, buoyed by a recent upward trend and a series of positive sector-wide developments, most notably the Competition Commission of India's (CCI) approval of its Ecom Express acquisition, which is expected to create significant synergies. The stock saw a Short Covering event, marked by a 5.8% decrease in open interest as 354 contracts were shed, bringing the total to 5,720 contracts. The July series futures open interest decreased by 49,800, with a notable rollover of 96% compared to 89.3%. This short-covering dynamic, coupled with a high rollover, suggests that bearish positions are being closed out, and traders are maintaining their bullish stance on the stock.

Indus Towers Ltd. suffered a steep decline, with its price falling -5.7%, as the company's Q1FY26 financial results revealed a nearly 10% YoY drop in net profit despite a healthy 9.1% revenue increase. This negative reaction was reflected in a Short Addition, where open interest increased by 0.7%, with 264 new contracts added to reach a total of 37,202. The July series saw a significant increase in futures open interest of 32,64,000, while rollover was 94.1% compared to 97.2%. The convergence of a price decrease and an increase in open interest, along with a high rollover, although lower than the previous series, indicates a building of new short positions, suggesting that traders are positioning for further downside.

IIFL Finance Ltd.'s stock experienced a significant drop of -5.4% following its mixed Q1FY26 results, which showed a robust 12.7% YoY revenue increase but a simultaneous 19% plunge in consolidated net profit. The stock witnessed a Long Unwinding, characterised by a 10.3% decrease in open interest as 922 contracts were unwound, reducing the total to 8,069. In the July series, IIFL saw a decrease in open interest of 5,95,650, and a rollover of 96% against 96.4% from the previous series. The unwinding of long positions, as evidenced by a price drop and a decrease in open interest, indicates a bearish sentiment where traders are exiting their existing bullish bets. The stable rollover points to the fact that many of the existing positions were taken off the table instead of being rolled over.

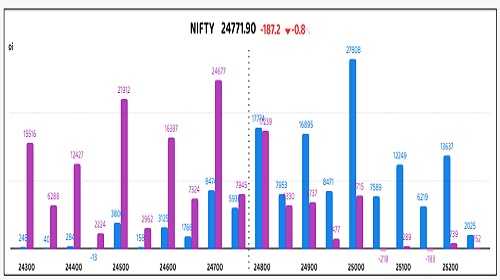

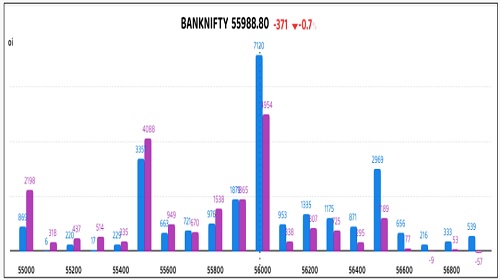

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.04 from 1.07 points, while the Bank Nifty PCR fell from 1.04 to 0.97 points.

Implied Volatility:

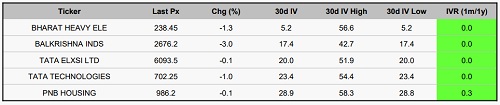

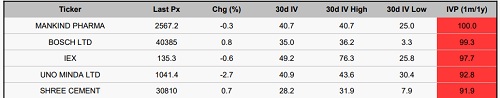

Mankind Pharma Ltd and Bosch Ltd have recently seen substantial fluctuations in their stock prices, primarily due to their high implied volatility (IV) rankings of 100 and 97, respectively. Mankind Pharma's IV stands at 40%, while Bosch Ltd’s is at 35%. Such elevated volatility indicates significant uncertainty in the market, often leading to increased options premiums, which raises costs and risks for traders. On the other hand, BHEL and Tata Elxsi Ltd have the lowest IV rankings, with implied volatilities at 5% and 20%, respectively. This suggests a period of relative price stability and decreased uncertainty. The lower IV environment allows for more affordable options premiums and diminished price volatility, creating a favourable situation for traders to employ cost-effective strategies like basic call or put options, while seasoned traders might explore writing options.

Options volume and Open Interest highlights:

Torrent Pharmaceuticals and Mankind Pharma are currently experiencing positive momentum, as shown by their impressive call-to-put ratios of 7:1 and 5:1, indicating a favourable outlook for quick profits. However, these elevated ratios could suggest that the options are overpriced, so exercising caution before initiating new long positions is wise. Conversely, IOC and Manappuram Finance are displaying bearish trends, characterised by high put-to-call ratios and increasing volumes. While the uptick in put activity might suggest an oversold market, it could also present contrarian investment possibilities. In terms of options activity, Kaynes Technology is notable for showing marked movement above its 20-day average in both call and put options, hinting at expectations for significant price changes. Meanwhile, Ambuja Cement appears to favour call options, while Manappuram Finance trends towards puts, signaling potential volatility ahead. The high call-to-put ratios suggest a careful approach to bullish strategies, while the rising put activity can provide contrarian opportunities. Overall, the dynamics in both calls and puts indicate an expected period of volatility, encouraging strategies that seek to benefit from substantial price movements. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a significant shift in open interest of 39,685 contracts was observed, driven by contrasting activities among key participants. Retail clients exhibited a notable bearish stance, aggressively reducing their positions by 29,064 contracts. Conversely, Foreign Institutional Investors (FIIs) displayed a robustly bullish outlook, substantially increasing their long positions by 35,353 contracts. Proprietary desks, meanwhile, contributed to the overall negative sentiment, scaling back their exposure by 10,621 contracts. A similar divergence characterized the stock futures market, where a total change of 65,808 contracts was recorded. Retail clients were overwhelmingly bearish, decreasing their positions by 43,094 contracts. This sentiment was echoed by FIIs, who also demonstrated a cautious disposition by decreasing their positions by 22,714 contracts. In stark contrast, proprietary traders adopted a decisively bullish position, adding 38,311 contracts, thereby positioning themselves as a significant counter-trend force in the segment.

Nifty

Bank Nifty

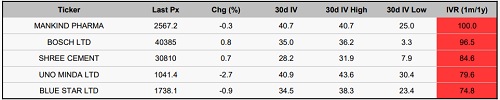

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

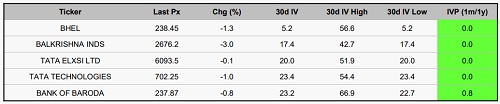

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633