Nifty opened higher with buying demand, boosting bullish sentiment - ICICI Direct

Nifty :26192

Technical Outlook

Day that was…

Indian equity benchmark has extended its gains for second-consecutive day to settle at 26,192 up 0.54%. Nifty Midcap & Small cap index ended on a flat note. Market breadth was balance with an AD ratio of 1:1. Sectorally, BFSI and Oil & gas were the outperformers, while PSU banks witnessed profit booking during the session.

Technical Outlook:

* Nifty started the day with a positive gap-up and witnessed follow through buying demand reinforcing bullish sentiment. As a result, daily price action formed a bull candle carrying a higher-high-low formation, validating strength seen in yesterday’s close above 26,000 level.

* Key point to note is that despite global volatility index has logged a resolute breakout from its four-week consolidation range. The traction in index heavy weight coupled with revival in the broader market makes us believe, Nifty would gradually challenge All Time level ~26300 and open the door for revised target of 26800, being the implicated target of recent consolidation.

* The current leg of up move is led by Bank Nifty and followed by Midcap index which has hit a fresh all-time high this week, while Nifty is shying away 85 points from its peak. Meanwhile, Small cap index is still trading below 9% from its all-time high. Thereby, we expect a catch-up activity to be seen in the small cap space. Hence focus should be on accumulating quality small and midcap stocks backed by strong Q2 performance as strong support is placed at 25,600 as it is 61.8% retracement of Sept-Oct rally (24588-26104) coincided with 50 days EMA

Following observations makes us reiterate our positive stance:

* Over past two-week US markets have corrected more than 5%, while Nikkie has corrected more than 8% in the same period. In the meantime, defined the global frame, Nifty has rallied 4%, indicating relative outperformance.

* Bank Nifty: After witnessing faster pace of retracement index extended its higher-high formation and trading near its all-time high, highlighting strength.

* Midcap: Midcap index has broken out above its 14-month consolidation range and trading near its all-time high. The current up move is backed by improvement in market breadth as currently 68% of Midcap index stocks are trading above their 200 days SMA compared to one month back reading of 64

* On the domestic macro front softer inflation print along with better-thanexpected Q2 earnings reinforces positive momentum that would drive index higher

Key Monitorable for the next week:

* With the Development of India-US tariff negotiations would be key monitorable

Intraday Rational:

* Trend- Sustaining above it 4-weeks consolidation range, indicating higher base formation

* Levels: Buy on declines near 80% of previous days upmove (25887-26090)

Nifty Bank : 59347

Technical Outlook

Day that was:

Bank Nifty continued its winning streak and extended its upward momentum, finishing at a new all-time high of 59,347 up 0.22%. The Nifty Private bank index has relatively outperformed the benchmark, closing firmly in green at 28,585 up 0.31%.

Technical Outlook:

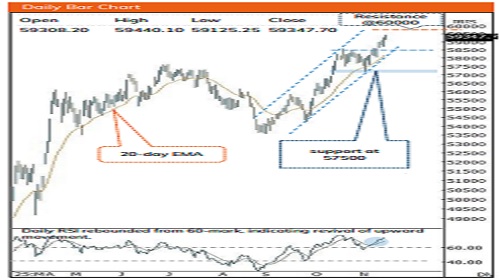

* Bank Nifty opened the day with a positive gap-up, however after initial minor decline index witnessed supportive buying efforts in the vicinity of previous session high. Consequently, the daily price has formed bullish candle with higher shadow at lower end, indicating bias remains positive.

* Key point to highlight is that index continues to outperform the benchmark indices, emerging as the clear leader by registering fresh all-time highs. The formation of higher high-low indicates continuation of uptrend. However, it is important to note that the index has advanced ~2,300 points(+4%) over the last 10 sessions, pushing the stochastic oscillator into the overbought zone (~ 90) on both daily and weekly timeframes, indicting plausibility of temporary breather can not be ruled out which would make market healthy.

* Only a decisive close below previous session low would indicate pause in upward momentum, else continuation of uptrend. Hence, any dip from hereon should be viewed as a constructive pause within the broader uptrend, offering an opportunity to accumulate quality banking names, especially those delivering strong Q2 earnings performance as immediate support is placed near 58,000, being 50% retracement of the ongoing advance (57,157–59,440) and expect the index to gradually resolve higher towards our projected target of 60,000 in the coming month.

* Historically, there have been 17 instances over the past two decades where Bank Nifty, following a decisive breakout above its previous two-month high, delivered double-digit returns within the subsequent four months. In the current setup, the index has once again confirmed a breakout above its prior twomonth high and surpassed the previous all-time peak, reaffirming the prevailing bullish structure. This setup indicates a high-probability continuation pattern for sustained upside momentum in the coming months.

* The PSU Bank Index continues to outperform, maintaining a higher-high, higher-low formation for the eleventh-straight week on the back of strong Q2 earnings. The index has advanced ~1800 points(+27%) over the last 12 weeks, pushing the stochastic oscillator into the overbought territory on both weekly and monthly timeframes hence, increases the probability of short-term healthy consolidation phase. However, any dip from hereon should not be construed as negative instead capitalized it as buying opportunity in quality stock as strong support is placed near 7,900, aligning with the 38.2% retracement of the latest rally (6,730–8,624) and 50-day EMA.

* Intraday Rational:

* Trend- Higher base formation above previous breakout zone (58,577)

* Levels Buy on declines near 80% retracement of previous days upmove (58773-59263)

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Opening Bell : Benchmarks to make cautious start amid mixed global cues