The daily RSI crossing above the 50 mark signals improving momentum - Tradebulls Securities Pvt Ltd

Nifty

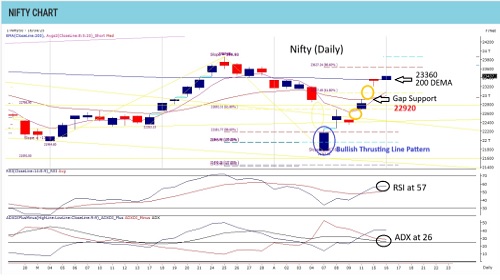

A second consecutive narrow-range candle near the 200 DEMA zone around 23,360 — especially after a string of gap-up moves — brings the strength of the current rally under scrutiny. The index has staged a sharp comeback, recovering nearly 70% of the recent fall with a 1,600-point surge from the swing low of 21,743 over the past five sessions. Now trading well above its short-term moving averages, the index finds immediate support around 22,950. Options data highlights 23,000 and 23,300 as strong base zones for the remainder of the series, while the upside remains open toward the 23,800–24,000 range. The daily RSI crossing above the 50 mark signals improving momentum. However, given the steep run-up, a phase of consolidation would be healthy and may set the stage for more sustainable gains ahead. Momentum traders should stay long as long as the index holds above 22,250 on a closing basis. Rather than chasing strength, fresh positions are better initiated on pullbacks. From a broader lens, the market structure remains positive, supported by sectoral leadership — particularly in financials — which continues to anchor the rally.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838