Buy Canara Bank Ltd for the Target Rs. 153 by Motilal Oswal Financial Services Ltd

Steady quarter; other income drives earnings beat

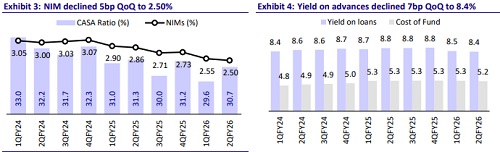

NIMs decline 5bp QoQ

* CBK reported 2QFY26 standalone PAT of INR47.7b (12% beat), up 19% YoY/ flat QoQ, aided by a healthy beat in other income.

* NII declined by 2% YoY to INR91.4b (up 1.5% QoQ, in line). NIMs declined by a modest 5bp QoQ to 2.50%.

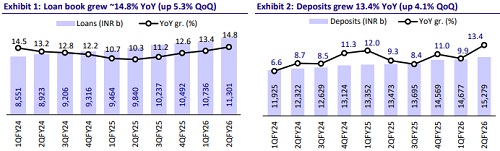

* Loan book grew 15% YoY/5% QoQ to INR11.3t, while deposits grew 13.4% YoY/4% QoQ to INR15.3t. CASA deposits grew 11% YoY/8% QoQ. As a result, CASA ratio improved 113bp QoQ to 30.7%.

* Slippages moderated to INR20.31b (INR21.29b in 1QFY26). Accordingly, GNPA/NNPA ratios improved by 34bp/9bp QoQ to 2.35%/0.54%. PCR stood at 77.4%.

* We increase our earnings estimates by ~3%, factoring in better other income. We estimate CBK to deliver FY27E RoA/RoE of 1.08%/18.6%. Reiterate BUY with a revised TP of INR153 (based on 1.1x FY27E ABV+ INR11 for subs).

Business growth steady; asset quality improves

* 2Q PAT rose 19% YoY to INR47.7b (12% beat), led by healthy fee income. NII declined by 2% YoY to INR91.4b (up 1.5% QoQ, in line). NIMs declined by a modest 5bp QoQ to 2.50%.

* Other income was up 42% YoY/flat QoQ at INR70.5b (14% beat). Treasury income stood at INR12.2b vs. INR16.2b in 1QFY26. Total revenue thus grew 13% YoY (7% beat).

* Operating expenses grew 14% YoY/1.2% QoQ to INR76.1b (broadly in line). Thus, C/I ratio stood at 47%. PPoP increased 12% YoY to INR 85.9b (11% beat). Provisions stood at INR23.5b (+4.6% YoY, 16% higher than est.).

* Loan book grew by a healthy 15% YoY/5.3% QoQ, led by robust growth in retail segment at 29% YoY/6.7% QoQ. Within retail, housing grew 15% YoY/ 5% QoQ. Deposits grew 13.4% YoY/4% QoQ, led by growth in CASA deposits at 11% YoY/8% QoQ. As a result, CASA ratio improved 113bp QoQ to 30.7%. CD ratio rose to 74%.

* Slippages moderated to INR20.31b (INR21.29b in 1QFY26). Accordingly, GNPA/NNPA ratios improved by 34bp/9bp QoQ to 2.35%/0.54%. PCR stood at 77.4%.

* Reported credit cost stood at 0.68% vs. the bank’s guidance of 0.9% for FY26. SMA book moderated to 0.65% in 2QFY26 from 0.8% in 1QFY26.

Highlights from the management commentary

* The stake sale of Canara Robeco and Canara HSBC Life resulted in a gain of INR20b for CBK (INR19.35b after expenses), which will be recorded in P&L in 3Q.

* Margins will remain stable at ~2.5% for one more quarter and will improve afterwards if there are no further cuts.

* ~INR3.8b has been provided for in standard provisioning related to one account in SMA-1 (state government drinking water project) and another account, which is out of SMA book.

* 2Q slippages: Agriculture at INR7.5b, Retail at INR3.5b, and MSME at INR9b.

Valuation and view

CBK reported a healthy quarter, with the earnings beat driven by healthy fee income, in-line NII, and contained opex. Margins are expected to remain stable in 3QFY26 and improve thereafter. Loan growth was steady and driven by robust growth in the retail segment. Deposit growth was healthy, aided by growth in CASA deposits. Asset quality improved as slippages declined, leading to a controlled credit cost for the bank. CBK maintains healthy provisions for the SMA book. It will record the stake sale gain of INR19.35b in P&L in 3Q, which will boost other income. We increase our earnings estimates by ~3% for FY27. We estimate CBK to deliver FY27E RoA/RoE of 1.08%/18.6%. Reiterate BUY with a revised TP of INR153 (based on 1.1x FY27E ABV+ INR11 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412