Buy Union Bank of India Ltd For Target Rs.135 by Motilal Oswal Financial Services Ltd

Robust other income drives earnings

Asset quality improves; CD ratio rises to 75.6%

* Union Bank of India (UNBK) reported 3QFY25 PAT of INR46b (28.2% YoY, 27% beat), led by lower provisions and higher-than-expected other income.

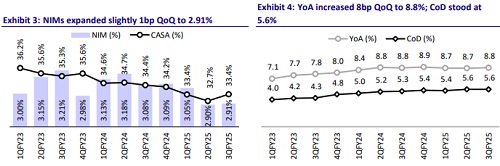

* NII grew 0.8% YoY to INR92.4b (up 2.1% QoQ; inline). NIMs expanded slightly, 1bp QoQ to 2.91%, during the quarter.

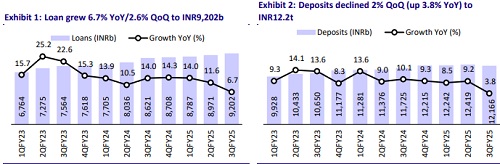

* Loan book grew at 6.7% YoY/2.6% QoQ while deposits grew 3.8% YoY/ declined 2% QoQ; CD ratio thus increased to 75.6%.

* Fresh slippages improved to INR19.7b from INR52.2b in 2Q, down 27% YoY/62% QoQ. GNPA/NNPA ratios improved 51bp/16bp QoQ to 3.85%/0.82%, respectively. PCR ratio increased to 79.3%.

* We increase our earnings estimate for FY26/27 by 5.9%/3.5%, factoring in lower credit costs and higher other income, and estimate RoA/RoE of 1.1%/15.5% by FY26. Reiterate BUY with a TP of INR135 (based on 0.8x Sep’26E ABV).

Business growth modest; NIMs remain broadly stable

* UNBK reported 3QFY25 PAT of INR46b (28.2% YoY, 27% beat), led by lower provisions and higher-than-expected other income. In 9mFY25, earnings grew 25.8% YoY to INR130b and we estimate 4QFY25 earnings to grow 23.7% YoY to INR41b.

* NII grew 0.8% YoY to INR92.4b (up 2.1% QoQ; inline). NIMs expanded slightly, 1bp QoQ to 2.91%, during the quarter.

* Other income grew 17% YoY to INR44.2b (6% higher than MOFSLe). Total income, thus, grew 5.5% YoY to INR136.6b (inline).

* Opex increased 8.8% YoY to INR61.6b (down 1.6% QoQ, inline). Provisions came in at INR16b (22% lower than MOFSLe). As a result, the overall C/I ratio increased 158bp QoQ to 45.1%. PPoP, thus, grew 2.9% YoY to INR75b (7% beat).

* Business growth was modest, with advances growing at 6.7% YoY/2.6% QoQ to INR9.2t. Retail book grew 16.4% YoY (4.9% QoQ) and commercial book grew 4.3% YoY (1.9% QoQ). MSME book declined 7.4% QoQ whereas agri book de-grew by 3.5% QoQ.

* Deposits grew 3.8% YoY/ declined 2% QoQ as the bank has shed ~INR300b of bulk deposits. CD ratio, thus, increased to 75.6%. CASA ratio improved 71bp QoQ to 33.4%.

* Fresh slippages improved to INR19.7b from INR52.2b in 2Q, down 27% YoY/62% QoQ. GNPA/NNPA ratios improved 51bp/16bp QoQ to 3.85%/0.82%, respectively. PCR ratio increased to 79.3%. SMA pool stood at 0.83%.

Highlights from the management commentary

* The bank has maintained its guidance of FY25 NIM at ~2.8-3%.

* MSME growth has been muted, primarily due to many INR 50b of MSME loans being upgraded to the mid-corporate segment and INR120b being declassified due to the unavailability of URN numbers. Additionally, agri growth was affected by state government waivers.

* The bank has a pipeline of INR750b in sanction limits, of which INR360b is pending disbursements and INR397b is awaiting sanction.

* Unsecured personal loans stood at INR128b, with a GNPA of ~1.8% in the personal loan segment.

Valuation and view

UNBK reported a steady quarter, driven by healthy other income and lower provisions, leading to an earnings beat. Margins expanded slightly by 1bp QoQ. Business growth was modest, with deposits declining sequentially due to the shed of bulk deposits; however, the CASA ratio showed improvement. Management continues to guide for NIMs in the range of 2.8-3%. There has been an improvement in overall asset quality ratios, with lower slippages leading GNPA/NNPA ratios to improve by 51bp/16bp QoQ. Credit costs were also well under control at 63bp during the quarter. We increase our earnings estimate for FY26/27 by 5.9%/3.5%, factoring in lower credit costs and higher other income, and estimate an RoA/RoE of 1.1%/15.5% by FY26. Reiterate BUY with a TP of INR135 (based on 0.8x Sep’26E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412