Buy SRF Ltd for the Target Rs.3,700 by Motilal Oswal Financial Services Ltd

Recovery complete; poised for growth in FY26

After a subdued performance in FY24, SRF witnessed a healthy recovery in FY25 across all segments. Moreover, the company expects to sustain the growth momentum going forward

* In FY25, EBITDA grew ~7% YoY to INR28.3b, driven by growth in Chemicals (up 5%) and Performance Films & Foils (PFF) (up 45%), while Technical Textiles (TTB) saw a decline (down ~8%). Although its margin performance remained mixed across segments, SRF achieved a healthy recovery in all businesses.

* Capex at ~INR11b was lower than the company’s initial guidance of INR22-23b. The chemicals business continued to be the largest part of the capex (~62%). In FY26, SRF plans to increase capex intensity and has guided for capex of INR22-23b.

* SRF’s moat lies in its technological innovation and advancement to meet evolving customer needs and maintain a leadership position. Its R&D spending has increased at ~11% CAGR over the last decade, with INR1.5b spent in FY25 — around 5.4% of EBITDA.

* With a healthy recovery in FY25, the company is expected to sustain its growth trajectory as its chemical business is estimated to grow ~20% YoY in FY26 led by fluorochemicals and specialty chemicals. However, TTB is expected to remain largely flat.

Broad-based recovery; margin performance mixed across segments

* SRF recorded a healthy performance in FY25, with revenue/EBITDA increasing ~12%/7% YoY to INR146.9b/INR28.3b. This was largely led by PFF revenue growth of ~24% to INR55.5b, followed by Chemicals business (6%) and TTB (7%). EBITDA for Chemicals/PFF grew 5%/45% YoY, while TTB reported a decline of 8.5% YoY.

* Chemicals business witnessed a recovery in FY25 and accounted for 46%/71% of consolidated sales/EBIT. Revenue/EBITDA grew 6%/5% YoY, led by a recovery in specialty chemicals and fluorochemicals. EBITDA margin contracted by ~40bp YoY to 31.9%, led by pricing pressure from Chinese competitors, increased competition and oversupply in domestic chloromethanes.

* Specialty Chemicals’ agro business showed signs of recovery, led by a pickup in demand for key agro intermediates and the stabilization in raw material prices. However, pricing pressure from China continued to drive price adjustments for several products. Accordingly, revenue grew 3% YoY to INR37.9b in this business.

* Fluorochemicals business also showed recovery with revenue growth of 6% YoY to INR22.5b, led by rising demand for refrigerants due to increased AC and automobile production in India, healthy demand for Dymel, and improvement in Polytetrafluoroethylene (PTFE).

* PFF business (~38%/~16% of consolidated revenue/EBIT) delivered healthy growth in FY25, driven by the identification of new export customers in the US and Europe and higher volumes in BOPET and BOPP. Revenue/EBITDA grew 24%/45% YoY (on a lower base) to INR55.5b/INR5.9b.

* TTB (14%/10% of consolidated revenue/ EBIT) reported revenue growth of 7% YoY to ~INR20b, led by the highest-ever production and sales of tyre cord fabrics and polyester industrial yarn. However, it reported an EBITDA decline of 8.5% YoY, led by lower margins in the nylon tyre cord fabrics, weak demand and increased competition from low-cost Chinese imports in belting fabrics.

* Other businesses, which include Coated and Laminated Fabrics businesses, declined 8.1% to INR43b, led by competition from cheap imports from China.

Growth supported by upcoming capacity additions

* Over the past few years, SRF has maintained a robust capex program aimed at expanding its manufacturing capabilities and entering new markets. However, its capex investments have focused on enhancing operational efficiency, upgrading existing equipment, and expanding into new business segments, such as the pharma segment.

* SRF has incurred a cumulative capex of ~INR95.2b over last five years as of Mar’25. Chemicals accounted for the highest capex (~67%), followed by Packaging Films (24%), and TTB (7%).

* The intensity of capex slowed in FY25, led by weakness across businesses and SRF’s conscious decision to preserve cash. SRF incurred a capex of INR10.9b in FY25, down 53% YoY, of which 62% was incurred in the Chemicals business (vs. 70% in FY24), followed by TTB (20% vs. 9% in FY24) and PFF business (16% vs. 19% in FY24).

* The company is focusing on both greenfield (new facilities) and brownfield (expansions/upgrades of existing facilities) projects across its segments.

* Its debottlenecking projects over the past 18 months have resulted in an increase in the chemicals business’ overall capacity by ~30%.

* Fluorochemicals business: The company has already announced a capex of INR5.5b for three new fluoropolymers, e.g., Polyvinylidene Fluoride (PTFE), Fluorinated Ethylene Propylene (FEP), and Fluorine Kautschuk Material (FKM), which may be commercialized and completed during FY26.

* With an improving business scenario in Chemicals, SRF is likely to increase its capex intensity in FY26, in line with its aspirations for the future.

* In the PFF business, SRF approved establishment of a new manufacturing facility for the Bopp-BOPET film line in Indore with an estimated cost of INR4.5b, with operations expected to commence in approximately 25 months.

* SRF is expecting a total capex of ~INR22-23b in FY26.

Increasing investments in R&D

* Through its Chemicals Technology Group (CTG), SRF prioritizes continuous technological innovation and advancement to meet evolving customer needs and maintain a leadership position.

* The company also focuses on process enhancements to reduce its resources, improve cost-effectiveness, and strengthen the value chain by integrating critical raw materials in-house. Management also aims to automate processes to improve robustness, cost, and safety.

* SRF spent ~INR1.5b on R&D in FY25, registering ~11% CAGR over the last decade. R&D spending as a percentage of EBITDA/sales largely remained flat at 5.4%/1% vs. 5.5%/1.1% in FY24.

* The company has so far filed 481 patents as of FY25 (filed 38 patents in FY25), out of which 151 total patents have been granted (two granted in FY25), indicating its commitment to technological advancement and maintaining a competitive edge in the market.

* In FY25, SRF launched eight new products catering to the agrochemical and pharma sectors, while it launched 12 new products in BOPET and BOPP. These products have good long-term prospects, are at a different maturity level of market potential, and have future growth potential.

Chemicals and PFF businesses to drive growth

* SRF is expecting a better performance in FY26, led by a strong order book in the specialty business, the ramp-up of export volumes, and growth in PTFE within the fluorochemicals business. The packaging business should improve in the near term, led by increasing focus on high-impact VAPs.

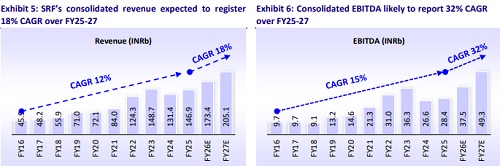

* Over the last decade, SRF has delivered a CAGR of 12%/15%/16% in revenue/ EBITDA/adj. PAT, and we expect a CAGR of 18%/32%/46% over FY25-27. This growth will be largely propelled by the Chemicals business (25% CAGR over FY25-27), followed by Packaging (14%), and TTB (8%).

* The Chemicals business has recorded a CAGR of 18%/18% in revenue/EBITDA over the last decade. Management expects the business to grow by ~20% YoY in FY26.

* The fluorochemicals segment has posted a 19% CAGR over the last decade, with 6% growth in FY25. Management expects growth to continue in FY26, aided by the growing Indian air conditioner industry, the ramp-up in PTFE and healthy demand for Dymel. Pricing pressures are anticipated to ease with market stabilization. SRF will focus on ramping up the newly commissioned plants to meet the rising demand, along with ongoing investments in R&D and technology to introduce the new and enhanced products. We expect a 28% CAGR in revenue of this business over FY25-27.

* Specialty Chemicals business has recorded a healthy 20% revenue CAGR over the last decade, though it faced macro headwinds in FY25. The business will continue to focus on agrochemicals and pharmaceuticals segments, collaborating with global innovators to drive process development, commercialization, and the production of complex, innovative molecules. We expect this segment to post a strong 26% CAGR over FY25-27.

* TTB segment has not been able to move the needle materially over the last decade, with a flat CAGR. SRF expects a similar performance in FY26 as in FY25. We expect a CAGR of 8%/28% in revenue/EBITDA over FY25-27.

* PFF business posted a 16% CAGR over the past decade, with strong growth of 24% in FY25. BOPET capacity utilization in India is expected to be better going forward, while BOPP capacity utilization may witness some pressure due to the addition of new lines during the year. With the temporary closure of Jindal Poly’s manufacturing facility in Nashik due to fire outbreak, SRF’s packaging business is expected to benefit from the increased supply gap in the industry. In FY26, SRF’s primary focus will be on significantly increasing sales of highimpact products across BOPP and BOPET with the commissioning of new downstream assets, including new offline coating machines in India and metallizers in Thailand and India. We expect a CAGR of 14%/36% in revenue/EBITDA for this business over FY25-27.

Broad-based improvement across key financial metrics

* SRF’s net working capital cycle improved marginally to 56 from 55 in FY24. This improvement was driven by a decline in receivables/inventory days by 1/14, bringing them down to 51/111 days. However, this gain was partially offset by a 13-day reduction in payables to 107 days.

* Although there was a marginal decline in gross margin/EBITDA margin to 48%/19% from 49%/20% in FY24, gross profit/EBITDA rose 9%/~7% to INR70b/INR28b.

* The company reported a 19% YoY increase in cash flow from operations (CFO) to INR24.9b in FY25. This marked a strong turnaround from the 28% decline in FY24. As a result, the CFO/EBITDA ratio improved to 88% from 79% in FY24. Further, FCF improved to INR12b from an outflow of INR1.8b in FY24.

* SRF’s debt-to-equity ratio improved to 0.37x from 0.43x in FY24, reflecting a healthier balance sheet. This was driven by an increase in profitability and a reduction in long-term borrowings.

Valuation and view

* Considering a healthy recovery in FY25, SRF aims to maintain the growth trajectory in FY26, driven by strategic investments and capacity expansions. The company targets to improve the performance of all segments, focusing on market recovery, innovation, and operational efficiencies to sustain profitability.

* Chemicals business (fluorochemicals and specialty chemicals) is expected to grow 20% YoY in FY26E, led by the ramp-up of commissioned facilities. Its packaging business is likely to continue its growth trajectory, led by the ramp-up in sales of high-impact VAPs and aluminum foils. TTB is expected to witness flat growth in FY26E.

* We expect SRF to clock a CAGR of 12%/15%/16% in revenue/EBITDA/adj. PAT over FY25-27. We reiterate our BUY rating on the stock with our SoTP-based TP of INR3,700, owing to its rich valuations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)