Neutral ACC Ltd for the Target Rs.2,040 by Motilal Oswal Financial Services Ltd

EBITDA below est.; realization gains offset by higher costs

Management estimates cement demand to grow ~6-7% YoY in FY26

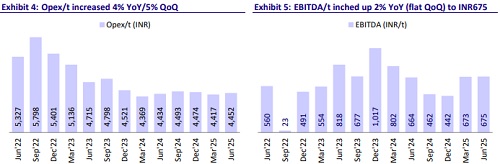

* ACC’s 1QFY26 EBITDA missed our estimate due to lower blended realization/t and higher opex/t. EBITDA increased ~14% YoY to INR7.7b (10% miss). EBITDA/t inched up ~2% YoY (flat QoQ) to INR675 (est. INR794). OPM contracted 30bp YoY to ~13% (est. ~15%). Adj. PAT increased ~5% YoY to INR3.8b (24% miss led by higher finance cost and effective tax rate).

* Management indicated that cement demand grew ~4% YoY in 1QFY26, and the outlook remains positive in 2Q. ACC believes demand will grow ~6-7% YoY in FY26, fueled by affordable housing and increased spending on the infrastructure and commercial segments. In Jul’25, ACC commissioned a 1.5mtpa grinding capacity through brownfield expansion at Sindri, Jharkhand. It is also setting up a greenfield GU at Salai Banwa, Uttar Pradesh, having a capacity of 2.4mtpa. The company also added 12 RMC plants during the quarter, taking the total RMC plant count to 114. The company’s premium product share increased to 41% of trade sales.

* We cut our EBITDA estimates by 7%/2% for FY26/FY27, factoring in ACC’s weak 1QFY26 performance. We also introduce our FY28 estimates with this note. We believe that the Adani group will have a single listed cement entity eventually leading to the merger of ACC and ACEM. Hence, the consolidated financials of ACEM reflect a clear picture of the group's cement business performance.

* Due to these reasons, we believe ACC will continue to underperform, despite trading at an inexpensive valuation of 10x/8x FY26E/FY27E EV/EBITDA and USD82/USD78 EV/t. Accordingly, we downgrade ACC to Neutral and value it at 8x Jun’27E EV/EBITDA to arrive at our TP of INR2,040 (vs. INR2,400 valued at 10x FY27E EV/EBITDA).

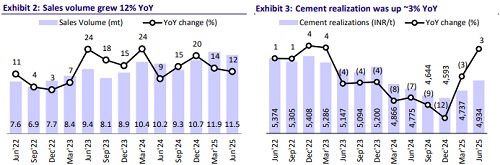

Sales volume up ~12% YoY; EBITDA/t at INR675 (est. INR794)

* ACC’s revenue/EBITDA/PAT stood at INR60.7b/INR7.7b/INR3.8b (+17%/+14%/ +5% YoY and +4%/-10%/-24% vs. estimates) in 1QFY26. Sales volumes were up 12% YoY at 11.5mt (+6% vs. our estimate). Cement realization rose 3% YoY (up 4% QoQ; in line with estimate) at INR4,934/t. Blended realization improved ~4% YoY/QoQ to INR5,298 (~1 below our estimate).

* Opex/t rose 4% YoY to INR4,623 (up 5% QoQ; 1% above our estimate), led by a 7%/9% YoY rise in variable costs/other expenses per tonne. Employee costs increased 27%/17% YoY, while freight cost/t declined ~6% YoY. OPM contracted 30bp YoY to ~13%, and EBITDA/t inched up 2% YoY to INR675.

* Depreciation increased ~7% YoY, whereas finance cost declined ~9% YoY. The effective tax rate was ~33% (est. 25%) vs. 25.6% in 1QFY25.

Key highlights from the management commentary

* Fuel consumption cost was INR1.56/Kcal vs INR1.73/INR1.47 in 1Q/4QFY25. The WHRS share was 13.9% vs. 9.9%/13.5% in 1QFY25/4QFY25. Its overall green power share surged to 26.2% vs. 14.3%/22.5% in 1QFY25/4QFY25. The target is to increase the green power share to ~60% by FY28.

* ACC expects thermal energy consumption to decline in the coming quarters, driven by capex-based efficiency improvement projects (currently at 738 Kcal/t of clinker).

* Logistics cost reduction was led by lead distance optimization, an increase in road direct dispatch (up 2pp to 69%), and freight price negotiations (road PTPK dipped 1% YoY to INR4.15).

Valuation and view

* ACC reported a weak performance in 1QFY26 as the gain of higher realization was offset by higher opex/t. Volume growth has also been higher, aided by MSA through group companies. Further, the benefits of the company’s initiatives towards sustainable cost reduction, product premiumization, and group-level synergies are yet to reflect in the profitability. We estimate a CAGR of 13%/24%/25% for revenue/EBITDA/PAT over FY25-28. We estimate a volume CAGR of ~11% over FY25-28 and EBITDA/t at INR660/INR730/INR790 in FY26/FY27/FY28 vs INR565 in FY25.

* ACC has underperformed ACEM in the last two years (Exhibit 1), and we believe that the underperformance will continue due to expectations of its merger with ACEM. Our channel checks indicate that the Adani group has started rebranding their non-trade products as Adani Cement and will remove the Ambuja and ACC names from the cement bags w.e.f. 1st Aug’25. Hence, we downgrade our rating on ACC to Neutral. We value ACC at 8.0x Jun’27E EV/EBITDA to arrive at our revised TP of INR2,040 (vs. INR2,400 valued at 10x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412