Sell Vodafone Idea Ltd for the Target Rs. 6.5 by Motilal Oswal Financial Services Ltd

AGR relief and debt raise remain key for LT survival

* Vodafone Idea’s (Vi) reported EBITDA declined 1% QoQ (vs.+2% QoQ for RJio/Bharti India wireless), which was above our estimates due to lower network opex (-2% QoQ, energy efficiencies) and SG&A costs (-1% QoQ).

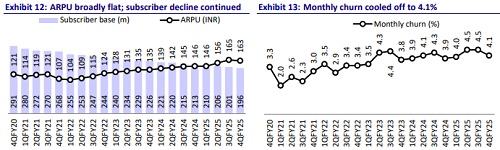

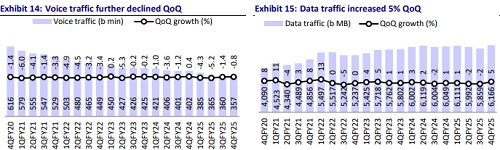

* Operationally, subscriber losses moderated significantly (-1.6m QoQ vs. ~5m+ net losses each in 2Q/3Q). However, data subscriber additions (excl. M2M) remained weak, despite acceleration in 4G/5G rollouts.

* Wireless revenue declined 1% QoQ (vs. 1-2% QoQ uptick for peers) as residual benefits from the tariff hike were partly offset by subscriber declines and two fewer days QoQ in 4Q.

* Vi’s capex increased further to INR42b (highest since the merger), with FY25 capex rising to INR96b. However, management indicated that FY26 capex beyond the current commitment of INR50-60b remains dependent on the successful closure of debt fund raise (which has been elusive so far).

* Despite equity infusion and acceleration in capex, Vi continued to lose market share to peers. On our estimates, it lost ~130bp in subscriber market share (SMS) and ~155bp in revenue market share (RMS) in FY25, among the three private telcos.

* Vi’s continued subscriber losses and weaker data net adds remain key concerns. Despite potential acceleration in network investments, we believe regaining subscribers will remain a tall ask for Vi, given that peers— with superior free cash flow generation and deeper pockets—can keep customer acquisition costs higher.

* Further, with no relief so far on AGR dues (repayments commence Mar’26) and no breakthrough on the debt raise, we believe Vi is likely to face an annual cash shortfall of ~INR200b and may be unable to meet its capex guidance of INR500-550b over FY25-27E.

* Our revenue and EBITDA estimates for FY26-27E remain broadly unchanged. We reiterate our SELL rating on Vi with an unchanged TP of INR6.5, based on DCF implied ~13x Jun’27E EV/EBITDA.

4Q above estimates on lower opex; subs decline moderates

* Vi’s wireless ARPU rose ~1% QoQ to INR164 (+12% YoY vs. flat to +1% QoQ for peers) as residual tariff hike benefits were offset by two fewer days.

* Subscriber base at 198.2m declined by ~1.6m QoQ (significant moderation vs. ~5m+ declines in 2Q/3Q), better than our est. of a 3.5m decline.

* Monthly churn declined 40bp QoQ to 4.1% and remains a key monitorable.

* Wireless revenue at INR98b (+4.5% YoY, 1% above) declined 1% sequentially (vs. 1-2% QoQ growth for peers) as residual benefits of the tariff hike were partly offset by a continued decline in the subscriber base.

* Reported EBITDA at INR46.6b (-1% QoQ, +8% YoY, vs ~2% QoQ growth for peers) was ~4% above our estimate, driven by lower SG&A and network expenses.

* Pre-Ind-AS 116 EBITDA at INR23.2b declined ~5% QoQ (+6% YoY) and was ~5% above our estimate, as margin contracted ~90bp QoQ to 21.1% (+50bp YoY and ~75bp higher than our estimate).

* Vi’s reported losses widened to INR72b (vs. INR66b QoQ, our estimate of INR73.7b). We note that 3Q benefited from lower interest costs due to settlement with a vendor.

* Vi’s reported net debt (excluding leases but including interest accrued and not due) declined INR302b QoQ to INR1.87t, following the accounting of ~INR369.5b equity conversion of GoI dues.

* Vi still owes ~INR1.95t to GoI for deferred spectrum and AGR dues. External/banking debt was stable QoQ at ~INR23b (lower vs. INR42b YoY).

* Vi’s capex increased further to INR42b, the highest since the merger. FY25 capex stood at ~INR96b.

* Vi has sought an enabling resolution to raise up to INR200b and has formed a committee to evaluate potential modes of fund raising.

Key highlights from the management commentary

* Subscriber trends: Management indicated that 4G net adds are improving with the ongoing network rollout. Further, it indicated that the 5G user base on its network continues to improve steadily.

* Network rollout: Vi rolled out ~7.6k towers (~8.5k MBB towers) and ~34k net MBB sites in 4Q, boosting 4G population coverage to 83%. 4G coverage is expected to increase to 84-86% in the near term, based on the current visibility of ~INR50-60b capex plans. The company also rolled out 5G in Mumbai, Delhi, Chandigarh, and Patna, with plans to expand 5G to key cities across 17 priority circles by Aug’25.

* Debt raise: Vi remains engaged with lenders for a debt raise, with discussions progressing following the ~INR369.5b equity conversion of GoI dues and recent upgrades to credit ratings. Management indicated that debt raise remains crucial for Vi to reach its target of ~215-220k unique tower sites (vs. ~195k currently) and to increase 4G population coverage to ~90% (vs. 83% currently).

* Network opex: Management highlighted several cost-saving initiatives, such as energy cost optimization, rental negotiations, and insourcing fiber maintenance, that have helped reduce expenses despite accelerated network rollouts.

* Tariff construct: Management continues to make a case for tariff construct to change from unlimited daily data allowance to usage-based plans. However, the company is reluctant to lead this change and prefers to wait for competitors to take the initiative. We note, even Bharti has long supported a move toward usage-based tariff plans.

Valuation and view

* Vi continues to lose market share to peers due to lower ARPU translation, given its inferior subscriber mix and elevated subscriber churn.

* It plans to embark on a significant capex cycle (INR500-550b over the next 2-3 years) to bridge the network gap with peers.

* Despite the likely capex, we believe regaining subscribers would be a tall ask for Vi, given its peers’ superior free cash flow generation and deeper pockets.

* Further, we believe the company’s network investments remain contingent on debt raise, which, in turn, is dependent on continued support/AGR relief from GoI (INR200b+ annual cash shortfall over FY26-31E).

* Stabilization of the subscriber base, along with further relief from the GoI, remains imperative for Vi’s long-term survival.

* Our revenue and EBITDA estimates for FY26-27E remain broadly unchanged. We reiterate our SELL rating on Vi with an unchanged TP of INR6.5, based on DCF implied ~13x Jun’27E EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412