Buy MAS Financial Services Ltd for the Target Rs.400 by Motilal Oswal Financial Services Ltd

Strategic focus on organic retail with a risk-calibrated approach

NIM improves ~10bp QoQ; asset quality broadly stable

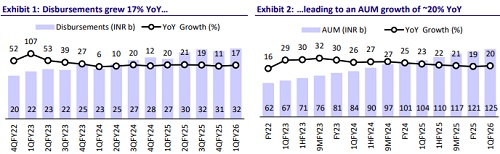

* MAS Financial Services (MASFIN)’s 1QFY26 PAT grew ~19% YoY to INR839m (in line). Fee income rose ~55% YoY to ~INR300m. Net total income was up 36% YoY to INR2.4b (in line), while opex at INR827m grew ~46% YoY (8% higher than MOFSLe). PPoP was INR1.5b (in line) and grew 31% YoY.

* Management indicated that the macroeconomic environment has not fully stabilized, which led to AUM growth coming in at the lower end of the guided range. However, it expects the momentum to improve in 2H, aided by a pickup in economic activity and the upcoming festive season.

* The company reiterated its guidance of ~20-25% AUM growth, with the organic retail business likely to outpace its partnership business. This will be driven by continued branch expansion and a strategic focus on the SME business, which is expected to be its key growth driver. We estimate a ~24% PAT CAGR over FY25-27, with RoA/RoE of ~2.9%/15% in FY27E. Reiterate BUY with a TP of INR400 (based on 2.2x Mar’27E BV).

AUM grows ~20% YoY; strong growth in salaried personal loans

* MASFIN’s standalone AUM stood at ~INR125b and rose ~20% YoY/3% QoQ. Within this, AUM of micro-enterprise/SME/2W/CV loans rose 11%/ 20%/30%/18% YoY. Salaried personal loans grew ~90% YoY to ~INR11.3b.

* About 35% of the underlying assets in the standalone AUM were sourced through partner NBFCs. The MSME segment contributed ~60% to the incremental AUM growth during the last one year.

* Management reiterated its target to scale AUM to INR200b over the next three years. The company also shared that its Organic Retail segment is expected to account for ~70-75% of the overall AUM within the next 6-12 quarters. We model an AUM CAGR of ~21% over FY25-27E.

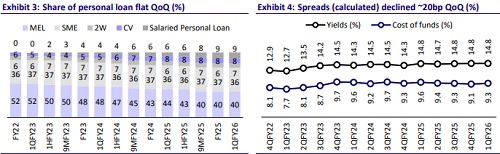

NIM rises ~10bp QoQ; expect CoB to dip ~25-35bp in FY26

* Yields (calc.) were largely stable QoQ at ~14.85%, while CoF (calc.) rose ~20bp QoQ to 9.3%. This resulted in ~20bp QoQ contraction in spreads to ~5.5%. Management expects a decline of ~25-35bp in its cost of borrowings in FY26, driven by a gradual reduction in MCLR by banks.

* NIM (calc.) expanded ~10bp QoQ to ~7.7%, while reported CoF was stable QoQ at ~9.8%. We model NIM (as % of AUM) of ~5.1/5.4% in FY26/FY27 (vs. ~5.1% in FY25).

Asset quality broadly stable; GS3 rises ~5bp sequentially

* The 1+dpd declined ~10bp QoQ to 6.6% in 1QFY26. Credit costs were at similar levels as the last quarter and stood at INR424m, translating into annualized credit costs of 1.4% (PQ: 1.4% and PY: 0.9%).

* GNPA (basis AUM) rose ~5bp QoQ to 2.5%, while NNPA was stable at 1.6%. PCR on Stage 3 assets rose ~1pp QoQ to ~41%.

Other highlights

* The average ticket size of micro-enterprise loans rose to ~INR66k (PQ: ~INR63k).

* The RoTA was largely stable QoQ at ~2.85% in 1QFY26.

* MASFIN Insurance Broking Pvt Ltd, a subsidiary of MAS Financial, has received in-principle approval from IRDAI to operate as a Direct Insurance Broker (Life & General), subject to compliance with IRDAI regulations and final conditions.

* CRAR stood at ~25.2%, with Tier 1 at ~23.2%.

HFC subsidiary

* MAS Housing reported an AUM of ~INR7.7b, rising ~27% YoY.

* GS3 in the HFC subsidiary declined ~2bp QoQ to ~0.92%.

* Management has guided that AUM would reach INR10b by the end of the year while continuing to uphold strong asset quality.

Key highlights from the management commentary

* While branch expansion has been temporarily moderated due to the macro environment, management expects to resume its branch expansion trajectory from 3QFY26 onwards.

* Management highlighted elevated slippages in the CV portfolio, which resulted in sequentially flat disbursements for the segment. Further, the company has initiated a pilot in the used car segment, though volumes remain modest.

* MASFIN shared that it may take another 1-2 quarters for eligible demand to rebound and for portfolio quality to strengthen meaningfully.

Valuation and view

* MASFIN reported in-line earnings for 1QFY26. The earnings were supported by strong disbursement growth of ~17% YoY, which led to an AUM growth of ~20% YoY. Asset quality remained largely stable, while credit costs continued to remain elevated at 1.4%. The company has a niche expertise in the SME segment, and its asset quality is perhaps the best among its MSME lending peers.

* Going forward, the organic retail mix is expected to continue rising, supporting further yield enhancement and margin expansion. Although operating expenses will remain elevated due to sustained investments in distribution and technology, it will still be able to deliver healthy return ratios.

* We model a CAGR of 21%/24% standalone AUM/PAT over FY25-FY27E, with RoA/RoE of 2.9%/15% in FY27E. The company has maintained high earnings quality, backed by its risk-calibrated AUM growth. Reiterate BUY with a TP of INR400 (premised on 2.2x Mar’27E BV). Key risk: Slowdown in the economic environment leading to sluggish loan growth and deterioration in asset quality.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)