Nepal Economy Update - December 2025 by CareEdge Ratings

Nepal’s macroeconomic environment continued to stabilise during the month, supported by easing inflationary pressures and a strong external buffer. Softer food prices helped keep headline inflation low, while the external sector remained comfortable amid ample foreign exchange reserves. Although remittance inflows moderated sequentially, the overall balance of payments position stayed firmly in surplus, cushioning the economy against external shocks.

Inflation

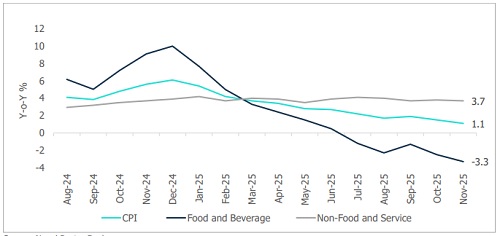

Nepal’s consumer price inflation moderated to 1.1% year-on-year (y-o-y) in mid-November, easing from 1.5% in mid-October. Deflation in the food and beverage category deepened, with prices contracting by 3.3% (y-o-y) versus 2.5% a month earlier. Meanwhile, non-food and services inflation edged marginally lower to 3.7% from 3.8%.

Consumer Price Inflation

External Sector

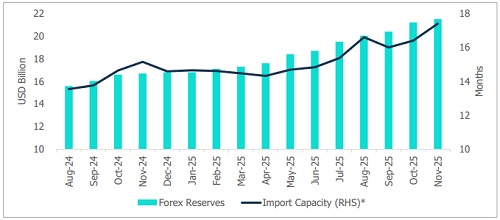

In mid-November, Nepal’s foreign exchange reserves climbed to a record USD 21.5 billion, marking a double-digit growth of 10.2% from mid-July. The current reserve level is adequate to cover 17.4 months of projected merchandise and service imports. Meanwhile, remittance inflows softened to Rs 133.8 billion in mid-November, compared to Rs 201.2 billion in the previous month.

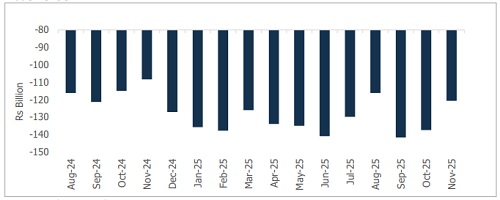

In mid-November, Nepal’s merchandise exports lost momentum for the second month in a row, easing to Rs 20.7 billion from Rs 25.5 billion in the previous month. Merchandise imports also declined sequentially to Rs 141.4 billion, compared with Rs 162.9 billion a month earlier. However, on a year-on-year basis, both exports and imports registered growth. Overall, the trade deficit narrowed modestly to Rs 120.7 billion from Rs 137.5 billion in the preceding month.

Forex Reserves and Import Cover

Trade Deficit

During the first four months of the fiscal year, Nepal recorded a current account surplus of Rs 279.7 billion, a sharp increase from Rs 147.8 billion in the same period last year. Net capital transfers also strengthened to Rs 6.2 billion, up from Rs 2.5 billion a year earlier. In contrast, foreign direct investment (equity only) softened, declining to Rs 2.5 billion from Rs 5.8 billion in the corresponding period. Consequently, the balance of payments surplus expanded to Rs 318.4 billion, compared with Rs 205.8 billion a year ago

Tourism

Tourist arrivals in Nepal dipped by 9.3% in mid-November compared with the previous month. On a year-on-year basis, arrivals were only marginally higher at 1.8%, suggesting that the sector’s broader recovery remains subdued. Overall, Nepal received 4.1 lakh tourists during the first four months of the fiscal year, unchanged from the same period last year.

Tourist Arrivals

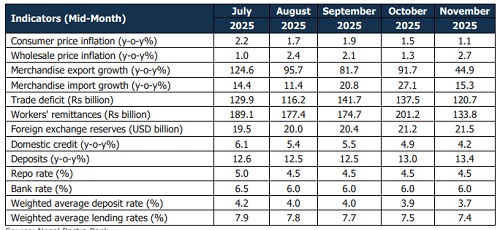

Monthly Data of Key Economic Variables

Above views are of the author and not of the website kindly read disclaimer