Buy IIFL Finance Ltd for the Target Rs. 635 by Motilal Oswal Financial Services Ltd

Earnings beat with off-book gaining traction; strong gold loan growth

Asset quality stress persists in micro-LAP, unsecured MSME, and MFI

* IIFL Finance (IIFL)’s 2QFY26 NII grew 7% YoY and ~11% QoQ to ~INR14.4b (in line). Other income stood at ~INR4.9b (PQ: INR3.8b). This was primarily due to higher assignment income of ~INR3.5b (PQ: INR2.3b).

* Net total income grew ~22% YoY to ~INR19.3b. Opex rose ~19% YoY to INR8.7b (~6% higher than MOFSLe), with the cost-to-income ratio declining to ~45% (PQ: 48% and PY: 46%). PPoP was INR10.6b; it grew ~24% YoY (~15% beat). Consol. PAT (post-NCI) was INR3.8b (~27% beat) in 2QFY26.

* Consol. yields/CoB rose ~25bp/10bp QoQ to ~13%/~9.9%. Calculated NIM rose ~25bp QoQ.

* Credit costs stood at INR5b (in line). This translated into annualized credit costs of ~3.4% (PQ: ~3.65% and PY: ~3.6%). NPAs were impacted by macro trends in MFI, unsecured business/personal, and small-ticket LAP.

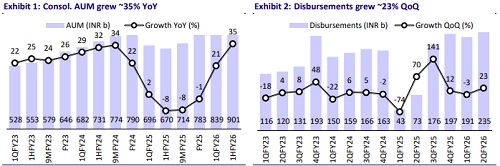

Consol. AUM rises ~35% YoY; strong 27% QoQ growth in gold loans

* Consol. AUM grew 35% YoY and ~7% QoQ to INR901b. On-book loans grew ~34% YoY. Off-book formed ~32% of the AUM mix, with co-lending forming ~13% of the AUM mix.

* Gold loan AUM stood at ~INR346b and rose ~27% QoQ. Sequential growth in consol. AUM was driven by gold loans (+27%). Home loan AUM was flat QoQ, while MSME loans declined ~4% QoQ and MFI declined ~6% QoQ.

* Management indicated that momentum in the gold loan segment remains strong, supported by high gold prices and sustained customer demand. IIFL expects robust growth in this segment in 2HFY26 and remains confident of maintaining both volume and customer growth.

* Management reiterated its guidance for medium-term AUM growth of 15- 20%, with co-lending expected to remain a key growth driver. The company also expects the off-book portfolio share to rise to ~40% and also exudes confidence that current assignment income levels can be sustained.

* We estimate gold loans/consolidated AUM to grow ~116%/~31% YoY in FY26, resulting in a consol. AUM CAGR of ~23% over FY25-28E.

GS3 declines ~20bp QoQ; credit costs elevated

* GS3 (consol.) declined ~20bp QoQ to ~2.14%, while NS3 dipped ~10bp QoQ to ~1%. PCR rose ~50bp QoQ to ~52.8%. NPAs were impacted by macro trends in MFI, unsecured business/personal loans, and small-ticket LAP.

* IIFL has done a portfolio reset as it now plans to exit unsecured MSME, micro-LAP, and high-risk MFI geographies. IIFL’s (standalone) CRAR stood at ~18.6% as of Sep’25.

* Management indicated that credit costs are expected to exhibit relative moderation in 2HFY26 and guided for consolidated credit costs of ~2.8-3% (as a % of avg. loan book) for FY26 and 2.2-2.4% for 2HFY26. We model credit costs of 2.8%/2.3% for FY26/FY27E.

Highlights from the management commentary

* Management indicated that the housing subsidiary maintained a cautious approach in 1H, focusing on improving collections and stabilizing asset quality.

* The company has guided for 15% growth in its Home Loan portfolio, with the improvement accompanied by stronger collection performance under the leadership of its new Housing Finance CEO, Mr. Girish Kousgi.

* Bihar was among the first states where IIFL Samasta introduced its new control framework, resulting in arrears now moderating to ~6%. Collection efficiency in the state remains strong at about 99%, supported by improved on-field discipline.

Valuation and view

* IIFL reported an operationally mixed quarter, with strong momentum in the gold loan segment supported by robust demand and higher gold prices, while growth in other segments remained subdued. The company exhibited asset quality pressures in its micro-LAP, unsecured business loan, and MFI portfolio, resulting in credit costs continuing to remain elevated. However, it expects an improvement in housing segment growth and a moderation in credit costs in 2H, aided by strengthened collection architecture and ongoing recovery efforts.

* We cut our FY26E EPS by ~2% to factor in higher credit costs, slightly offset by higher assignment income. The stock trades at 1.5x FY27E P/BV and ~11x P/E for an estimated RoA/RoE of 2.3%/14% in FY27. We have a BUY rating on the stock with a TP of INR635 (based on SoTP valuation; refer to the table below).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412