Neutral Infosys Ltd For Target Rs. 1,600 by Motilal Oswal Financial Services Ltd

Poor 4Q but commentary springs a surprise

Limited near-term catalysts drive our Neutral rating

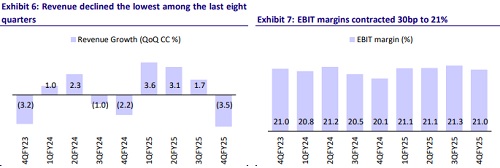

* Infosys (INFO) reported 4QFY25 revenue of USD4.7b, down 3.5% QoQ CC/up 4.8% YoY CC vs. our estimate of 1.0% QoQ CC decline. For full year, revenue stood at USD19.2b, up 4.2% YoY CC. EBIT margins stood at 21% vs. our estimates of 20.6%. EBIT declined 3.8% QoQ/up 12.5% YoY to INR85b (est. INR87b). PAT came in at INR68b, flat QoQ/up 12.1% YoY, above our estimate of INR67b.

* The company guided for FY26 CC revenue growth of 0-3%. This guidance implies a CQGR of +0.5% to +1.5% over the next four quarters. Large deal TCV stood at USD2.6b vs. USD2.5b in 3Q, up 4% QoQ. The book-to-bill ratio was 0.5x. Net new TCV was down 24.7% QoQ. For FY25, revenue/EBIT/PAT grew 6.1%/8.4%/8.8% YoY in INR terms. We expect revenue/EBIT/PAT to grow 5.4%/4.7%/3.9% YoY in 1QFY26. We reiterate our NEUTRAL rating on INFO with a TP of INR1,600, implying a 13% potential upside.

Our view: Better growth in 1Q; lower pass-through to aid margins

* The management struck an optimistic tone on guidance: The upper end of INFO’s guidance (3% YoY organic cc growth) assumes a ‘stable to marginally improving environment’, according to management. We found this to be notably positive; we assume FY26e could end up at 2% YoY organic cc growth, ahead of most large-caps. We build in ~0.5% contribution from acquisitions for the year.

* Normal seasonality points to a positive start to FY26e: Management also guided for normal seasonality, indicating little to no impact from current macro uncertainties on Q1 revenues—unlike peers. This guidance suggests that INFO is likely to outperform peers, with an expected 2% QoQ cc revenue growth in 1QFY26.

* Lower pass-through revenues for FY26e bode well for margins: Passthrough revenues for FY26e could be materially lower, and this could provide a good lever for margin expansion in FY26e. While there could be a wage hike impact in the coming quarter, we believe margins could expand ~30bp for the full year on the back of lower pass-through revenues.

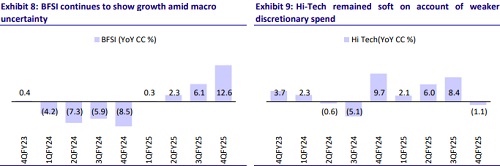

* Earnings cut could be lower than expected, but we remain below consensus: The current guidance protects against downside risks to earnings cuts for FY26/FY27e. The absence of widespread deferrals or ramp-downs in Q1 means our numbers are cut by a marginal 2-3%. We believe discretionary spends are certainly not recovering in a hurry, and we continue to remain below consensus.

Valuation and changes in estimates

* We have made minor adjustments to our FY26/FY27E estimates to reflect the current macro environment and trends in discretionary spending. Nonetheless, INFO has maintained its margin guidance of 20-22%. We value INFO at 22x FY27E EPS. This yields a rounded TP of INR1,600, implying a 13% upside. We reiterate our NEUTRAL rating

Miss on revenues and beat on margins; upper end of guidance better than beaten-down estimates

* USD revenue declined 4.2% QoQ to USD4.7b. In CC, it was down 3.5% QoQ, below our estimate of a 1% QoQ decline. For full year, revenue stood at USD 19.2b, up 4.2% YoY CC, below the guidance of 4.5-5%.

* The company guided for organic FY26 CC revenue growth of 0-3%. This guidance implies a CQGR of +0.5% to +1.5% over the next four quarters.

* In 4QFY25, Life Sciences/Retail/BFSI declined 14.3%/7.7%/2.2% QoQ in USD terms. Hi-Tech and Communications reported flat QoQ growth.

* EBIT margin stood at 21%, beating our estimates of 20.6%. For FY25, EBIT margin stood at 21.1% vs 20.7% in FY24. FY26 EBIT margin guidance was maintained in the 20-22% range.

* PAT was up 3.3% QoQ/down 11.7% YoY at INR68b (above our est. of INR67b). For FY25, PAT stood at INR265b.

* Employee additions were flat QoQ. Total headcount at the end of FY25 stood at 323,578, up 2% from FY24.

* Large deal TCV stood at USD.2.6b vs. USD2.5b in 3Q, up 4% QoQ. For FY25, deal TCV stood at USD11.6b. The book-to-bill ratio was 0.5x.

* LTM attrition was up 40bp QoQ at 14.1%. Utilization dropped QoQ to 84.9% vs 86% in 3Q (ex-trainees).

* The company announced two acquisitions during the quarter—one in the Energy, Utilities, and Services vertical in the US and the other in the cybersecurity space in Australia.

* INFO’s board has proposed a final dividend of INR22/share.

Key highlights from the management commentary

* The environment remains uncertain. With changes in the economic outlook, client conversations are increasingly centered around cost take-outs and vendor consolidation.

* Roughly two-thirds of the revenue decline was due to lower third-party costs and revenues, as some deals slipped out of the quarter.

* Third-party costs and revenues are expected to be lower in FY26 vs. FY25, given the current deal pipeline.

* Recently won deals have started ramping up during 4QFY25. No major rampdowns or closures were observed.

* Pricing remained stable during the quarter. The company sees opportunities for pricing improvement through value-based selling and does not expect pricing pressure from vendor consolidation deals.

* FY26 revenue growth guidance stands at 0-3% in CC terms. M&A closed during the quarter are expected to contribute 40-50 bps to full-year revenue growth in FY26. The top end of the guidance assumes steady to marginal improvement; the lower end assumes elevated macro challenges. Tariff impact remains difficult to quantify.

* Wage increments were rolled out in Jan’25, with the remainder implemented in Apr’25.

Valuation and view

* We have made minor adjustments to our FY26/FY27E estimates to reflect the current macro environment and trends in discretionary spending. Nonetheless, INFO has maintained its margin guidance of 20-22%. We value INFO at 22x FY27E EPS. This yields a rounded TP of INR1,600, implying a 13% upside. We reiterate our NEUTRAL rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)