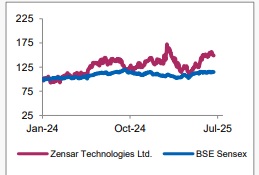

Hold Zensar Technologies Ltd For Target Rs. 875 by Axis Securities Ltd

Steady Performance; Digital Transformation to Lead Growth

Est. Vs. Actual for Q1FY26: Revenue: INLINE; EBIT Margin: INLINE; PAT - BEAT

Recommendation Rationale

• Macro Headwinds: The quarter began with considerable macro uncertainty with slowing growth in both the US and Europe. Clients paused net new spending due to uncertainties related to tariffs. However, GenAI continues to remain in demand.

• Wage Hikes & ESOPs: The company's wage hikes and ESOPs implementation will impact margins in the next quarter. However, the management is committed to maintaining a midteens EBITDA margin range in the long run.

• AI Implementation: AI is central to Zensar's strategy, driving 30% of its active pipeline, with over half of its talent upskilled in AI and GenAI. 20% of order bookings are AI-influenced. The company launched "Zen's AI," a GenAI accelerator platform, which has been praised for connected intelligence, multimodal search, and enterprise-grade agentic AI models.

Sector Outlook: Cautiously Optimistic Company

Outlook & Guidance: The management remains cautiously optimistic on performance for the rest of the year due to macro uncertainty, relying on core operational foundations.

Current Valuation: 24x FY27E P/E

Current TP: Rs 875/share

Recommendation: Over the years, the company’s focus has been on reskilling and upskilling in next-gen tech, which has resulted in healthy utilisation levels, and this is expected to continue further. We resume our coverage with a HOLD rating on the stock.

Financial performance

In Q1FY26, Zensar Technologies reported revenue of Rs 1,385 Cr vs Rs 1,288 Cr (Q1FY25), up 7.5% YoY and 1.9% QoQ on account of growing traction in AI-led deals and impactful solution delivery. EBIT stood at Rs 188 Cr vs Rs 172 Cr, reporting growth of 9.3% YoY, but fell 0.6% QoQ. Net income stood at Rs 182 Cr vs Rs 158 Cr, up 15.3% YoY and 3.2% QoQ, supported by higher other income. Moreover, in CC terms, revenue grew by 3.8% YoY and 1.9% QoQ. Attrition rate fell by 80 bps to 9.8% vs 10.6% YoY.

Valuation & Recommendation

The demand outlook across most verticals remains uncertain, impacting revenue growth momentum in the near term. However, given the company's stable performance supported by favourable business deals and enhanced customer retention, we resume over coverage with a HOLD rating on the stock and assign a 24x P/E multiple to its FY27E earnings to arrive at a TP of Rs 875/share, implying an upside of 8% from the CMP.

Outlook

• From a long-term perspective, Zensar Technologies seems to be effectively addressing client-specific requirements across various verticals, while maintaining a strong deal pipeline. We believe that the new strategy will facilitate a sequential recovery, thereby boosting confidence in near-term growth.

Key highlights

• In CC terms, US region reported a QoQ and YoY growth of 4.3% each. Europe region saw a sequential QoQ decline of 5.8%, but YoY growth of 3.8%. Africa region saw a sequential QoQ growth of 1.5% and YoY growth of 0.6%.

• On the segmental front, in CC terms, revenue growth in Telecom, Media, and Technology (TMT) stood at 5.5% QoQ, but a decline of 5.6% YoY; BFSI grew by 2.9% QoQ and 8.2% YoY; Healthcare and Life Sciences grew 5.2% QoQ and 16.5% YoY; Manufacturing and Consumer Services saw YoY growth of 1.1% but a decline of 4.1% QoQ due to impact of "Liberation Day". However, the company is expecting growth in Q2FY26.

• Zensar launched "Zen's AI," a GenAI accelerator platform, which has been praised for connected intelligence, multimodal search, and enterprise-grade agentic AI models. It enhances engineering velocity, value realisation in modernisation programs, and optimises AMS and IT operations costs.

• The macro environment remains challenging with slowing growth in both the US and Europe. During the quarter, clients paused net new spending due to uncertainties. Nevertheless, GenAI continues to remain in demand.

• The company took a wage hike across the board for both offshore and onshore employees on 1st July, with the hikes in India being slightly higher than in the US, UK, and South Africa. As per the management, $3 Mn impact will be seen on margin in Q2FY26.

• Zensar Tech booked orders worth $172 Mn, up 11.7% YoY, despite uncertainties, and it remains optimistic about further bookings.

• Cash conversion has been good so far, and investment will be done in large deal creation (structure deal), M&A, with initiatives on innovation.

• The company believes in creating large deals through innovation and solutioning rather than bidding on existing deals and extreme pricing pressure.

• The management stated that the onshore and offshore mix is based on clients' demand. Also, the subcontracting cost (higher by 64% QoQ) was due to third-party cost and headcounts increase, while it is expected to be in line in coming quarters.

• New member was appointed in Apr’25 for Africa region, and the company has started witnessing some initial green shoots. However, it will take some quarters to reflect in revenues.

• The shifting of demand and uncertainty is leading clients to focus on essential projects over new capital projects. On AI talent cost, the company focuses on creating AI talent internally rather than spending significantly on attracting external AI talent

Key Risks to our Estimates and TP

• The demand environment is uncertain because of the potential threat of recession from the world’s largest economies.

• The rising subcontracting cost and cross-currency headwinds may impact operating margins negatively.

Outlook

• From a long-term perspective, Zensar Technologies seems to be effectively addressing client-specific requirements across various verticals, while maintaining a strong deal pipeline. We believe that the new strategy will facilitate a sequential recovery, thereby boosting confidence in near-term growth.

Key highlights

• In CC terms, US region reported a QoQ and YoY growth of 4.3% each. Europe region saw a sequential QoQ decline of 5.8%, but YoY growth of 3.8%. Africa region saw a sequential QoQ growth of 1.5% and YoY growth of 0.6%.

• On the segmental front, in CC terms, revenue growth in Telecom, Media, and Technology (TMT) stood at 5.5% QoQ, but a decline of 5.6% YoY; BFSI grew by 2.9% QoQ and 8.2% YoY; Healthcare and Life Sciences grew 5.2% QoQ and 16.5% YoY; Manufacturing and Consumer Services saw YoY growth of 1.1% but a decline of 4.1% QoQ due to impact of "Liberation Day". However, the company is expecting growth in Q2FY26.

• Zensar launched "Zen's AI," a GenAI accelerator platform, which has been praised for connected intelligence, multimodal search, and enterprise-grade agentic AI models. It enhances engineering velocity, value realisation in modernisation programs, and optimises AMS and IT operations costs.

• The macro environment remains challenging with slowing growth in both the US and Europe. During the quarter, clients paused net new spending due to uncertainties. Nevertheless, GenAI continues to remain in demand.

• The company took a wage hike across the board for both offshore and onshore employees on 1st July, with the hikes in India being slightly higher than in the US, UK, and South Africa. As per the management, $3 Mn impact will be seen on margin in Q2FY26.

• Zensar Tech booked orders worth $172 Mn, up 11.7% YoY, despite uncertainties, and it remains optimistic about further bookings.

• Cash conversion has been good so far, and investment will be done in large deal creation (structure deal), M&A, with initiatives on innovation.

• The company believes in creating large deals through innovation and solutioning rather than bidding on existing deals and extreme pricing pressure.

• The management stated that the onshore and offshore mix is based on clients' demand. Also, the subcontracting cost (higher by 64% QoQ) was due to third-party cost and headcounts increase, while it is expected to be in line in coming quarters.

• New member was appointed in Apr’25 for Africa region, and the company has started witnessing some initial green shoots. However, it will take some quarters to reflect in revenues.

• The shifting of demand and uncertainty is leading clients to focus on essential projects over new capital projects. On AI talent cost, the company focuses on creating AI talent internally rather than spending significantly on attracting external AI talent.

Key Risks to our Estimates and TP

• The demand environment is uncertain because of the potential threat of recession from the world’s largest economies.

• The rising subcontracting cost and cross-currency headwinds may impact operating margins negatively

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633