Buy Angel One Ltd For Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

Higher customer acquisition costs dent profitability

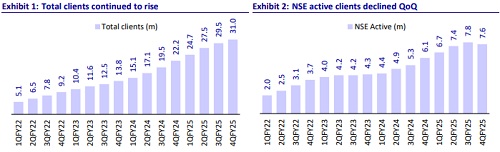

* Angel One (ANGELONE) reported a total income of INR8.3b (-16% QoQ), which was broadly in line with our estimate. F&O regulations as well as weak market activity in 4QFY25 adversely impacted the company’s sequential growth. For FY25, total income grew 24% YoY to INR41.3b.

* While total operating expenses were flat sequentially, excluding a onetime reversal of variable employee pay (INR640m) and IPL costs (INR344m), the company’s opex jumped QoQ, indicating a spike in customer acquisition costs. PAT at INR1.7b declined 38% QoQ (13% miss). For FY25, ANGELONE’s PAT grew 4% YoY to INR11.7b.

* The number of orders declined 22% QoQ to 327m. The average MTF book was largely stable QoQ at INR40.3b. Loan distribution volumes were down sequentially to INR1b from INR2.4b in 3QFY25.

* The revenue curve has picked up in Mar’25, and a similar trajectory is being witnessed in Apr’25. Management expects the impact of F&O regulations to gradually normalize, which would lead to an operating margin of 40-45% in 4QFY26.

* We cut our EPS estimates by 15%/7% for FY26/27, factoring in a slower MTF growth trajectory and elevated cost structure due to higher client acquisition costs and continued investments in new businesses. Consequently, we revise our TP to INR2,800 (based on 18x FY27E EPS).

Revenue hit by regulations and weak market sentiments

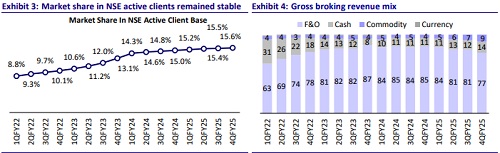

* Gross broking revenue at INR6.3b declined 23% QoQ (in line), hurt by a dip in F&O activity (F&O brokerage down 26% QoQ, in line) as well as weak cash activity (cash brokerage down 10% QoQ, 10% miss). The commodity segment remained stable sequentially (commodity brokerage flat QoQ, 8% miss).

* The impact of F&O regulations on retail participation led to a 26% sequential decline in the number of F&O orders to 230m. Revenue per order declined to INR21.2 (INR21.4 in 3QFY25).

* The weak market environment led to a 16% sequential decline in cash orders to 75m. Sequentially, revenue per order increased to INR11.8, driven by the introduction of brokerage in the cash delivery segment.

* Commodity orders declined 4% sequentially to 22m due to the market share of ANGELONE in crude oil, which was volatile in 4QFY25.

* The average client funding book was largely stable sequentially at INR40.3b (INR40.5b in 3QFY25), resulting in a slight sequential decline in net interest income to INR2.6b (5% miss).

* Other income at INR869m declined 10% QoQ (6% miss), broadly impacted by a sequential decline in depository income due to lower cash delivery orders and distribution income led by the SIP slowdown.

Continued investments and higher CAC keep the C/I ratio elevated

* Total operating expenses were flattish QoQ, with the sequential rise in admin & other expenses offset by a sequential decline in employee expenses. On a sequential basis, the CI ratio increased to 68.2% in 4QFY25 from 58% in 3QFY25.

* Employee costs declined 21% sequentially to INR1.9b (22% below est.) owing to the reversal of variable pay to employees of INR641m. Excluding the one-off impact, employee expenses would have been 5% above our estimate.

* Admin and other expenses grew 14% QoQ to INR3.8b (21% above est.), despite a decline in client additions due to: 1) the company’s aggressive client acquisition strategy in the current volatile market and 2) continued investments in technology and new business ventures (1.8% hit in 4QFY25 operating margin). The IPL-related expenses of INR344m were in line with our expectations.

Highlights from the management commentary

* The company’s variable employee expenses serve as a lever for achieving cost efficiency. Projections are made for fixed and variable pay during the beginning of the year, and then the variable part is leveraged, considering ANGELONE’s performance during the year.

* The company has been gaining market share with respect to client additions and aims to remain aggressive while the industry is in a wait-and-watch mode.

* The management expects the distribution segment to contribute significantly to revenue diversification, driven by a calibrated approach towards launching new products, especially for credit and insurance.

Valuation and view

* During 4QFY25, ANGELONE witnessed the impact of F&O regulations and a weak market environment on its revenue. Further, the company saw the effect of elevated cost structure along with IPL expenses on its profit level.

* While the company has the lever of corrective pricing, among others, to revive revenue growth and protect profitability, sustained recovery in market activity can help the company achieve the 40-45% operating margin guidance. New businesses such as the distribution of loans, fixed deposits, wealth management, and AMC are likely to gain traction over the medium term.

* We cut our EPS estimates by 15%/7% for FY26/27, factoring in a slower MTF growth trajectory and elevated cost structure due to higher client acquisition costs and continued investments in new businesses. Consequently, we revise our TP to INR2,800 (based on 18x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)