Buy Godrej Agrovet Ltd for the Target Rs. 790 by Motilal Oswal Financial Services Ltd

Lackluster 2Q and a bleak outlook lead to the retraction of guidance

* Godrej Agrovet (GOAGRO) reported a muted operating performance (EBIT down 5.2% YoY) in 2QFY26, primarily due to a sharp dip in the crop protection business (EBIT down 70%), which was offset by growth in the palm oil business (PO)/Dairy/Poultry businesses (EBIT up 88%/8%/4.6x). Conversely, the Animal Feed business (AF) was largely flat.

* Management revoked its revenue growth guidance for FY26 after factoring in the weak outlook for the crop protection business (due to heavy and unseasonal rains). However, the company still maintains a healthy growth outlook for FY26, fueled by other businesses.

* Hence, we broadly retain our FY26/FY27/FY28 EBITDA estimates. We reiterate our BUY rating on the stock with an SOTP-based TP of INR790.

Weak demand hurts operating performance

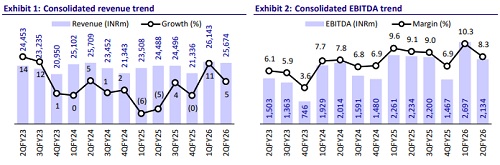

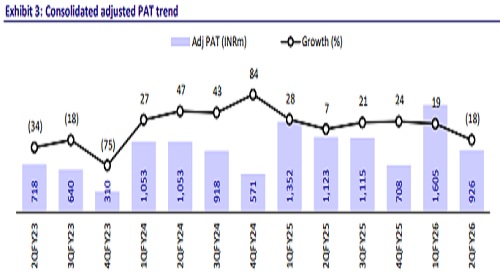

* Consolidated revenue stood at INR25.7b, up 5% YoY (est. in line). EBITDA margin contracted 80bp YoY to 8.3% (est. 8.6%), led by an increase in employee cost (stood at 6.4% vs 5% in 2QFY25) and other expenses (stood at 11.9% vs 11.5% in 2QFY25). While gross margins expanded by 100bp YoY to 26.6%. EBITDA stood at INR2.1b, down 4.5% YoY (est. in line). Adjusted PAT declined ~18% YoY to INR926m (est. of INR1.3b).

* AF: Revenue inched up 1% YoY at INR12.2b, while margins contracted 10bp to 5.8%. Volumes grew by ~11% YoY, which was partially offset by a 9% dip in realizations.

* Palm Oil: Revenue grew ~45% YoY to INR6.4b, led by higher realizations in crude palm oil (CPO) and palm kernel oil (PKO), as realizations improved ~20% and ~63%, respectively. FFB arrivals rose 9% YoY, leading to an EBIT margin expansion of 5pp YoY to 21.6% and an EBIT growth of ~88% YoY to INR1.4b. OER also improved to 19% in 1HFY26 (vs. 18.3% in 2Q).

* CP: Consolidated CP revenue dipped 28.3% YoY to ~INR2b, with standalone CP revenue/Astec declining 25.3%/29.8% YoY. Astec’s decline was due to a dip in the CDMO business, while the Enterprise business was up 16% YoY. Consolidated CP EBIT declined 70% YoY to INR163m, with standalone CP EBIT declining 62% YoY to INR320m. Astec posted an operating loss of INR157m vs. an operating loss of INR299m in 2QFY25.

* The Dairy businessrevenue dipped 2.4% YoY to INR3.9b, while EBIT grew ~7.7% YoY to INR91m, led by a strong VAP performance. The Poultry and Processed Food business’srevenue declined ~7.4% YoY to INR1.8b, mainly due to lower volumes and realizations in the live bird business, while EBIT wasINR23m (up 4.6x YoY) and EBIT margin expanded 100bp YoY to ~1.3%.

* For 1HFY26, GOAGRO’s revenue/EBITDA/adj. PAT grew 8%/7%/2% to INR51.8b/INR4.8b/INR2.5b. For 2HFY26, its implied revenue/EBITDA/PAT growth stands at 17%/15%/35% YoY.

* Gross debt was INR21.2b as of Sep’25 vs. INR13.7b in Mar’25. Further, the company had a CFO of INR3.3b as of Sept’25 vs INR1.6b in Sep’24

Highlights from the management commentary

* Crop protection (standalone): GOAGRO had a weak 2Q due to persistent and widespread rainfall across key markets. In Jul’25, the company launched a new in-licensed maize herbicide, Ashitaka, to diversify its product portfolio. Further, the company expects to launch new products in 4Q, which could be another product to diversify its product portfolio.

* Astec: Demand for CDMO business has shifted towards 2H. The company only sees a temporary shift but feels that annual demand is normal. The company is on it course to grow CDMO to 55% of this busines

* Dairy: VAP posted ~10% growth, and the VAP contribution to total sales rose to ~36% from ~32% in 2QFY25, reflecting continued portfolio premiumization. EBITDA margins remained resilient even as milk procurement prices rose and the advertising and marketing expenses increased.

Valuation and view

* The momentum in the palm oil segment is expected to be sustained, supported by a stable pricing environment and a strategic shift toward value-added products such as PKO.

* However, this will likely be offset by a weak outlook for the domestic crop protection segment, owing to heightened competitive intensity, continued pricing pressure, and unfavorable weather for crops. We broadly retain our FY26/FY27/FY28 EBITDA estimates. We reiterate our BUY rating on the stock with an SOTP-based target price of INR790.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)