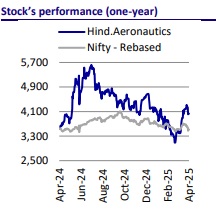

Buy Hindustan Aeronautics Ltd For Target Rs. 5,100 by Motilal Oswal Financial Services Ltd

Well positioned!

Expert Series 1: Key takeaways

Our recent interactions with industry participants and defense consultants focused on 1) the need to put defense and aerospace projects on a fast track, 2) the potential bidders for future tenders for MRFA, 3) the potential impact on the overall defense budget kitty if such large deals were to go through, and 4) how HAL can benefit from the entire situation. We continue to remain upbeat on the defense aerospace segment and believe that HAL would now have to focus on execution, given some of the major supply chain issues are broadly under control. We retain our positive stance on the Defense sector and reiterate our BUY rating on the stock with a TP of INR5,100, based on Mar’27 estimates.

Key highlights from our interaction with an industry expert

The need for modernization originates from the retiring fleet

The Indian Air Force (IAF) continues to remain committed to upgrading and modernizing the existing fleet and has mentioned to the government that there is a need for 42 squadron strength, which the IAF needs vs. the current strength of 31 squadrons. IAF presently has 31 squadrons, comprising 13 Su-30MKI + 6 Jaguar + 3 Mirage 2000 + 3 MiG-29 + 2 Tejas Mk 1 + 2 Rafale + 2 MiG-21 squadrons. Of these, 17 are to be retained long-term (the Su-30MKI, Rafale, and Tejas Mk 1). That translates to a shortfall of 25 squadrons, or about 450-500 aircraft, plus attrition replacements. To meet this requirement, there is an urgent need to order new projects as well as to put existing projects on the fast track. In this process, various options are being evaluated to fast-track projects that are in the initial stages and even to consider bids from foreign companies.

An unanswered question: How will the government’s defense capex budget grow to meet these requirements?

The government’s defense capex budget has clocked an 8% CAGR over FY20-25 and is budgeted to post 13% YoY growth in FY26 to INR1.8t. This budget is required to fund DPSUs, private defense companies, and import requirements. With the increase in indigenization level, import requirements have come down, and exports too have grown at a CAGR of 23% over FY20-24. During the same period, some select defense PSUs have grown faster than the rate of defense capex growth. Potentially, a 10% CAGR in defense capex is expected over the next seven years, and much higher growth is anticipated for defense PSUs over FY25-32. This can be manageable if India’s net defense import bill comes down due to increased indigenization and higher exports. However, we believe that if the government agrees to 2-3 bigger deals with other countries, then it will be required to increase the defense capex budget at a much higher rate to meet both domestic PSU growth and immediate requirements via imports. This would depend on several factors, such as the urgency to upgrade the fleet and managing the fiscal deficit.

Potential scenarios for MRFA tender bids

According to our discussion with the defense expert, India is likely to seek bids this year for 114 multi-role fighter aircraft. The Indian Air Force plans to begin induction of these planes in the next four to five years through a fast-tracked MRFA global tender worth USD20b. This planned induction of these 114 multirole fighter jets is needed to help the IAF maintain its squadron strength over the next 10 years along with the indigenous fighter jets (including the different variants of the Light Combat Aircraft, such as the Mark 1A and the Mark-2). Various aircraft that can be part of the global tender and future requirements of the IAF could be the F-35, Su-57E, Super Sukhoi, South Korean KF21 Boramae, Saab JAS 39E/F Gripen, and Lockheed Martin F-21. Other options that can also be in the queue could be the F-16, F-18, MiG-29 upgrade, Eurofighter Typhoon, MiG-31, etc. However, we are given to understand that the government will have to take a balanced view based on 1) retiring the fleet and the immediate requirements of the IAF, 2) budgetary constraints in sourcing large G2G deals, 3) technology transfer and any kind of indigenization benefit to Indian players or component suppliers, as well as 4) future maintenance and integration of these new fleets into the existing fleet.

TAM for HAL remains strong over the medium to long term

We believe that over the next 2-3 years, the TAM for HAL will remain strong where initial groundwork on prototypes is already being done by HAL for projects such as follow-on orders from Tejas Mk1A (97 aircraft) worth INR650b, Su-30 Mk1 (84 aircraft) worth INR630b, followed by LUH and NUH orders, and subsequently Tejas Mk2. This translates into a medium-term pipeline of INR2.4t for HAL, and the overall long-term TAM remains around INR6t.

Financial outlook

We expect the company’s overall revenue to record a CAGR of 29% over FY25-27, primarily driven by a sharp scale-up in manufacturing revenue and a 5% CAGR in RoH and spares. We project its EBITDA margin to remain strong at 25.9%/27.4%/ 27.6% for FY25/ FY26/FY27, fueled by indigenization efforts taken by the management. With an annual capex of INR30b/INR40b/INR50b and comfortable working capital, we expect its PAT to register a 29% CAGR over FY25-27. With improving revenue and stable margins, we expect HAL’s RoE/RoCE to remain comfortable, reaching 22.5%/23.2% by FY27.

Valuation and recommendation

HAL is currently trading at 34.0x/27.6x FY26E/FY27E EPS. We reiterate our BUY rating with a TP of INR5,100 premised on an average of DCF and 32x P/E on Mar’27E.

Key risks and concerns

Key risks would include: 1) slower-than-expected finalization of large platform orders, 2) further delays in deliveries of key components such as engines for Tejas Mk1A, 3) delays in payments from MoD, and 4) increased involvement of the private sector.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412