Buy Triveni Turbine Ltd for the Target Rs.620 by Motilal Oswal Financial Services Ltd

Weak export pipeline

Triveni Turbine (TRIV)’s 1QFY26 result was significantly lower than our expectations due to deferred dispatches and order execution. Geopolitical issues resulted in delayed customer decision-making regarding dispatches. Though the inquiry pipeline remains strong and domestic order inflows are witnessing improvement, a decline in the export pipeline and export order inflows is a negative. This is likely to result in export revenue volatility, while domestic revenue was already weak due to muted ordering last year. We thus expect FY26 to be a weaker year for the company and expect recovery to start getting visible from FY27 onwards. We thus cut our estimates by 8%/13% for FY26/27 due to subdued order inflow and execution, particularly on the export side, and arrive at our revised TP of INR620 (based on 40x Sep’27E earnings). Our revised target multiple of 40x (vs. 42x earlier) takes into account lower growth assumptions compared to earlier estimates. We reiterate our BUY rating as TRIV is continuously introducing new products and can ramp up sharply as demand starts reviving.

Result materially below our estimates

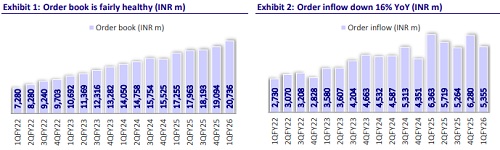

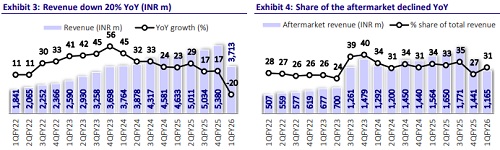

TRIV’s 1QFY26 performance was hit by deferred dispatches and order execution, as geopolitical tensions led to inspection delays from international customers. Revenue stood at INR3.7b (-20% YoY). Domestic/export sales declined 24%/15% to INR1.9b/INR1.8b. Exports as a % of sales increased to 49% in 1QFY26 compared to 47% in 1QFY25. The EBITDA at INR736m declined 23% YoY, while the EBITDA margin contracted 80bp YoY to 19.8% vs. our estimate of 20.3%. Its PAT at INR644m declined 20% YoY. Order inflows declined 16% YoY to INR5.4b due to lower export demand across products and aftermarkets. Order booking was also impacted by geopolitical tensions, which delayed advance collections. The total order book stood at INR20.7b as of 30th Jun’25 (+20% YoY).

Domestic inquiry conversion visible

In 1QFY26, TRIV reported a significant recovery in domestic order inflows, which jumped 32% YoY to INR2.9b, reversing the softness seen in FY25. The inquiry pipeline from the domestic market has increased by ~130% YoY, driven by strong traction across key sectors, including steel, cement, sugar, waste-to-energy, and process cogeneration industries. Management indicated that the overall steam turbine market itself has grown substantially in the quarter, and TRIV’s market share has increased from ~46%-48% last year to nearly 53%-55%.. The company believes that this momentum will be maintained through FY26, backed by the elevated inquiry levels and a healthy mix of sectors. However, while the increased domestic inquiry pipeline indicates elevated customer interests, conversion of these into actual orders may take longer. We thus expect domestic order bookings to decline 5% in FY26 on a high base, as FY25 consisted of a large order from NTPC. From thereon, we expect improved inquiry conversions, translating into an 18-20% YoY growth from FY27 onwards.

Export orders slowing down amid global uncertainty

Export order inflows declined 40% YoY to INR2.5b in 1QFY26, hit by the geopolitical turmoil in the Middle East and South Asia. Several clients deferred decisions or shifted to European suppliers, leading to a 5% YoY contraction in TRIV’s international enquiry pipeline. While traction declined in Europe, Southeast Asia, and SAARC, select markets like the US (+175% YoY), Central Asia, and Africa remained active, though conversions are slower. The US saw strong inquiry momentum, but order finalizations were delayed due to tariff and localization uncertainties. Triveni has invested in its US subsidiary, absorbing near-term losses to build presence. Europe saw a pause in investment activity but remains a key region for the company, contributing ~20% of export revenue, especially in waste-toenergy and renewables. Export markets continue to be an important long-term growth lever, but near-term visibility is clouded by extended sales cycles and geopolitical caution. We expect export order inflows to clock a CAGR of 19% over FY25-28, with export revenue to grow moderately at 9% in FY26. We further project a ramp-up thereon as geopolitical concerns ebb, and the current year’s inquiry conversions start reflecting on execution from the next fiscal year.

Focus on higher margin projects in the aftermarket business

TRIV’s aftermarket business continued to be a steady contributor, accounting for 31% of revenue in 1Q. However, growth in this segment was subdued, with management admitting underperformance in refurbishment activities, particularly in the Southern African Development Community (SADC) market where one project was taken at lower margins. The company emphasized that turbine-related aftermarket offers better margin potential compared to relatively newer areas like heat pumps, primarily due to the higher frequency of spares and servicing required for rotating equipment. Going forward, TRIV aims to focus on higher-margin refurbishment projects rather than generic service contracts, although the conversion cycle for such projects tends to be longer.

Expanding portfolio through product innovations

TRIV has launched India’s first CO?-based ultra-efficient high-temperature heat pump with primary application across industrial sectors such as food and beverage, pharmaceuticals, textiles, and district heating. The product can deliver heat at 122°C using carbon dioxide as a natural refrigerant, offering a climate-friendly alternative to conventional synthetic refrigerants. Although the technology is innovative, management indicated that commercial adoption will be gradual given its earlystage nature and technical complexity. Consequently, near-term revenue contribution is expected to remain modest, likely in low single digits of overall sales over the next couple of years.

Financial outlook

We cut our estimates by 8%/13% for FY26/27 due to subdued order inflow and execution, particularly on the export side. We expect TRIV’s revenue/EBITDA/PAT to clock a CAGR of 14%/14%/14% over FY25-28. Backed by a comfortable negative working capital cycle, strong margins, and low capex requirements, we expect its OCF and FCF to report a CAGR of 48% and 55% over the same period, respectively.

Valuation and view

The stock is currently trading at 45.3x/38.1x/31.8x on FY26E/27E/28E earnings. We revise our TP to INR620 (from INR700) based on 40x Sep’27E EPS. Our revised target multiple of 40x (vs. 42x earlier) takes into account lower growth assumptions than earlier estimates.

Key risks

Slowdown in capex initiatives, intensified competition, technology disruption, inability to innovate and launch new products, and geopolitical headwinds that are resulting in a sharp slowdown in exports and aftermarket segments are some of the key risks.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412