Neutral Voltas Ltd for the Target Rs. 1,390 by Motilal Oswal Financial Services Ltd

Disappointing performance; recovery expected in 2HFY26

Sequential market share gains in RAC

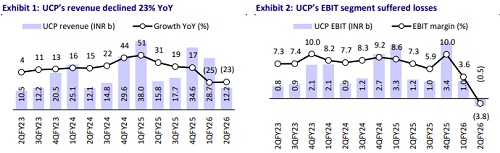

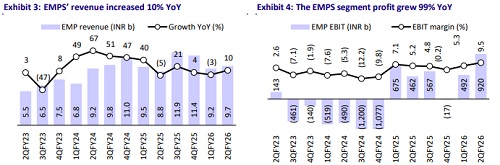

* Voltas (VOLT)’s revenue declined ~10% YoY to INR23.5b (in line) in 2QFY26, driven by a 23%/5% dip in UCP/PES segments, while EMPS revenue grew ~10% YoY. EBITDA declined ~57% YoY to INR704m (~33% below our estimates, led by a loss in the UCP segment vs. our estimate of ~3% EBIT margin). Overall, OPM stood at ~3.0%, down 3.2pp YoY (1.7pp below our estimate). PAT declined ~74% YoY to INR343m (~61% below our estimate).

* Management indicated that the UCP segment had an unusual quarter, with muted retail offtake during the lean season and delayed consumer purchases due to the GST-rate cut announcement. This led to higher inventory (currently at around two months). Despite this, it maintained its market leadership in the RAC segment and gained market share sequentially (at 18.5% vs. 17.8% in 1Q). It is optimistic for a recovery in the UCP segment in 2HFY26 and expects the channel to start stocking up for the upcoming season. It is also fully ready with the new products with the upcoming transition in new energy labeling effective Jan’26.

* We cut our EPS by ~19% for FY26E to account for the underperformance in 2QFY26 and by ~3-5% for FY27/FY28E. We reiterate our Neutral rating on the stock with a TP of INR1,390, based on 45x Dec’27E EPS for the UCP segment, 20x Dec’27E EPS for the PES and EMPS segments (each), and INR20/sh for Voltbek.

UCP revenue dips ~23% YoY; UCP loss at INR458m

* VOLT’s consolidated revenue/EBITDA/PAT stood at INR23.5b/INR704m/ INR343m (down 10%/57%/74% YoY and +4/-33%/-61% vs. our estimates) in 2QFY26. Depreciation/interest costs grew 49%/47% YoY, whereas ‘other income’ declined 39% YoY.

* Segmental highlights: 1) UCP – Revenue dipped 23% YoY to INR12.2b, and loss stood at INR458m vs. EBIT of INR1.2b in 2QFY25; 2) EMPS – Revenue rose 10% YoY to INR9.7b, PBIT grew ~99% YoY to INR920m, and EBIT margin surged 4.3pp YoY to 9.5%; 3) PES – Revenue dipped 5% YoY to INR1.4b, EBIT rose ~11% YoY to INR439m, and EBIT margin expanded 4.6pp YoY to 31.6%.

* In 1HFY26, revenue/EBITDA/adj. PAT stood at INR62.9b/INR2.5b/INR1.7b (down 17%/58%/63% YoY). UCP/PES segment revenue declined ~24%/11% YoY to INR40.8b/INR2.7b, whereas EMPS segment revenue grew ~3% YoY to INR18.9b. UCP EBIT declined by ~87% YoY to INR586m, and EBIT margin contracted 6.8pp YoY to 1.4%. It reported an operating cash outflow of INR10.7b vs. OCF of INR1.2b in 1HFY25, due to lower profitability and a surge in working capital. Its net cash balance declined to INR15.7b as of Sep’25 from INR28.5b in Mar’25.

Key highlights from the management commentary

* VOLT’s market share in RAC stood at 18.5% in 2QFY26 vs. 17.8% for 1QFY26 (vs. 16.0% in 4QFY25).

* The order book stood at INR62b (INR48b domestic and INR14b international) and a healthy bid pipeline. The order book is well diversified across MEP, electrical, water, and solar verticals.

* Voltas Beko remains central to VOLT’s long-term strategy of diversification and premiumization, supporting its transition into a full-fledged home appliances player offering complete cooling and home solutions.

Valuation and view

* Voltas’ 2QFY26 performance came in below expectations, primarily due to weakness in the UCP segment, which reported losses. The management sounded confident of a positive demand outlook, as the GST reduction and efficiency transition are expected to unlock pent-up consumer demand. It believes that with the season going to pick up, inventory will also ebb over a period of time. While the company gained market share sequentially, it remained lower on a YoY basis.

* We estimate VOLT’s revenue/EBITDA/PAT CAGR at 7%/12%/13% over FY25-28. We estimate the UCP revenue to decline ~9% YoY in FY26, due to a weak 1HFY26, and estimate ~15% YoY growth in FY27, on a low base. UCP margin should also improve in 2HFY26 and FY27 with a recovery in demand and positive operating leverage. We maintain our Neutral rating on the stock with a TP of INR1,390, based on 45x Dec’27E EPS for the UCP segment, 20x Dec’27E EPS for the PES and EMPS segments (each), and INR20/share for Voltbek.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412