Buy Kalpataru Projects International Ltd for the Target Rs. 1,500 by Motilal Oswal Financial Services Ltd

In-line performance

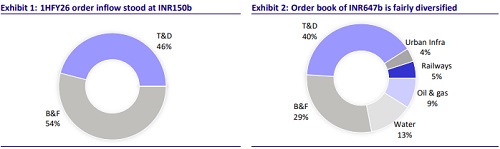

Kalpataru Projects’ (KPIL) 2QFY26 performance was in line with our estimates as strong execution offset the impact of slightly lower margins. Revenue growth was driven by strong execution across T&D, B&F, and the oil & gas division. Prospect pipeline for KPIL remains strong across T&D and buildings & factories, while the company continues to be cautious on water and railways projects. With a strong order book of INR647b and a fairly diversified mix across better-margin projects, we expect KPIL to benefit from 1) execution ramp-up from the existing strong order book, 2) margin improvement, 3) comfortable working capital, and 4) divestment of non-core assets. We marginally cut our estimates by 8%/2%/2% for FY26/27/28 to bake in the slightly lower margin and lower other income. The stock is currently trading at attractive valuations of 17.1x/14.7x P/E on FY27/28E earnings. Reiterate BUY with a revised SoTP-based TP of INR1,500, valued at 18x P/E on Dec’27 estimates for the core business.

Results largely in line

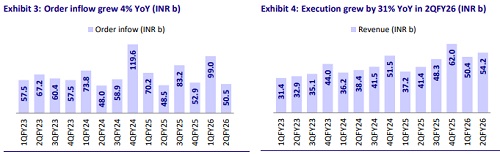

KPIL’s 2QFY26 revenue at INR54b (+31% YoY) was 5% above our estimate. Growth was driven by execution ramp-up and a strong order backlog. T&D/B&F revenue grew 51%/20% YoY, while O&G/Urban Infra jumped 21%/65% YoY. Railways grew moderately by 9% YoY, while Water segment continued to witness challenges, declining 5% YoY. Absolute EBITDA grew 28% YoY to INR4.5b, in line with our estimate of INR4.4b. EBITDA margin was 8.3%, slightly below our estimate of 8.6%, owing to warranty provisions worth INR300m made during the quarter. Adj. PAT surged 51% YoY to INR2.0b, in line with our estimate. Order inflows at INR51b were up 4% YoY. The order book stood at INR647b (+7% YoY). NWC days stood at 102 in 2QFY26 vs. 118 in 2QFY25. Net debt was down YoY at INR22b in 2QFY26 (vs. INR28b in 2QFY25). For 1HFY26, revenue/EBITDA/PAT stood at INR104.6b/INR8.8b/INR4b, up 33%/32%/61%. YTD order inflows of INR150b rose 26% YoY. For 1HFY26, OCF and FCF outflow stood at INR4b and INR8b.

T&D continues to grow at a healthy pace

T&D segment delivered a strong performance with a 51% YoY increase in revenue, driven by strong execution across India, Sweden, and other international markets. YTD order inflows stood at INR69b, with L1 positions exceeding INR45b, primarily from overseas markets, taking the order book in this division to INR263b (+18% YoY). The tender pipeline expanded to around INR1.5t for the next 12-18 months, supported by upcoming HVDC projects, grid strengthening in southern India, and increased tendering activity across the Middle East, Africa, and Latin America. The pipeline also includes largescale solar EPC opportunities in the Middle East, reflecting the company’s strategic foray into renewable infrastructure within its broader power transmission portfolio. The segment maintains stable profitability with EBITDA margins in the range of 9-10%, with selective participation in high-quality bids and potential margin improvement in international markets providing further upside.

B&F, oil and gas remain growth drivers in non-T&D businesses

The B&F and O&G segments continued to witness strong execution momentum, supported by a strong order pipeline and healthy demand across key end markets. The B&F business sustained healthy momentum with 20% YoY revenue growth and YTD order inflows of INR80b. The order book rose 43% YoY to an all-time high of INR188b, backed by a strong presence in large design-build projects and partnerships with marquee developers. EBITDA margins remained in the 9-11% range, with expected growth of over 20% in the medium term. The Oil & Gas segment grew 21% YoY in 2Q, led by steady progress on the large Saudi project. The company remains qualified with Aramco and ADNOC, though some tender awards have been deferred amid crude price volatility. The Railways segment reported INR2b in revenue (+9% YoY), supported by progress in metro and urban infrastructure projects. International railway bids have been submitted and prequalification has been achieved in several markets, but no major wins are expected in the near term.

Water projects continue to see payment delays in JJM funding

The Water business continues to see a delay in payments and saw a 5% YoY revenue decline to INR5b in 2Q. Order backlog stood at INR84b. Collections improved in Madhya Pradesh, Punjab, and Bihar, but remained sluggish in Uttar Pradesh and Jharkhand, resulting in an INR1b QoQ increase in receivables to INR16b. Receivables from Uttar Pradesh (INR7b) and Jharkhand (INR2b) are the largest and include several overdue accounts exceeding 180 days. The company highlighted funding constraints in these states due to pending central government approvals under the Jal Jeevan Mission program. The company continues to prioritize the completion of ongoing civil works while limiting fresh material supply until receivable visibility improves.

Non-core assets divestment

The roads portfolio reported steady performance with average daily collections of INR6.14m in 2Q, up 9% YoY. The company terminated the WEPL project in Jul’25 and handed over to NHAI, effective 30th Sep’25. The sale process for the Vindhyachal Expressway is progressing well and is expected to conclude in 2H. Shree Shubham Logistics reduced its external debt to INR0.9b and plans to monetize certain warehouse assets to bring down debt to INR0.4-0.5b by end of FY26, targeting a near-zero external debt position by the end of FY27.

LMG subsidiary is doing well

LMG (Sweden) subsidiary continues to do well, delivering a strong 2Q performance with revenue of INR7.2b (+89% YoY) and 1HFY26 revenue of INR15b (+80% YoY). The business maintained healthy profitability, achieving an EBITDA margin of above 7.5% and a PBT margin of around 7% in 1HFY26. The order backlog stands at INR36b, providing visibility for 20-25% annual growth over the next 2-3 years, maintaining stable PBT margins of 6.5-7.5%. Fundraising options for the Swedish business are under evaluation through appointed advisors, with potential progress expected in FY26-27. Fasttel, however, faced project-related challenges and delays, reporting 1HFY26 revenue of INR4b and EBITDA loss. Management’s near-term focus is on operational stabilization and returning to profitability rather than pursuing growth.

Future growth guidance

KPIL raised its FY26 revenue growth guidance to 25%+ YoY (from 20-25% earlier) at both standalone and consolidated levels, supported by a record order book and strong execution pipeline. Management reaffirmed its commitment to improving PBT margins by at least 50bp YoY in FY26, aided by favorable business mix. EBITDA margins are expected to trend toward 9% in FY27, supported by better project mix. Order inflow guidance stands at INR250b+ for FY26, with a possible upward revision later in the year. Consolidated net working capital stood at 90 days (standalone: 102 days) and is expected to remain below 100 days for standalone and less than 90 days on consolidated through FY26.

Financial outlook

We marginally cut our estimates by 8%/2%/2% for FY26/27/28 to bake in the slightly lower margin and lower other income. We expect KPIL to report a CAGR of 17%/21%/30% in revenue/EBITDA/PAT over FY25-28. This would be driven by: 1) inflows of INR280b/INR318b/INR366b in FY26/FY27/FY28 on a strong prospect pipeline, 2) a gradual recovery in EBITDA margin to 9.2% by FY28E, 3) control over working capital owing to improved customer advances, better debtor collections from water and railways, and claims settlement. Driven by improvement in margins and moderation in working capital, we expect KPIL’s RoE/RoCE to improve to 15%/14% in FY28.

Valuation and view

KPIL is currently trading at 17.1x/14.7x P/E on FY27/28 earnings. Reiterate BUY with a revised SoTP-based TP of INR1,500, based on 18x P/E for the core business.

Key risks and concerns

Slowdown in execution, lower-than-expected order inflows, sharp rise in commodity prices, and increase in promoter pledge are some of the key concerns that can weigh on financials and valuations of the company.

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412