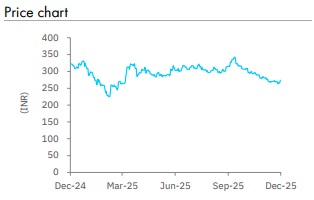

Buy JSW Infrastructure Ltd for Target Rs. 362 by Elara Capital

FY28 major reset; 3x EBITDA by FY30

Although JSW Infrastructure (JSWINFRA IN) port volume in the near term has been volatile, due to slow iron ore exports, however port EBITDA has been stable on tariff hikes. Recent addition of Kolkata container terminal, Oman Port and Railways rakes business are in line with planned capex of INR 390bn up to FY30, the benefits of which will be visible from FY28. We expect EBITDA to more than triple from INR 23bn in FY25 to INR 72bn by FY30E. Management targets new projects rate of return to be in the mid-teens. Port EBITDA margin could scale up from 50% to 59% by FY30E, led by the portfolio shift toward Greenfield private ports, cargo diversification to containers, and commissioning of the Oman Port, all with highmargin potential. Logistics EBITDA margin may rise from 15% to 30%, led by addition of the Railways rakes business and scale-up in Navkar Corporation via planned capacity expansion. We incorporate new projects into our estimates, leading a rise of 10% for FY27 and 5% for FY28. We revise to Buy with a higher TP of INR 362, valuing at 28x FY27E EV/EBITDA for ports and 8x for logistics.

Recent project additions clears roadmap to 400MT of port capacity by FY30: Recent strategic addition of Kolkata container terminal of 6mn tonne [MT] (container cargo diversification) and Oman port of 27MT (third-party cargo diversification) in addition to ongoing 185MT of expansion at existing and Greenfield ports in India is set to take total capacity from 180MT in FY25 to 390MT by FY30 (leaving scope for Phase 3 terminal bidding at Kolkata port, government port privatization, and inorganic growth). Although bulk will remain mainstay, supported by limited competition and captive volume, gradual diversification to containers would raise capacity from 2% in FY25 to 12% by FY30, aided by Kolkata and Murbhe ports. Third party share has risen from 5% in FY19 to 50%. This may sustain as captive cargo from JSW Steel capacity increase from 35.7MT to 51.5MT by FY31, likely offset by third-party cargo from Oman and Murbhe ports. We expect a volume CAGR of 16% during FY25-30E.

Acquisition of Railways rakes business EPS-accretive step in rail logistics: JSWINFRA has signed an agreement to buy 100% equity in three rail logistics entities from JSW Shipping & Logistics at an EV of ~INR 12.1bn at 8x FY27E EV/EBITDA. Valuation is lower than Navkar acquisition at 15x, lower than the logistics acquisition by peers and industry average. With high EBITDA margin of 40%, contribution is likely from FY27. With pre-approved capex of INR 5.4bn to increase rakes from 17 to 45 and 100 in the long term, management plans to scaled up EBITDA to INR 6bn by FY30 from INR 0.5bn in FY25. After evaluating third-party prospects, it finalized the related party acquisition on strategic access to rail rakes, stable cashflow with a 10-year agreement with anchor customers & synergy with ports business.

Revise to Buy with a higher TP of INR 362: We remain confident of long-term growth potential, which will be back-ended starting from FY28, led by commissioning of new ports and scale-up in the logistics business. Planned growth capex would be supported by healthy balance sheet (cash, internal accruals and low leverage). We revise to Buy from Accumulate with a higher TP of INR 362 from INR 345 on 28x (unchanged) FY27E EV/EBITDA for ports and 8x for logistics. Timely execution of projects within budget will be a key monitorable.

Please refer disclaimer at Report

SEBI Registration number is INH000000933