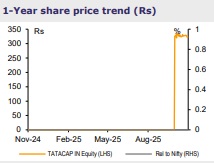

Add Tata Capital Ltd for the Target Rs.360 By Emkay Global Financial Services Ltd

Voice of the head – Focus on risk-calibrated growth

We recently met the management of Tata Capital to discuss its business strategy post the IPO, Tata Motors Finance’s integration, and the near-tomedium term growth outlook. KTAs: 1) The management expects 18-20% consolidated AUM growth (22-25% excl motor finance) in FY26 and 23-25% in FY27, led by balanced expansion across retail, housing, SME, and corporate products. Housing remains a key area, with the branch network set to double over 2Y, while the launch of new products like gold loans is likely in the medium term. 2) The Motor Finance business (TMFL), now fully integrated and operating as a multi-OEM platform, is undergoing strategic realignment, with the book expected to see growth from Q1FY27 and become profitable; RoA to come at par with the overall RoA target of 2.5-2.7% by FY28. 3) Profitability levers remain strong: NIMs are expected to expand by ~20-30bps on better asset mix (increasing share of affordable and emerging business), rising fee income, and moderating CoFs. Cost-to-income is expected to improve to ~33%, and credit costs to normalize ~1% by FY28. Overall, Tata Capital remains well placed to deliver sustainable growth, with improving profitability (our IC Note link). We retain ADD, with a Sep-26E TP of Rs360, implying FY27E P/BV of 2.8x.

Focusing on risk-calibrated growth to deliver 2.5-2.7% RoA by FY28E

The management highlighted that growth will be largely organic, anchored by a welldiversified product strategy spanning housing, SME, and select corporate lending. While most existing products will continue to scale up through deeper penetration and improved cross-sell, new product launches like gold loans will be evaluated over the medium term. The management indicated that margin improvement will be mostly a function of a better asset mix (increasing share of affordable and mid-emerging business segment), improving cross-sell, better fee income in non-lending business, and moderating CoFs; it expects cost-to-income to stabilize at ~33% in FY28, led by improving efficiency. The management remains confident of containing credit cost at ~1% in the medium term, led by better customer selection and a stabilizing captive motor book. Together, NIM + Fee is improving by ~30bps, opex is moderating by 10-20bps, and credit cost is moderating by ~20bps; this would result in the RoA expanding to 2.5-2.7% by FY28E.

CV finance business to normalize; profitability aligning across businesses

The management indicated that the Motor Finance business is now fully integrated and operating as a multi-OEM, retail-focused franchise, marking a strategic shift from the earlier captive model. The near-term focus is on realigning the portfolio and restoring profitability, with disbursements consciously moderated as the company strengthens underwriting and collection frameworks. The business is pivoting toward a healthier mix, targeting to reduce HCV share to ~25% and increase used vehicle to ~50%, while expanding presence in non-Tata OEMs (~13% share in disbursements).

We maintain ADD with a Sep-26E TP of Rs360

We believe Tata Capital’s valuation is well supported by its strong execution, diversified franchise, and rising profitability, with RoA expected to rise from ~2.1% in FY26E to 2.5– 2.7% by FY28E, on margin gains, lower credit costs, and operating leverage. We retain ADD, with an unchanged TP of Rs360, implying FY27E P/B of 2.8x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354