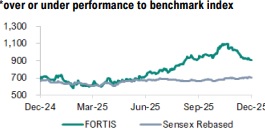

Buy Fortis Healthcare Ltd For Target Rs. 1,030 By Geojit Financial Services Ltd

Strong Quarter, Promising Outlook

Fortis Healthcare Ltd, an IHH Healthcare Berhad company, is one of the largest and leading integrated healthcare service providers in India, with 33 facilities, 5,800 operational beds and 400 diagnostic centres.

* In Q2FY26, consolidated revenue grew 17.3% YoY to Rs. 2,331cr owing to growth in the healthcare and diagnostics businesses.

* Hospital business increased 19.3% YoY to Rs. 1,974cr, led by 13.0% YoY growth in occupied beds. The segment accounted for 85% of the total revenue. Diagnostic business increased 7.1% YoY to Rs. 357cr.

* Average revenue per operating bed (ARPOB) increased to Rs. 2.51cr in Q2FY26 from Rs. 2.37cr in Q2FY25, fueled by a favorable shift in its specialty mix, with notable advancements in the oncology sector.

* EBITDA increased 29.2% YoY to Rs. 579cr, while margin expanded 230bps YoY to 24.8% on account of operational efficiency, higher occupancy rates and optimal utilisation of existing hospitals.

* Reported PAT increased 70.3% YoY to Rs. 329cr owing to higher topline growth, favourable mix and improving utilization.

Outlook & Valuation

The company delivered strong Q2FY26 financial results, driven by margin expansion in the hospital and diagnostic businesses. Fortis is targeting a full-year addition of 400-500 beds, supported by capacity expansion in Noida and Jalandhar. Fortis is targeting an EBITDA margin of 25% in the hospital business for the next couple of years. Additionally, the international patients segment is expected to remain strong. Hence, we upgrade our rating to BUY from HOLD with a revised target price of Rs. 1,030 based on 31x FY27E EV/EBITDA.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

.jpg)